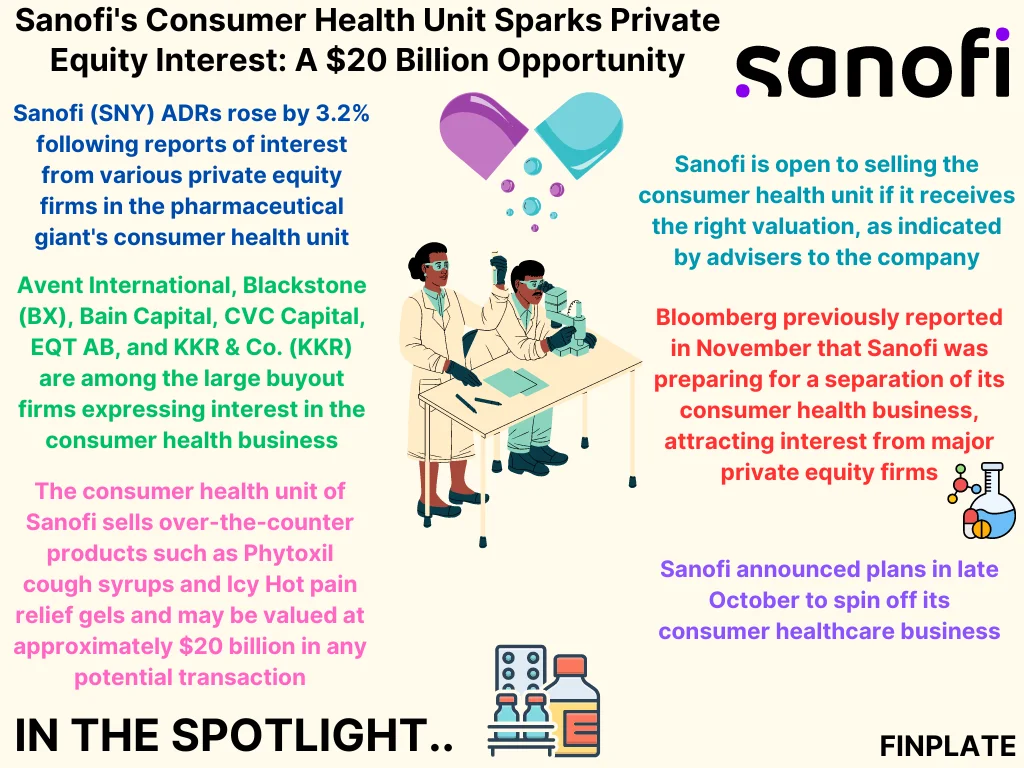

Sanofi’s ADRs experienced a 3.2% increase following reports indicating interest from multiple private equity firms in the pharmaceutical giant’s consumer health division. According to sources familiar with the matter cited by Bloomberg, prominent buyout entities such as Avent International, Blackstone, Bain Capital, CVC Capital, EQT AB, and KKR & Co. have expressed interest in the consumer health segment, potentially ahead of its separation.

This division, known for selling popular over-the-counter products like Phytoxil cough syrups and Icy Hot pain relief gels, could be valued at around $20 billion in any forthcoming deal. Sanofi’s advisors have communicated the company’s willingness to sell the unit if the valuation aligns appropriately. This development follows previous reports from November, which highlighted Sanofi’s preparation for the separation of its consumer health business, with indications of interest from significant private equity players. Sanofi initially announced its intentions to spin off the consumer healthcare division in late October.

Key Points

- Interest from Private Equity Firms: The report indicates that several prominent private equity firms, including Avent International, Blackstone, Bain Capital, CVC Capital, EQT AB, and KKR & Co., have shown interest in Sanofi’s consumer health unit.

- Valuation and Potential Transaction: The consumer health division, which includes popular products like Phytoxil cough syrups and Icy Hot pain relief gels, is estimated to be valued at approximately $20 billion in any potential transaction. Sanofi’s advisors have stated the company’s openness to selling the unit if the valuation meets expectations.

- Continued Strategic Moves: This development follows earlier reports from November, indicating Sanofi’s readiness to separate its consumer health business. The company’s announcement in late October about its plans to spin off the consumer healthcare division sets the stage for these potential transactions.

- Market Response: Sanofi’s American Depositary Receipts (ADRs) saw a 3.2% rise following the reports, indicating investor optimism about the potential transactions and the company’s strategic moves in the consumer health sector.

About Sanofi

Sanofi, an innovative global healthcare company, strives to harness the wonders of science for the betterment of humanity. With teams spanning approximately 100 countries, their mission is to revolutionize medical practices by pushing boundaries and making the seemingly impossible achievable. Through their efforts, they offer potentially transformative therapies and essential vaccine coverage to millions worldwide, all while prioritizing sustainability and social accountability in their endeavors.

Summary