In spite of the fact that the formula and method for calculating Enterprise Value are all over the web, there is still some confusion when we are actually trying to calculate it for a specific company. No issues, Finplate is here to support.

Enterprise valuation, often abbreviated as EV, is a crucial financial metric used to ascertain a company’s total value. It’s a comprehensive assessment that considers various financial elements like debt, equity, market capitalization, and cash reserves to arrive at a singular valuation figure. Unlike other valuation methods, EV is preferred as it offers a holistic view of a company’s financial health and feasibility for potential investors or during mergers and acquisitions.

The calculation involves summing up a company’s market capitalization, adding debt, minority interest, and preferred stock, and then subtracting cash. This approach assumes that the cash held by the company being valued will be used to pay off its debt. This metric serves as a foundation for negotiations during acquisitions, aiding in determining the actual worth of a business and facilitating competitive bidding wars in cases where multiple buyers are interested. Knowing the precise enterprise value assists in making informed decisions regarding premium offerings, ensuring fair acquisition prices, and steering clear of undervaluation or overpayment scenarios during corporate transactions.

Let’s take the example of BrightView Holdings, Inc.

BrightView is the nation’s leading commercial landscape company. It delivers consistent and excellent results for clients across the country, throughout the lifecycle of their landscapes.

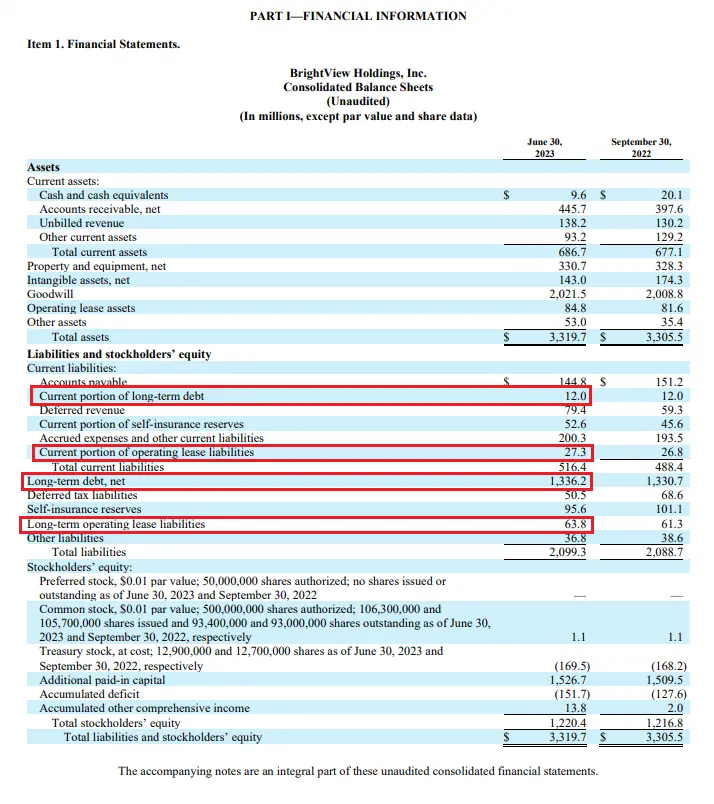

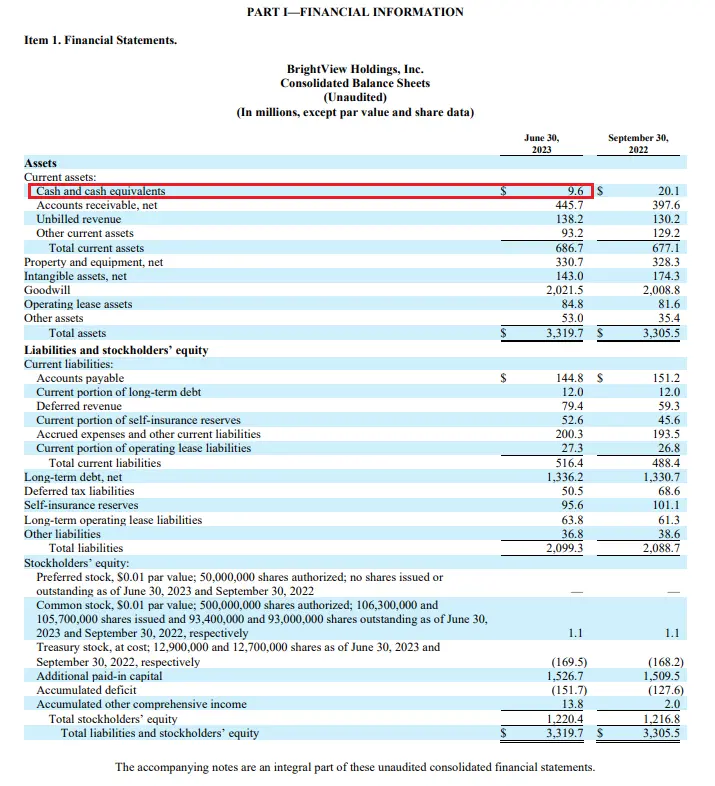

In the 10Q report, required values will be provided to calculate the Enterprise Value as of 31st July 2023.

STEP 1: Gather the Financial Data

Visit the company’s website and click on “Investors“.

It is mandatory for NYSE listed companies to release 10K reports for their annual numbers and 10Q reports for their quarterly numbers.

Click on Financials & Filings and then on “SEC filings” section. Select 2023 in “Select year” drop down and Quarterly Filings in “Filter filing type” drop down. You’ll see “Aug 03, 2023” in “Date” column , download the PDF given in front of it That’s the 10Q report which has been released on 3rd August 2023, this means we’ll find June Quarter numbers in this filing itself.

NOTE:

In order to calculate Enterprise Value, certain assumptions must be specified:

1. The Enterprise Value will be calculated as of 31st July 2023

2. All values are in Millions Dollars except for per share data.

For calculating the Enterprise Value we need Market Cap (shares outstanding x share price), Preferred stock, Outstanding debt, Minority interest, and Cash and Cash Equivalents. We’ll find all the values in the Financial Statements of 10Q report. I’ll guide you through each component individually.

