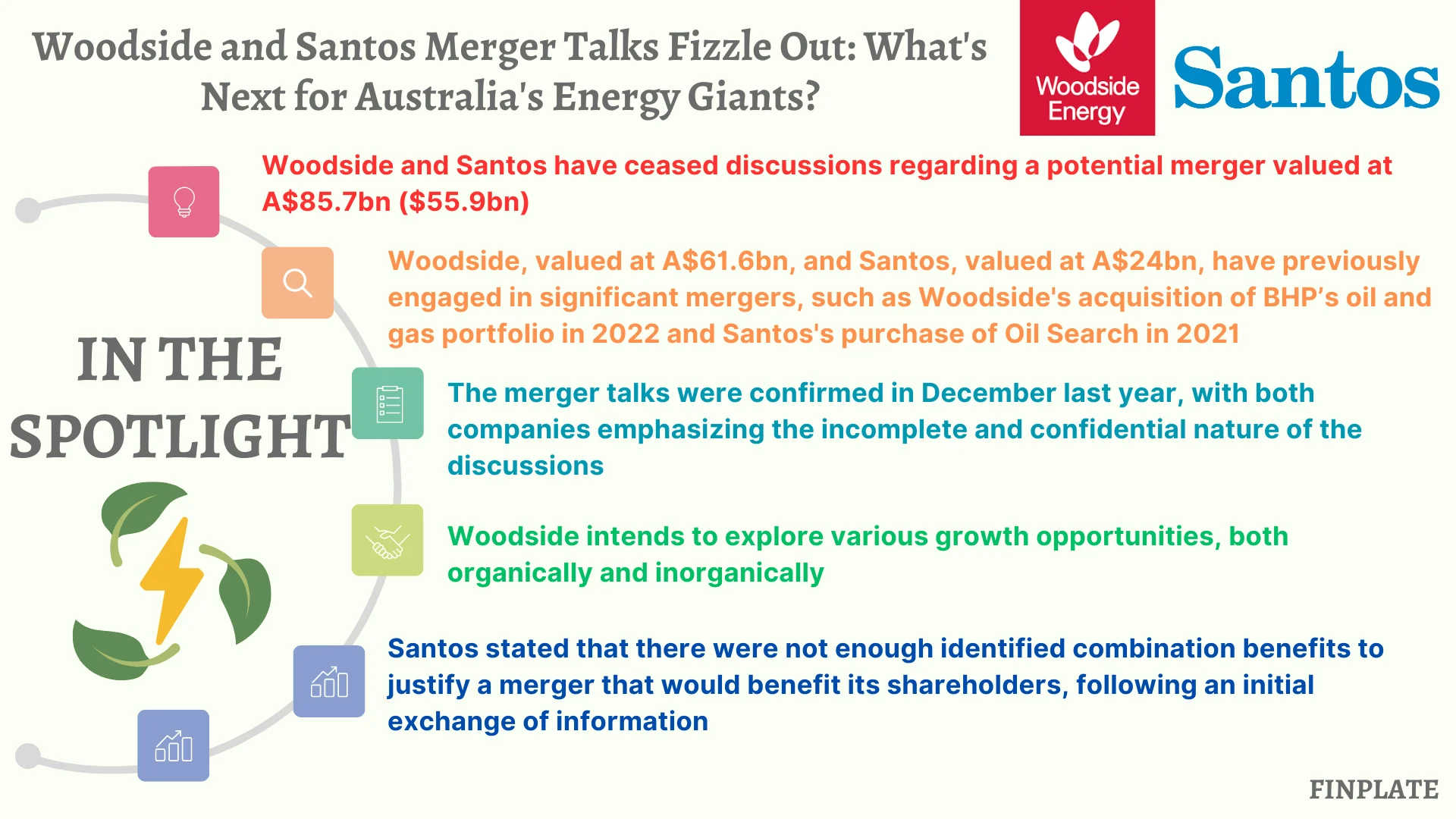

Australian energy giants Woodside and Santos have terminated all discussions surrounding an A$85.7 billion ($55.9 billion) merger, affirming media speculation that arose in early December. At that time, Woodside emphasized the confidentiality and incompleteness of the discussions, noting the uncertainty of their outcome. Both companies have experienced mergers previously, with Woodside acquiring BHP’s oil and gas assets in 2022, propelling it into the top 10 independent energy firms, and Santos acquiring Oil Search in 2021. The cessation of talks, which could have birthed a global oil and gas powerhouse, has left the reasons undisclosed.

However, Woodside has expressed its intent to evaluate various organic and inorganic growth opportunities while maintaining a disciplined approach to mergers, acquisitions, and capital management. Meg O’Neill, CEO of Woodside, stressed the significant potential for value creation in the global LNG sector despite the failed discussions with Santos. In a separate statement, Santos disclosed that the initial exchange of information did not reveal sufficient combined benefits to warrant a merger beneficial to its shareholders’ interests.

Key Points

- Background of the Merger: Woodside and Santos, both prominent players in the Australian energy sector, were in discussions about a potential merger valued at A$85.7 billion. This would have marked a significant event in the industry, potentially creating a global oil and gas leader.

- Previous Mergers: The announcement of a merger between Woodside and Santos comes against the backdrop of their past merger activities. Woodside had previously acquired BHP’s oil and gas assets, while Santos had acquired Oil Search. These historical mergers provide context to the companies’ strategic moves and growth trajectories.

- Reasons for Termination: The specific reasons behind the termination of discussions remain undisclosed. However, both companies have emphasized the need to act in the best interests of their shareholders. Despite the potential benefits of a merger, it appears that the companies couldn’t identify sufficient synergies or advantages to justify moving forward with the deal.

- Future Growth Strategy: Woodside’s statement suggests that it will continue to explore growth opportunities both organically and through potential mergers and acquisitions. This reflects the company’s commitment to creating shareholder value while maintaining a disciplined approach to capital management.

- Market Potential: Despite the setback of failed merger discussions, both Woodside and Santos acknowledge the significant potential for value creation in the global LNG sector. This indicates their long-term vision and confidence in the industry’s prospects despite the current setback.

In essence, the termination of merger discussions between Woodside and Santos reflects the complexities and uncertainties inherent in major corporate transactions. While the deal did not materialize, both companies remain focused on their strategic objectives and growth opportunities in the dynamic energy market.

About Woodside Energy

Woodside Energy, an international energy corporation established in Australia, operates various assets across regions including Australia, the Gulf of Mexico, and Trinidad and Tobago. These assets are categorized into operated and non-operated, with brief descriptions and additional information provided for each on the company’s website. Additionally, the company’s webpage acknowledges and pays tribute to the Aboriginal and Torres Strait Islander peoples as Australia’s original inhabitants and extends this recognition to other First Nations communities globally.

About Santos

Santos is a multinational energy corporation dedicated to supplying dependable and cost-effective energy for societal advancement while progressively transitioning towards lower carbon emissions. The company’s objective is to lead the global shift towards low-carbon energy sources, aiding in worldwide decarbonization efforts while ensuring continued provision of reliable and affordable energy necessary for modern life and human

Summary