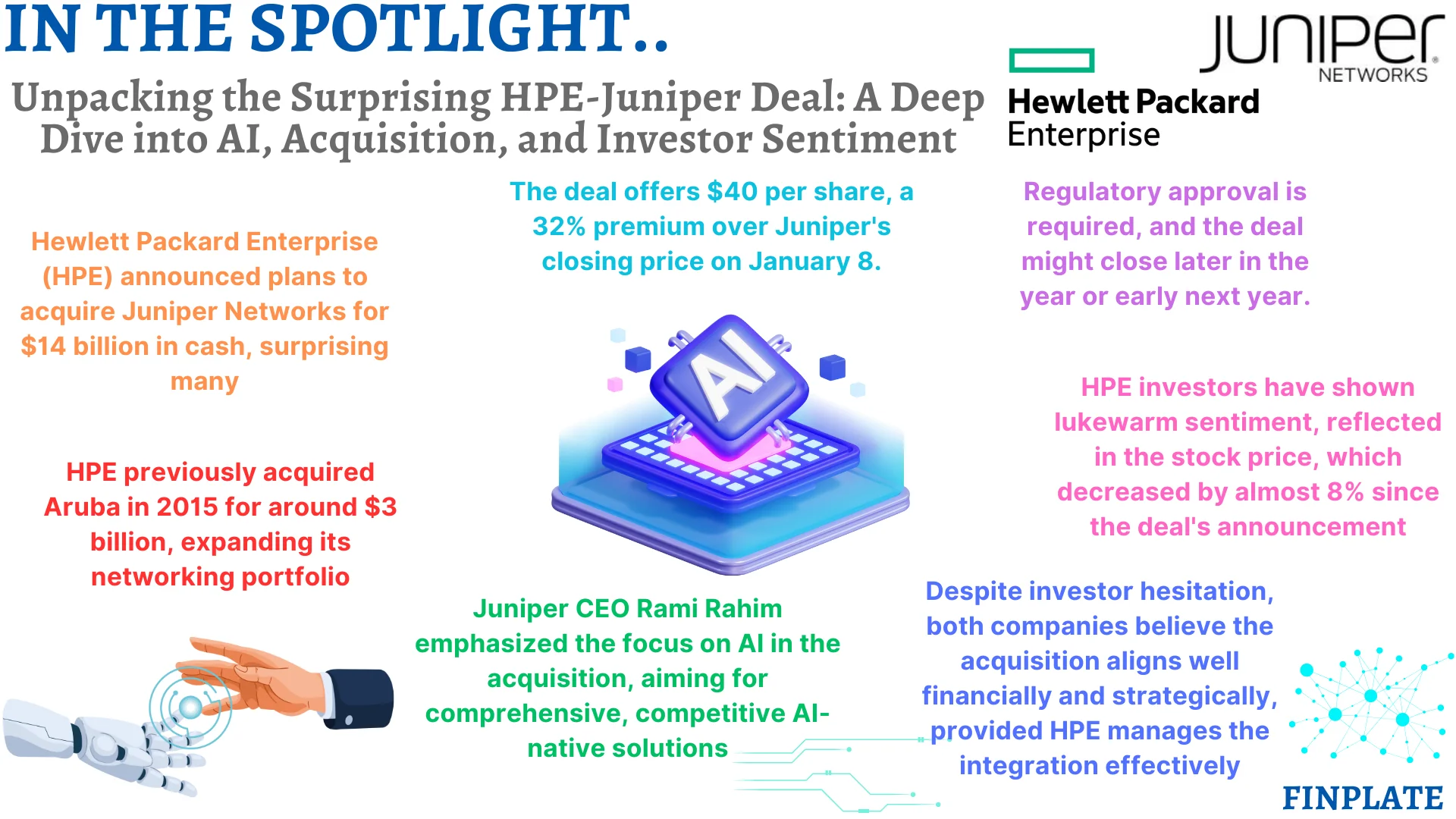

Hewlett Packard Enterprise (HPE) recently made headlines by announcing its plan to acquire Juniper Networks for a hefty $14 billion in cash, a move that caught many by surprise. This acquisition follows HPE’s previous purchase of Aruba in 2015 for approximately $3 billion, signaling a strategic expansion in the networking sector. Integrating such large entities often poses challenges, and Hewlett Packard Enterprise hasn’t always had the smoothest track record in this regard.

Interestingly, the companies involved didn’t solely frame the merger as a conventional networking venture. Juniper CEO Rami Rahim emphasized in a blog post that the focus was on advancing artificial intelligence (AI) capabilities. He highlighted the potential for the combined entity to offer more comprehensive AI-driven solutions, prioritizing user experience.

Despite differing interpretations, the deal, valued at $40 per share and representing a 32% premium over Juniper’s closing price on January 8, presents an offer too compelling for Juniper to ignore. The closure timeline hinges on regulatory approval, which remains uncertain given current regulatory trends.

Since the announcement on January 12, investor response to Hewlett Packard Enterprise’s move has been lukewarm, evident in the stock price fluctuations. The stock price declined from $17.72 on January 8 to $15.89 on January 12 and has since remained relatively stagnant, closing at $15.92 by the end of the month, marking nearly an 8% decline for the month.

With some time to reflect on the deal, it’s worth examining its implications and whether investors should adopt a more optimistic stance. Both companies express confidence in the synergy and financial prospects of the merger, provided HPE manages the integration effectively.

About Hewlett Packard Enterprise (HPE):

Hewlett Packard Enterprise (HPE) is an American IT company headquartered in Spring, Texas, established in 2015 after the split from Hewlett-Packard. It focuses on business solutions like servers, storage, networking, and software services. With $28.5 billion in revenue and 60,200 employees, Hewlett Packard Enterprise offers a range of products including financial technology, hardware, software, cloud computing, IoT, AI, and networking. Subsidiaries include Aruba Networks, Cray, Zerto, Silver Peak Systems, AXIS, Athonet, and Juniper Networks.

About Juniper Networks:

Juniper Networks, a pioneer in AI Networking, Cloud, and Connected Security Solutions, aims to revolutionize connectivity experiences worldwide. Founded in 1996 and headquartered in Sunnyvale, California, Juniper is dedicated to empowering network teams and individuals alike. Their solutions drive crucial connections across diverse sectors, from education to healthcare to banking. With a relentless focus on customer satisfaction, Juniper prioritizes simplifying network operations for architects, builders, and operators, ensuring optimal productivity for end-users. Committed to social responsibility, Juniper sets industry standards by supporting its people, preserving the planet, and upholding ethical values.

To summarize:

To read more news, click here