STEP 2: Calculate Market Capitalization

Let’s start with calculation of Market Capitalization. Latest number of shares outstanding and valuation’s last day’s closing share price will be required.

So, the shares outstanding given on cover page of 10Q report are 93,400,000.

Closing share price on 31st July 2023 was $7.71.

Source: https://www.nasdaq.com/market-activity/stocks/bv/historical, Pg 4

Market Cap = Number of Shares Outstanding * Share Price

= 93.4 Million * $7.71

= $720.114 Million

Occasionally, Market Capitalization alone serves as an indicator of a company’s worth. BrightView Holding’s substantial market cap of $720.114 Million signifies its significant size, an accomplishment in itself. Comparing companies using this metric aids in investment decisions. In the stock market, companies are typically classified into three categories based on their market capitalization:

- Large-Cap Companies: These corporations boast a market capitalization of $10 billion or more, known for steady growth, consistent dividend payouts, and a robust customer base. Investors often perceive them as safer investments due to their industry prominence and stability compared to smaller market cap companies.

- Mid-Cap Companies: Falling within the $2 billion to $10 billion market cap range, these entities exhibit steady growth and establish a secure position in the market. They offer a middle ground between large-cap and small-cap stocks, presenting moderate growth potential and reduced risk compared to small-caps.

- Small-Cap Companies: Ranging from $300 million to $2 billion in market cap, these firms are viewed as riskier investments. They are usually newer to the market and are still establishing their presence. Limited resources and market presence make them more vulnerable to macroeconomic disruptions. Investors might anticipate short-term price fluctuations but also potential long-term price increases.

Investors have the liberty to choose which category of companies to invest in. For instance, BrightView Holdings, Inc. falls into the Small Cap category, presenting an investment opportunity for the investor. Understanding that BrightView Holdings, Inc. is a small-cap company, an investor should consider the following features:

- Volatility: Small-cap companies are highly affected by market fluctuations, earning them a reputation for volatility. Their stocks perform well in bullish markets but underperform when the market is bearish, hence posing a riskier investment.

- Limited Market Activity: Small-cap stocks experience lower liquidity compared to mid-cap and large-cap stocks due to fewer investors trading in them. However, improved price discovery over time might increase their liquidity.

