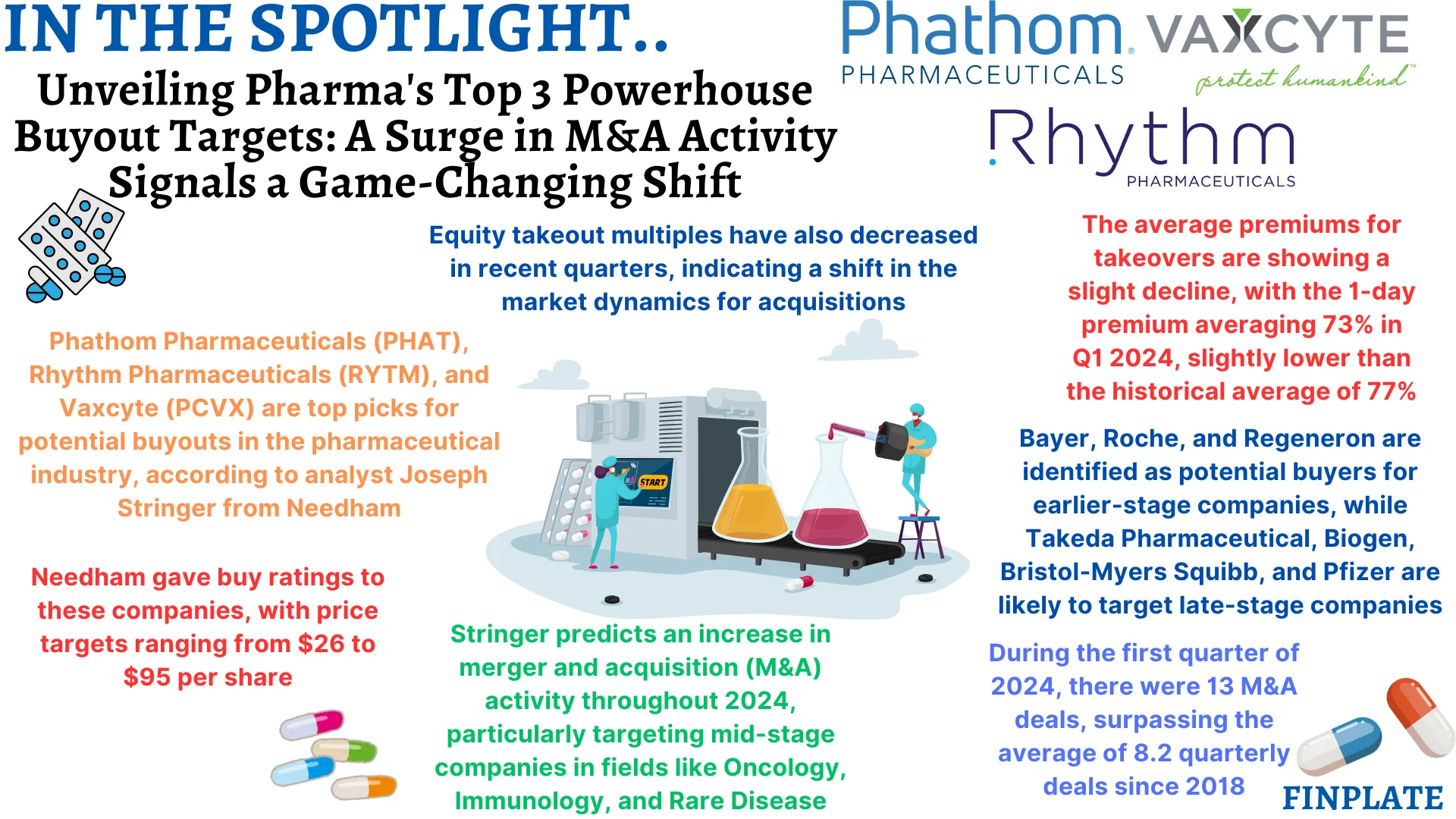

According to a Needham analyst named Joseph Stringer, three pharmaceutical companies—Phathom Pharmaceuticals (PHAT), Rhythm Pharmaceuticals (RYTM), and Vaxcyte (PCVX)—are the top candidates to be bought out by larger companies in the pharmaceutical industry. Stringer believes that these companies are the most likely takeover targets in Needham’s list of companies they follow closely.

He rates Phathom with a buy rating and a price target of $26, Vaxcyte with a buy rating and a price target of $95, and Rhythm with a buy rating and a price target of $50.

