What is Enterprise Valuation(EV)?

EV stands for enterprise value, a financial metric used to determine the total value of a company. EV is an essential criterion for potential investors and analysts to assess a company’s overall financial health and potential profitability and is preferred over other valuation methods. EV is one of the crucial concepts of Corporate valuations and serves as a base for Mergers and acquisitions deals.

It considers the market value of a company’s outstanding debt, equity, and cash to arrive at a single valuation number. This is the most comprehensive way of valuing a company which takes all the major factors to study the financial health of a company.

How to Calculate EV?

Enterprise value is calculated using a formula:

Simple formula:

EV = Market Capitalization + Debt – Cash

Extended formula:

EV = Market capitalization + Preferred stock + Outstanding debt + Minority interest – Cash and cash equivalents

Now, let’s discuss the components individually.

1. Market Capitalization / Equity Value

Market Capitalization / Equity value is the actual worth of a company in the open market and acts as a base for relative comparison among the companies in the same industry. It also reflects the market’s anticipation of the company’s future prospects because it gives a fair idea of what an investor is willing to pay for its stock.

To calculate the Market Capitalization of a company, Fully diluted shares are taken into consideration along with the share price for the day before the deal announcement. It includes common shares, preferred stock, in-the-money options, warrants, PSU, RSU etc.

Common stock

Common stock is a type of investment that symbolizes one’s ownership in a company. Individuals who hold common stock have the authority to choose the board of directors and participate in decision-making by voting regarding the company’s policies. Generally, this form of ownership offers greater potential for long-term financial gains. Nevertheless, in the case of the company’s liquidation, common shareholders are entitled to the company’s assets only after bondholders, preferred shareholders, and other debt holders have been fully compensated.

Preferred shares

- Preferred stock is often referred to as a hybrid security that combines characteristics of both common stock and bonds. It brings together the reliable and steady income payments of bonds along with the ownership advantages of common stock.

- Preferred stock provides consistent and regular dividend payments, similar to the interest payments on bonds. Shares of preferred stock are issued with a fixed face value, or par value, similar to bonds.

- Both common stock and preferred stock grant ownership in a company. Common stock is more familiar, offering voting rights and the possibility of dividend payments. Preferred stock, on the other hand, offers more predictable dividend payments on a regular schedule, which may be attractive to certain investors, As opposed to common stock, preferred stock pays dividends on a regular basis, which may be of interest to certain investors, but it doesn’t confer the same voting rights or long-term value potential.

Options

An option is a type of financial tool linked to the worth of underlying assets like stocks. It grants the purchaser the chance to either purchase or sell the underlying asset, depending on the specific contract they possess. Every options agreement includes a designated expiration date by which the holder must execute their option. The predetermined value listed on an option is referred to as the strike price.

An option is “In the money” if stock’s current market price is higher than option’s strike price.

Warrants

Warrants give the holder the right to buy a predetermined amount of stock from the issuing company at a predefined price (called exercise price or strike price) before a predetermined expiration date. Investors or employees may receive warrants from a company as a form of compensation or an opportunity to raise capital. Warrants can be exercised before expiration date.

RSUs & PSUs

RSUs and PSUs are an alternative to stock options which are given to an employee with certain conditions in context to their maturity and conversions.

They come with a lock-in period, during which employees are unable to exercise them. The company imposes a certain time period as a precondition for exercising the RSUs. And some performance benchmarks to meet before an employee can exercise PSUs along with the lock in period condition.

2. Total debt

Money contributed by banks and other institutions to the business is considered as debt. These are the interest-bearing liabilities that may be paid back in the short term or long term depending on the tenure for which it has been granted. The most common form of debt is Loan which may be Secured or Unsecured.

- Secured debt is the one that is granted in exchange for collateral which can be seized by the lender in case the loan is not paid back because it is pledged to the lender as security.

- Unsecured debt is given without any collateral or security. And it totally depends on the ability of the debtor to pay back the debt.

Lease liabilities are also a crucial part of Debt. These are basically the obligations to make payments that arise from leases or properties which are taken on rent.

3. Minority interest

Minority Interest is less than 50% stake which is not owned by the Parent/Holding company. For eg. I hold a 52% stake in a company, the remaining 48% will be called the Minority Interest. According to Accounting standards, it is mandatory for my company to include 100% financials of the target company in my Consolidated Financial Statements.

It is included in all the line items of the Income Statement and also reported separately at the end of it as “Net Income from Non-Controlling Interest” and in the Balance Sheet, it is reported as line item “Investment in Associates” or “Investment in Affiliates” and “Non-Controlling Interest”. Hence, The companies which hold Minority interests in the target company will not include its financials in their Consolidated Financial Statements.

Role of Minority Interest in Calculation of Enterprise Valuation:

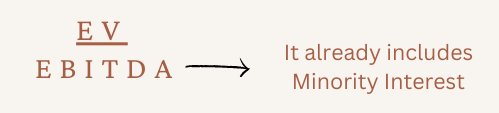

While evaluating a company’s financial health, certain multiples are calculated. EV/ EBITDA is one of the most common ones.

As we already know that 100% financials of the target company are included in our company’s Consolidated Financial Statement. This means that the denominator(EBITDA), is already increased due to the inclusion of the target company’s financials. If we do not incorporate these financials into the Enterprise Value (EV) calculation, it would not provide an accurate comparison. Therefore, to ensure that both the denominator and numerator are aligned, we include Minority Interest when calculating the Enterprise Value.

4. Cash and cash equivalents

Cash and cash equivalents are the most liquid form of assets in the financial statement of the company. Its examples include short-term investments, marketable securities, commercial paper, and money market funds.

=>These are reduced while calculating Enterprise value because it is understood that in case the business is acquired, then the acquiree will use cash and other equivalents to pay for debt the target company holds. And to that extent, debt value is considered to be less and remaining.