- Taxation: Profits from selling small-cap shares are subject to taxation as income under Section 80C. Short-term gains (shares held for less than a year) incur a 15% short-term capital gain tax, while long-term gains (shares held for over a year) face a 10% long-term capital gain tax.

- Investment Outlook: Small-cap companies have the potential to grow into medium-sized enterprises over time. Yet, realizing gains from investments in small-cap stocks demands patience. Seasoned investors with a longer investment horizon may consider them for their potential to yield higher returns.

Hence, investing in BrightView Holdings, Inc. or any other small-cap company requires careful consideration of these features. Investors should keep these points in mind while making investment decisions.

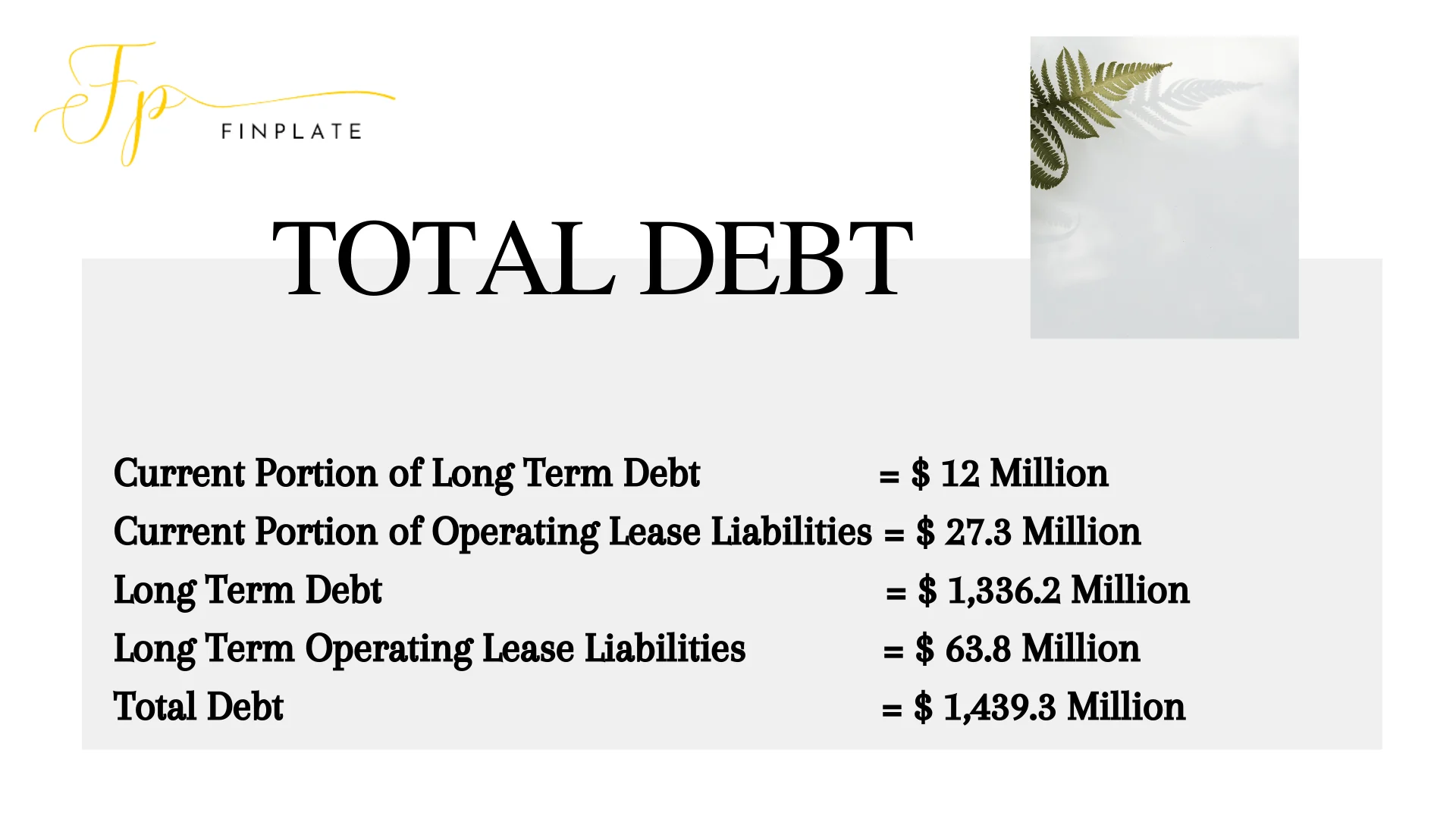

STEP 3: Add Total Debt

Let’s move to Debt portion of the Enterprise Value formula,

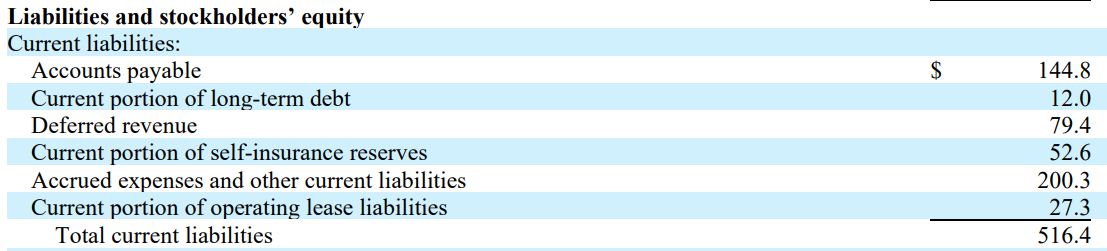

In Balance Sheet, Look for all Short Term liabilities section first.

