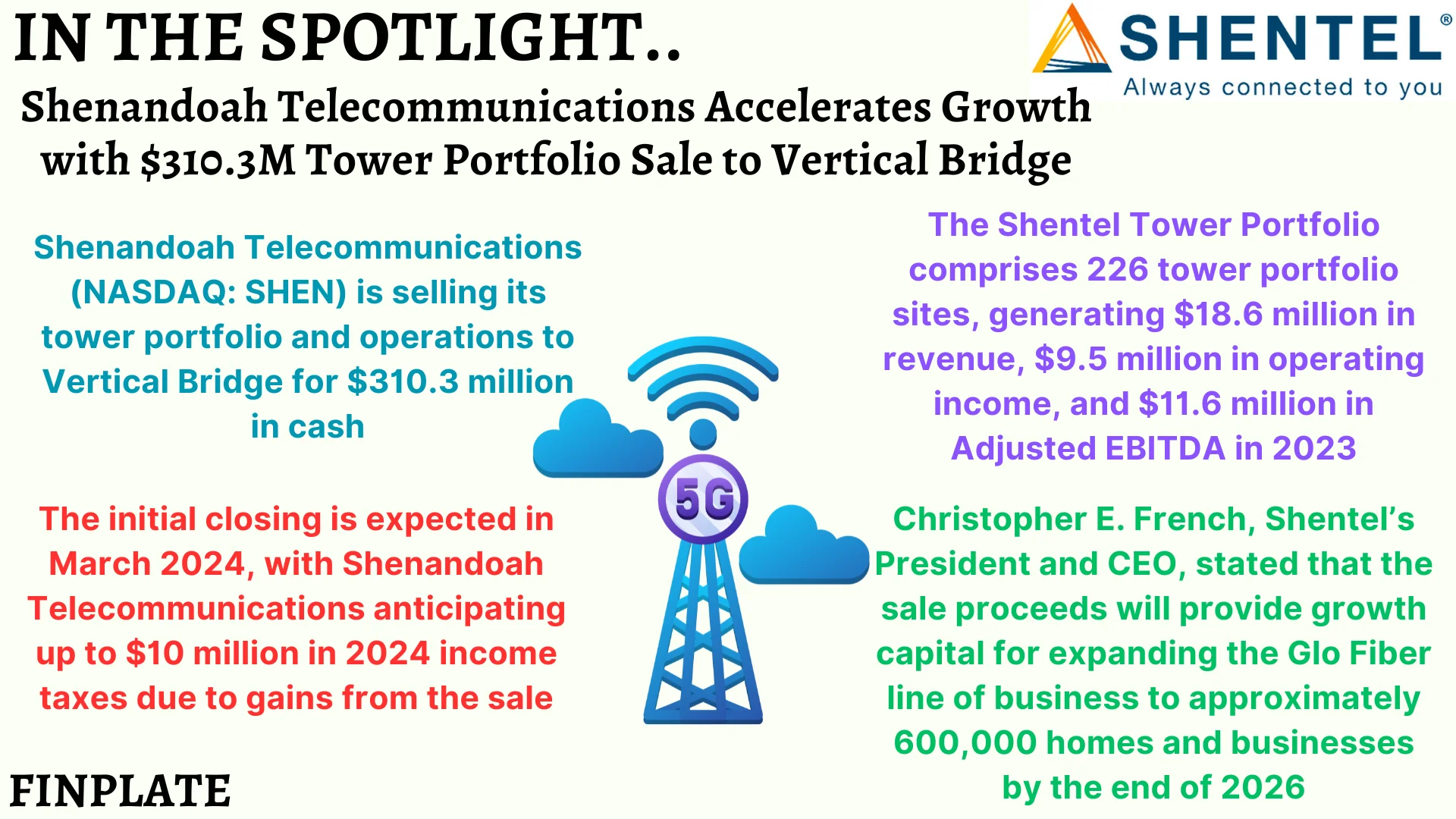

Shenandoah Telecommunications (NASDAQ: SHEN) (Shentel) announced its agreement to divest its tower portfolio and operations to Vertical Bridge for $310.3 million in cash, as stated on Friday. The deal anticipates an initial closing scheduled for March 2024, with Shenandoah Telecommunications potentially incurring up to $10 million in 2024 income taxes due to gains from the sale, after utilizing net operating loss carryforwards.

The portfolio being sold encompasses 226 tower sites, which contributed $18.6 million in revenue, $9.5 million in operating income, and $11.6 million in Adjusted EBITDA during 2023. Christopher E. French, President and CEO of Shenandoah Telecommunications, remarked that the proceeds from this transaction will furnish the company with additional growth capital to bolster the planned expansion of its Glo Fiber business line, extending coverage to approximately 600,000 homes and business passings by the conclusion of 2026.

Key Points:

- Sale Details: Shenandoah Telecommunications (SHEN) (Shentel) has reached an agreement to sell its tower portfolio and operations to Vertical Bridge for $310.3 million in cash. This transaction is aimed at reshaping SHEN’s business focus and optimizing its asset utilization.

- Financial Implications: Following the sale, Shenandoah Telecommunications anticipates an initial closing in March 2024. However, it expects to incur income taxes of up to $10 million in 2024, attributed to gains from the sale after utilizing net operating loss carryforwards. This indicates a strategic financial move for Shenandoah Telecommunications, balancing gains from the sale against tax obligations.

- Tower Portfolio Metrics: The tower portfolio being divested comprises 226 sites. In 2023, these sites generated significant revenue, with $18.6 million recorded. The operating income stood at $9.5 million, indicating the efficiency and profitability of the tower portfolio. Adjusted EBITDA for the same period amounted to $11.6 million, highlighting the financial robustness of the tower business being sold.

- Strategic Reallocation of Capital: Shenandoah Telecommunication’s President and CEO, Christopher E. French, emphasizes that the proceeds from the tower sale will serve as growth capital. This capital infusion will be directed towards expanding Shentel’s Glo Fiber business line. The goal is to extend coverage to approximately 600,000 homes and business passings by the end of 2026. This strategic reallocation underscores SHEN’s commitment to long-term growth and innovation in its core business areas.

About Shenandoah Telecommunications

Introducing Shenandoah Telecommunications, a company with a rich history dating back to 1902. Though we might be a recent discovery for you, our roots trace back to our humble beginnings as a small phone company catering to the residents of Virginia’s Northern Shenandoah Valley. Over the years, we’ve evolved into a provider of cutting-edge broadband services, digital TV, voice, high-speed internet, and mobile services in collaboration with Sprint. Our reach now extends to neighbors in Virginia, West Virginia, Kentucky, Pennsylvania, and Maryland.

Shentel takes pride in its specialization in delivering advanced services to rural and underserved markets. We firmly believe that these communities deserve the same caliber of service as their counterparts in larger metropolitan areas.

Summary