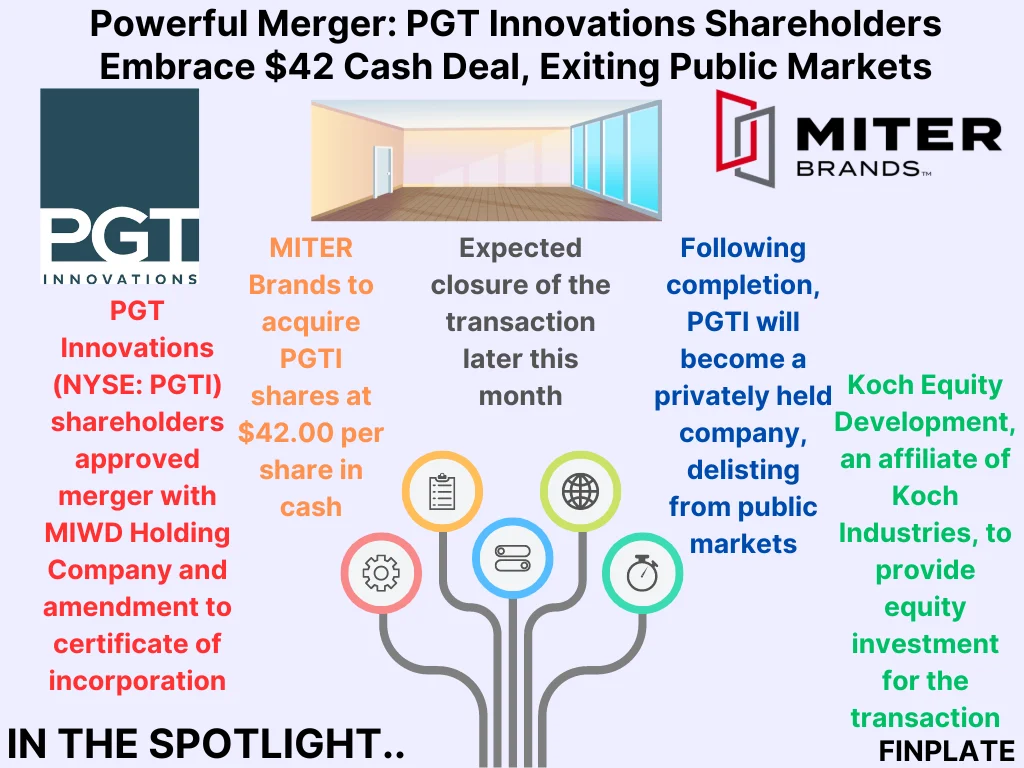

The shareholders of PGT Innovations, a company listed on the New York Stock Exchange (NYSE:PGTI), agreed to a merger with MIWD Holding Company. This means they voted to join forces with MIWD Holding Company and make some changes to the company’s official documents.

MITER Brands will buy each share of PGTI for $42.00 in cash. MITER Brands is able to do this partly because another company called Koch Equity Development, which is part of Koch Industries, is putting money into MITER Brands.

This deal is expected to be completed by the end of this month. After it’s done, PGT Innovations will no longer be a company that anyone can buy stock in, and its shares won’t be traded on the stock market anymore.

Key Points:

- Merger Approval: Shareholders of PGT Innovations voted in favor of a merger agreement with MIWD Holding Company. This decision was made at a special meeting called for the purpose of voting on this agreement. Approval from shareholders is essential in such transactions, as it reflects their consent to significant changes in the company’s ownership and operations.

- Share Acquisition: MITER Brands, a presumably related entity to MIWD Holding Company, will acquire each share of PGT Innovations at a price of $42.00 in cash. This means that shareholders of PGT Innovations will receive $42.00 for each share they own as part of the merger agreement.

- Financing Details: MITER Brands’ acquisition of PGT Innovations’ shares will be partly financed by an equity investment from an affiliate of Koch Equity Development. Koch Equity Development is a key investment arm of Koch Industries and has existing investments in MITER Brands, indicating a strategic financial arrangement facilitating this acquisition.

- Expected Timeline: The merger transaction is anticipated to close later in the current month, suggesting that all necessary regulatory approvals and procedural requirements are in progress or have been met. This timeline is crucial for stakeholders as it sets expectations for when the merger will be finalized.

- Private Ownership: Upon the completion of the merger, PGT Innovations will transition from being a publicly traded company to a privately held one. This implies that its shares will no longer be available for trading on any public stock exchange. The move to private ownership can have implications for corporate governance, reporting requirements, and shareholder relations.

About PGT Innovations

For more than four decades, PGT Innovation‘s team has been dedicated to crafting the most robust and secure building materials available, with an unwavering commitment to prioritizing the needs of their customers above all else. Over the years, they have expanded through acquisitions such as Eze-Breeze®, PGT® Custom Windows + Doors, CGI®, WinDoor®, Western Window Systems, CGI Commercial, NewSouth Window Systems, Eco Window Systems, Anlin Windows & Doors, and Martin Door.

This growth has fostered a community built on principles of honesty, safety, innovation, and sustainable development. United under the umbrella of PGT Innovations™, they are harnessing their collective expertise to integrate their product lines, introduce new offerings to the market, enhance their services, and venture into new territories. Their ethos is clear: they innovate, they construct, they deliver.

About Miter Brands

From a third-party perspective, MITER Brands™ emerges as a prominent collective of top-tier window and door brands, bound by a steadfast dedication to quality and excellence. Their narrative unfolds as follows:

Heritage and Mission

Since its inception in 1947, MITER Brands has been a trusted name for homeowners, distributors, architects, builders, and contractors nationwide. Their comprehensive service, spanning manufacturing to exemplary customer support, underscores a profound commitment to both craftsmanship and clientele. Yet, beyond the realm of windows and doors, MITER Brands cultivates a culture prioritizing people, acknowledging that their workforce drives innovation and industry standards.

Community Impact

MITER Brands transcends mere business success, actively engaging in philanthropy at local and national levels. The MITER Foundation epitomizes their ethos of community engagement, emphasizing care and contribution beyond corporate confines.

Pinnacle of Industry

As a frontrunner in the windows and doors sector, MITER Brands leverages its esteemed reputation to further elevate its legacy. Their unyielding pursuit of perfection propels their ascendancy, evidenced by brands such as MI Windows and Doors and Milgard Windows and Doors. Boasting an extensive network of over 10 manufacturing facilities nationwide, MITER Brands remains a cornerstone supplier of precision-engineered, energy-efficient windows and doors. Their vast distribution network serves thousands of dealers, positioning them as a significant force in the market.

Whether reflecting on their illustrious past or charting a course for the future, MITER Brands steadfastly upholds its commitment to excellence, community, and purpose.

Summary