Current Portion of Long Term Debt = 12

Current Portion of Operating Lease Liabilities = 27.3

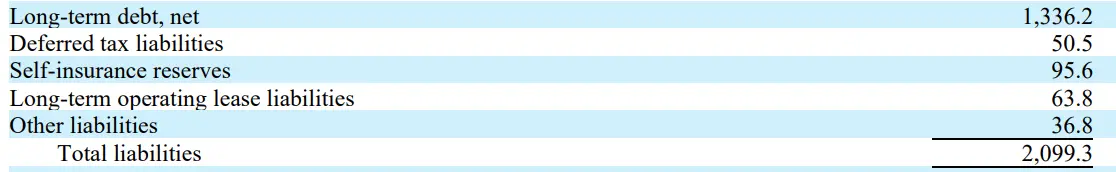

In Long Term Debt section,

Long Term Debt = 1,336.2

Long Term Operating Lease Liabilities = 63.8

Total Debt = 1,439.3

Step 4: Add Minority Interest

This value is clearly given in Balance Sheet after Shareholder’s Equity as Minority Interest / Non Controlling Interest and as a separate line item also in name of “Redeemable Non Controlling Interest”.

Here in this case, no Minority Interest is given, this means that BrightView Holdings, Inc. doesn’t own any Minority Interest in any other company.

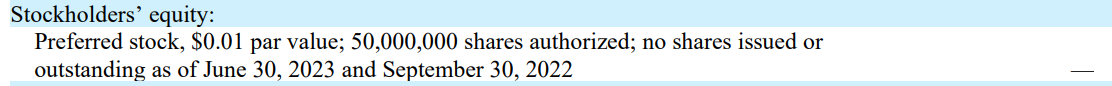

Step 5: Add Preferred Stock

Go Balance Sheet under Shareholder’s Equity section. It is given there only if there is any.

BrightView Holdings doesn’t have any Preferred Stock so it’ll be zero in this case.

Step 6: Deduct Cash

Cash is given in Balance Sheet as first line item as “Cash and Cash Equivalents”. This represents the company’s available liquid assets.

