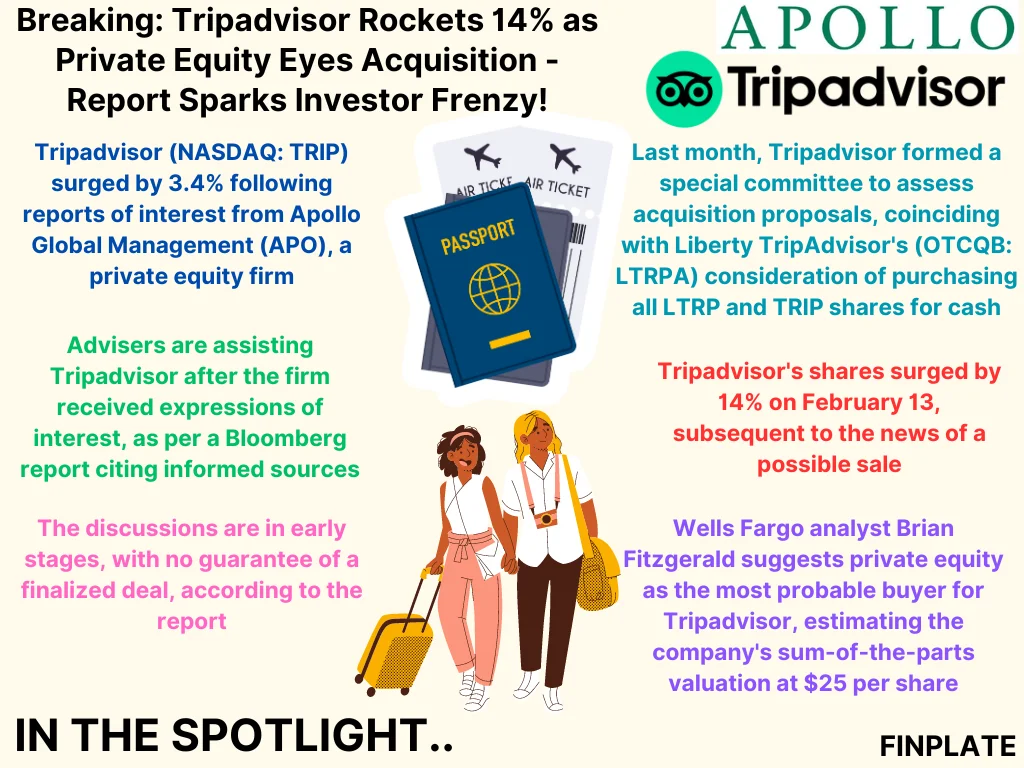

Tripadvisor (NASDAQ: TRIP) experienced a rapid 3.4% surge in its stock value following reports indicating that Apollo Global Management (APO), a private equity firm, has shown interest in acquiring the renowned travel information services firm. As outlined in a Bloomberg report on Wednesday, Tripadvisor has engaged with advisors subsequent to the expressed interest from Apollo Global Management, as disclosed by sources familiar with the situation.

However, it’s crucial to note that these discussions are in their nascent stages, and the possibility of a deal remains uncertain, as highlighted in the report. This development follows Tripadvisor’s recent announcement about the establishment of a special committee tasked with assessing acquisition proposals. Additionally, Liberty TripAdvisor (OTCQB: LTRPA), under Gregory Maffei’s ownership, which holds a significant stake in Tripadvisor (21%) and controls 57% of its voting power, also revealed considerations for a transaction that involves the purchase of all LTRP and TRIP shares with cash.

Notably, Tripadvisor’s stock experienced a notable 14% surge on February 13th, following the disclosure of potential acquisition discussions. According to Wells Fargo analyst Brian Fitzgerald, private equity firms are deemed the most probable acquirers of Tripadvisor, with the company’s valuation estimated at $25 per share based on a sum-of-the-parts analysis, as noted in his report from the previous month.

Key Points

- Interest from Apollo Global Management: The surge in Tripadvisor’s stock price follows reports of interest expressed by Apollo Global Management, a private equity firm, in acquiring the company.

- Early Stage Discussions: Tripadvisor has initiated discussions with advisors regarding the interest from Apollo Global Management. However, the discussions are still in their early stages, and the outcome remains uncertain.

- Formation of Special Committee: Tripadvisor recently formed a special committee to evaluate acquisition proposals, indicating the seriousness of potential acquisition considerations.

- Consideration by Liberty TripAdvisor: Liberty TripAdvisor, with a significant stake and voting control in Tripadvisor, is also contemplating a transaction involving the purchase of all LTRP and TRIP shares with cash.

- Market Reaction: Tripadvisor’s stock experienced a substantial surge following the disclosure of potential acquisition discussions, underscoring investor interest in the company’s future prospects.

- Valuation Analysis: Wells Fargo analyst Brian Fitzgerald suggests that private equity firms are likely acquirers of Tripadvisor, estimating the company’s valuation at $25 per share based on a sum-of-the-parts analysis.

About Tripadvisor

Tripadvisor, the world’s largest travel platform, helps 463 million travelers each month make every trip their best trip. Travelers across the globe use the Tripadvisor site and app to browse more than 859 million reviews and opinions of 8.6 million accommodations, restaurants, experiences, airlines and cruises. Whether planning or on a trip, travelers turn to Tripadvisor to compare low prices on hotels, flights and cruises, book popular tours and attractions, as well as reserve tables at great restaurants. Tripadvisor, the ultimate travel companion, is available in 49 markets and 28 languages.

The subsidiaries and affiliates of Tripadvisor, Inc. (NASDAQ:TRIP) own and operate a portfolio of websites and businesses, including the following travel media brands:

www.bokun.io, www.cruisecritic.com, www.flipkey.com, www.thefork.com, www.helloreco.com, www.holidaylettings.co.uk, www.jetsetter.com, www.niumba.com, www.seatguru.com, www.singleplatform.com, www.vacationhomerentals.com, and www.viator.com.

About Apollo Global Management

Apollo emerges as a rapidly expanding, globally positioned alternative asset manager. Within its asset management division, the company aims to deliver superior returns across varying levels of risk through three primary investment strategies: yield, hybrid, and equity. With over thirty years of experience, Apollo’s integrated platform offers expert investment guidance, catering to the financial objectives of its clientele while furnishing businesses with innovative capital solutions for expansion.

Through its subsidiary Athene, Apollo specializes in retirement services, offering a range of products to bolster financial security and serving as a solutions provider for institutional clients. Apollo’s investment philosophy, characterized by patience, creativity, and expertise, fosters alignment among clients, invested businesses, employees, and the broader communities impacted, thereby fostering opportunities for growth and positive outcomes.

Summary