Stringer predicts that there will be more mergers and acquisitions (M&A) happening throughout 2024, focusing on companies in the middle stages of development, particularly those involved in Oncology, Immunology, and Rare Diseases. He also mentions that Bayer, Roche, and Regeneron are likely to acquire companies in earlier stages, while Takeda Pharmaceutical, Biogen, Bristol-Myers Squibb, and Pfizer are more inclined to buy companies in later stages.

However, he notes that the average premium paid for takeovers seems to be decreasing, as well as the equity takeout multiples, which suggests that companies might be less willing to pay high premiums for acquisitions lately.

Key Points:

- Top Takeover Targets: Phathom Pharmaceuticals, Rhythm Pharmaceuticals, and Vaxcyte are identified by Needham analyst Joseph Stringer as the prime candidates for acquisition in the pharmaceutical sector.

- Stringer’s Recommendations: Stringer assigns buy ratings and specific price targets for each of the three companies: Phathom ($26), Vaxcyte ($95), and Rhythm ($50), indicating his confidence in their potential.

- Expected M&A Trends: Stringer anticipates that mergers and acquisitions activity will continue to be robust in 2024, with a focus on mid-stage companies involved in Oncology, Immunology, and Rare Diseases.

- Likely Buyers: Stringer suggests that Bayer, Roche, and Regeneron are inclined to acquire companies in earlier developmental stages, while Takeda Pharmaceutical, Biogen, Bristol-Myers Squibb, and Pfizer are more likely to target companies in later stages.

- Trends in Premiums and Multiples: Stringer observes a decrease in the average premium paid for takeovers and a decline in equity takeout multiples over recent quarters, indicating a possible shift in acquisition strategies towards more conservative valuation metrics.

About Phathom Pharmaceuticals

Phathom Pharmaceuticals specializes in advancing innovative therapies for gastrointestinal (GI) ailments. They’ve obtained exclusive rights in key regions like the United States, Europe, and Canada for a potassium-competitive acid blocker (PCAB), designed to address specific GI conditions. The company has successfully concluded Phase 3 clinical trials targeting Erosive GERD, Non-Erosive GERD, and H. pylori infection. Additionally, they are gearing up to commence another Phase 3 trial focusing on a groundbreaking “As Needed” dosing approach for Non-Erosive GERD patients.

About Rhythm Pharmaceuticals

Rhythm Pharmaceuticals is a commercial-stage biopharmaceutical company dedicated to transforming the lives of patients and their families who are affected by hyperphagia and severe obesity caused by rare melanocortin-4 receptor (MC4R) pathway diseases. Their mission involves rapidly advancing care and developing precision medicines that address the root cause of these conditions.

The company’s focus lies in translational research based on the largest known DNA database specifically centered around obesity. Additionally, they have clinical development programs with trials targeting rare obesities linked to variants in certain genes relevant to the MC4R pathway.

For those living with hyperphagia and severe obesity, Rhythm Pharmaceuticals aims to provide hope and effective treatments.

About Vaxcyte

Vaxcyte stands out as a cutting-edge vaccine company headquartered in San Carlos, California. They possess a unique capability to swiftly develop, refine, and mass-produce top-tier vaccines. Their approach involves revamping the traditional methods of vaccine production using sophisticated chemistry and modern synthetic techniques, such as the XpressCF™ cell-free protein synthesis platform. This enables them to create complex proteins that offer superior immunological advantages.

Their flagship product, VAX-24, a pneumococcal conjugate vaccine (PCV) comprising 24 valences, earned FDA Breakthrough Therapy designation for preventing invasive pneumococcal disease in adults. Vaxcyte has a well-defined strategy for their PCV lineup, capitalizing on established regulatory pathways for approved PCVs. They are gearing up for global distribution post-regulatory approval through a strategic partnership with Lonza, a leading contract manufacturer of biologics.

Furthermore, their pipeline includes VAX-31, a PCV candidate with an even broader spectrum, along with preclinical programs targeting Group A Strep, periodontitis, and Shigella infections.

Vaxcyte’s overarching mission revolves around safeguarding humanity from the grave consequences of invasive bacterial infections. Their focus extends beyond pneumococcal disease, encompassing various other health threats like Group A Strep, periodontitis, and Shigella. With a clear and well-defined path to success, Vaxcyte is poised to make significant strides in the field of vaccine development.

Summary