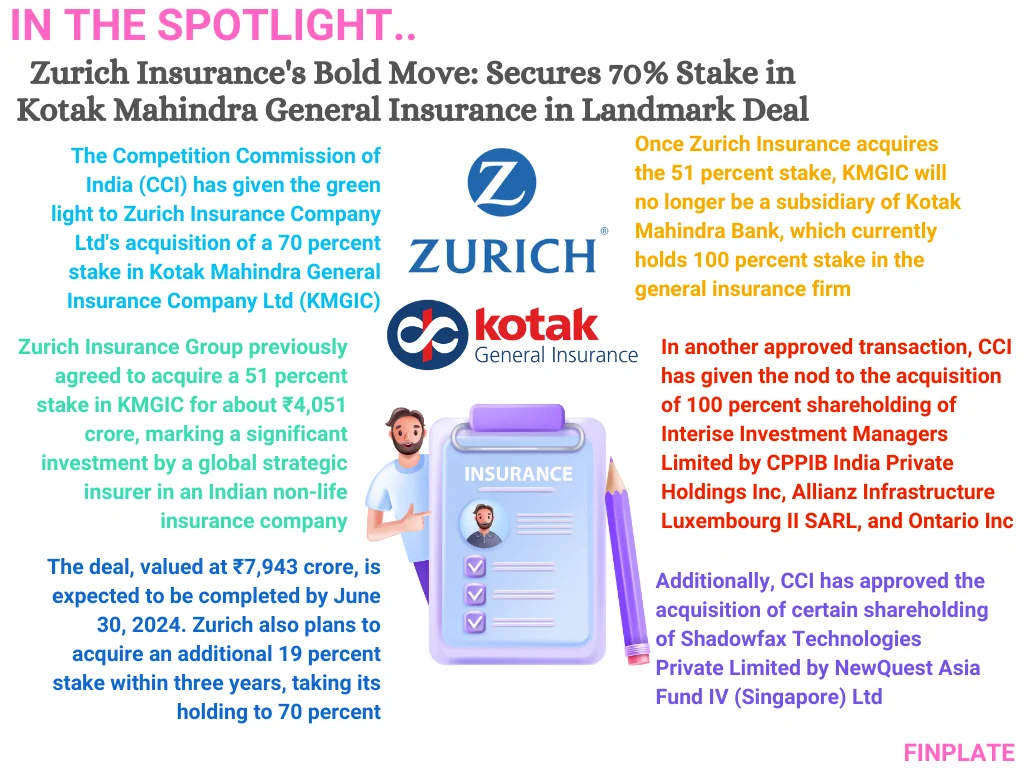

The Competition Commission of India (CCI) has granted its approval for Zurich Insurance Company Ltd to acquire a 70 percent stake in Kotak Mahindra General Insurance Company Ltd (KMGIC). Initially, in November of the preceding year, Zurich Insurance Group, headquartered in Switzerland, had reached an agreement to purchase a 51 percent stake in KMGIC for approximately ₹4,051 crore, employing a mix of fresh capital injection and share acquisition. This acquisition stands as the largest investment made by a global strategic insurer in an Indian non-life insurance company.

The transaction, slated for completion by June 30, 2024, involves Zurich Insurance’s intention to procure an additional 19 percent stake within three years post the transaction’s closure, thereby raising its ownership in the Indian general insurer to 70 percent. Upon acquiring the initial 51 percent stake, KMGIC will no longer operate as a subsidiary of Kotak Mahindra Bank, which currently holds full ownership of the general insurance firm. The valuation of KMGIC in this proposed deal stands at ₹7,943 crore ($955 million) on a post-money basis.

The CCI announced its approval of the acquisition through a post on X, formerly known as Twitter. Concurrently, the CCI has also cleared other transactions, including the acquisition of Interise Investment Managers Limited by CPPIB India Private Holdings Inc, Allianz Infrastructure Luxembourg II SARL, and Ontario Inc., as well as the acquisition of specific shareholding of Shadowfax Technologies Private Limited by NewQuest Asia Fund IV (Singapore) Ltd.

Key Points:

- Acquisition Details: Zurich Insurance Company Ltd is set to acquire a 70 percent stake in Kotak Mahindra General Insurance Company Ltd, a move initiated after Zurich’s agreement to initially purchase a 51 percent stake.

- Significance of the Acquisition: This marks the largest investment made by a global strategic insurer in an Indian non-life insurance company, underlining the growing interest of international players in India’s insurance sector.

- Transaction Timeline: The acquisition process is expected to conclude by June 30, 2024, with Zurich Insurance planning to increase its stake to 70 percent within three years post the initial transaction.

- Change in Ownership Structure: Upon acquiring the 51 percent stake, Kotak Mahindra General Insurance Company Ltd will cease to be a subsidiary of Kotak Mahindra Bank, which presently owns the entire stake in the general insurance firm.

- Valuation: The proposed transaction values Kotak Mahindra General Insurance Company Ltd at ₹7,943 crore ($955 million) post the investment, reflecting the perceived worth of the company in the market.

- CCI Approval and Other Transactions: The Competition Commission of India has granted approval for the acquisition, along with clearance for other transactions, demonstrating regulatory compliance and activity in India’s business landscape.

Overall, the acquisition of KMGIC by Zurich Insurance represents a significant development in India’s insurance sector, signaling both investor confidence and regulatory endorsement in the evolving market dynamics.

About Zurich Insurance Company Ltd

Zurich Insurance, a prominent insurer with operations spanning over 200 countries and territories, has been serving individuals and enterprises for 150 years. In addition to traditional insurance coverage, Zurich is pioneering preventive services aimed at promoting well-being and bolstering climate resilience. With a workforce of approximately 54,000, Zurich offers a diverse array of insurance products and services in areas such as property and casualty, as well as life insurance.

The company’s operations are structured around three primary segments: General Insurance, Global Life, and Farmers. Listed on the SIX Swiss Exchange, Zurich boasted a shareholders’ equity of $34.494 billion in 2012. Committed to fostering healthier lifestyles, building community resilience, and contributing to environmental restoration endeavors, Zurich strives to shape a brighter future collectively. For direct inquiries, individuals can easily reach out to Zurich.

About Kotak Mahindra General Insurance Company Ltd (KMGIC)

Kotak General Insurance, a fully owned subsidiary of Kotak Mahindra Bank Ltd., India’s fastest growing bank, was established to meet the increasing demand in India’s non-life insurance sector. In November 2015, it obtained the necessary license to commence operations. Since then, the company has expanded its presence nationally, operating through 25 branches across India and employing 1339 individuals as of December 2022. Emphasizing customer service, quality, and innovation, Kotak General Insurance strives to serve diverse customer segments and regions, offering a range of non-life insurance products such as Motor, Health, Home, and Commercial insurance. The company is committed to delivering a unique value proposition by delivering tailored products and services, leveraging cutting-edge technology and digital infrastructure.

Summary