We’ll take that value i.e. 9.6

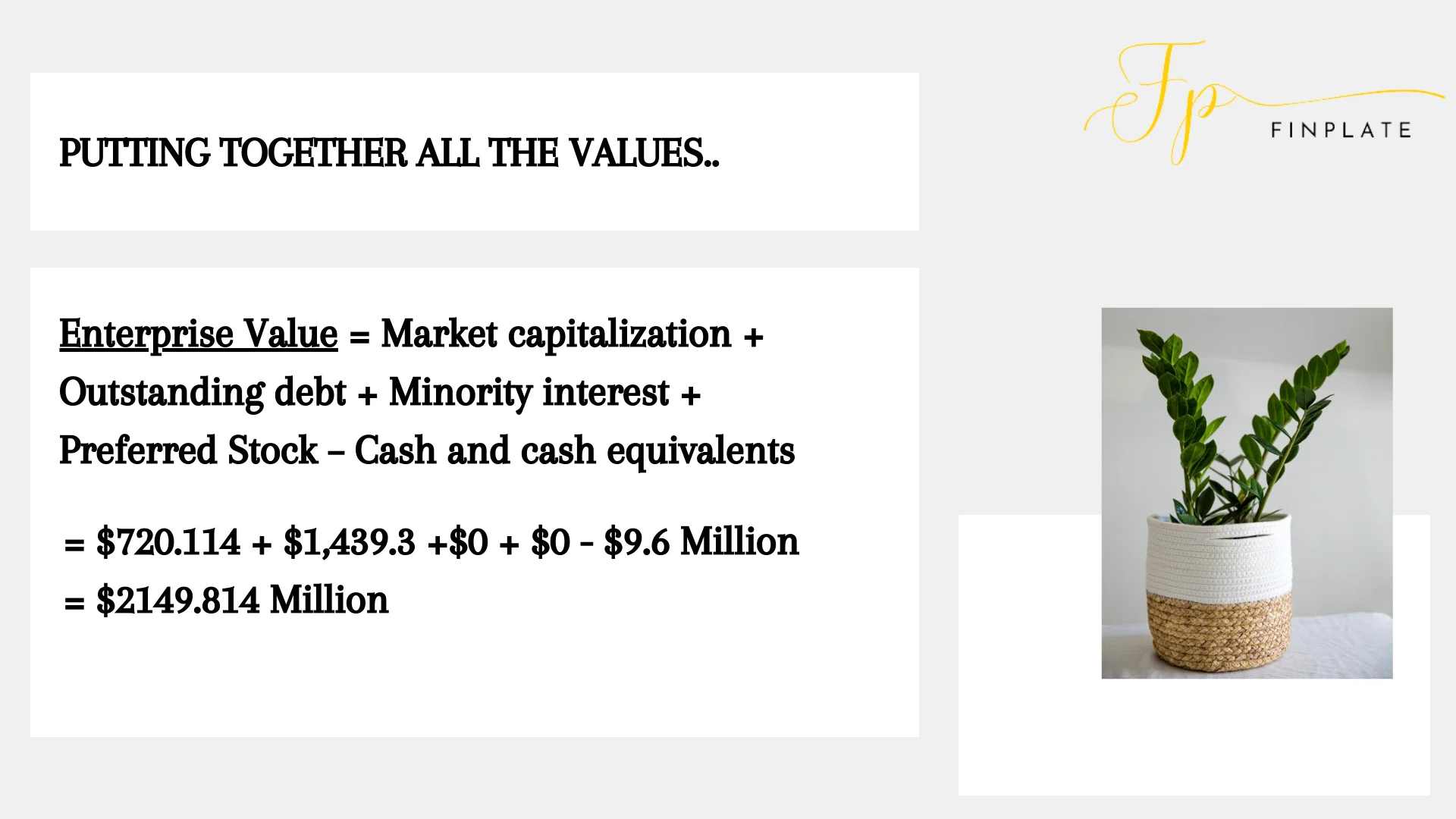

Step 7: Combine all values and Put in formula of Enterprise Value

Since we have gone through all the components of the formula of Enterprise Value, we can now bring all the values together and put in formula.

Enterprise Value = Market capitalization + Outstanding debt + Minority interest + Preferred Stock – Cash and cash equivalents

Enterprise Value = Market Capitalization + Outstanding Debt + Minority Interest + Preferred Stock – Cash and Cash Equivalents

= 720.114 + 1,439.3 + 0 + 0 – 9.6

= $2149.814 Million

If any corporation or person intends to acquire Brightview Holdings , Inc., they will need to pay a valuation of $2149.814 Million as of July 31st, 2023. Payment can be made using stocks, cash, or a combination of both cash and stocks.

To learn more about Enterprise Valuation, click here.