In the previous article, we calculated the Enterprise Value of Brightview Holdings. To understand it in detail and step by step, click here. Comparing its value with some other companies, enterprise value alone is not enough. For that, we need to have several more parameters that can act as a basis for comparison. So, multiples come into the picture. We understood the most prevalent multiples of the industry in my other article. To read it, click here. I have calculated those multiples for Brightview Holdings as of 31st Jul’23.

Let’s start understanding the step-by-step calculation of multiples for the company.

In finance, multiples are comparative metrics used to assess different facets of a company’s performance, aiding in evaluating its value concerning similar companies in the industry. There are two primary types of multiples: Equity Multiples and Enterprise Multiples.

Equity Multiples concentrate on stock-related indicators:

1. Price-to-Sales Ratio: Measures a company’s market value relative to its sales, providing insight into how investors perceive the company based on its revenue without diving into complex financial details.

2. Price-to-Book Ratio: Compares a company’s market value to the value of its assets, helping investors ascertain whether a stock is reasonably priced concerning its asset value.

3. P/E Ratio (Price-to-Earnings Ratio): Divides a company’s share price by its earnings per share, offering insight into the price investors are willing to pay for each dollar of earnings and aiding in understanding stock valuation relative to earnings.

4. Dividend Yield: Divides a company’s dividend per share by its share price, revealing the return on investment from dividends and assisting investors in selecting stocks aligned with their investment objectives.

Enterprise Multiples provide a broader evaluation of a company’s value:

1. EV/Revenue (Enterprise Value/Revenue): Divides a company’s enterprise value by its revenue, which is particularly beneficial for companies without positive earnings or when evaluating high-growth businesses.

2. EV/EBIT (Enterprise Value/Earnings Before Interest and Taxes): Compares a company’s enterprise value with its earnings, indicating whether a stock might be overvalued or undervalued based on its profitability.

3. EV/EBITDA (Enterprise Value/Earnings Before Interest, Taxes, Depreciation, and Amortization): Considers earnings before specific expenses, offering insights into a company’s operational efficiency and financial health.

4. EV/EBITDAR (Enterprise Value/Earnings Before Interest, Taxes, Depreciation, Amortization, and Rental Costs): Includes rental costs/leases in EBITDA, especially pertinent in industries where leasing assets are prevalent.

5. EV/Invested Capital: Divides enterprise value by invested capital, commonly used in capital-intensive industries to evaluate fixed asset efficiency.

Understanding these metrics necessitates comprehensively comprehending the company, its industry, and specific financial contexts. Investors frequently use multiples for comparative analysis, seeking potentially undervalued stocks for higher returns or to make well-informed investment decisions.

Before starting the calculation of multiples of Brightview Holdings, certain assumptions need to be noted. Those are mentioned below:

- For Share price, click here, Pg 4. As per Nasdaq data, the Share price of Brightview Holdings is $7.71

- For annual numbers, consider the 10K report; for Quarter numbers, consider the 10Q Report.

- Since we are calculating the multiple as of 31st Jul’23, we’ll have to calculate the LTM as 30th Jun’23 for Income Statement items because the latest released reports were only for June numbers. The concept of LTM numbers has been explained deeply below.

Certain concepts also need to be understood:

Concept of LTM Numbers:

It stands for the Last Twelve Months. The calculation we do has always been for the last 12 months. So, standing on 31st Jul’23, the last twelve months would be formed when the period starts on 1st Jul’22 and ends on 30th Jun’23 because the latest numbers released as of 31st Jul’23 were June quarter. The company’s financial year ends on 30th September, including numbers from 1st October to 30th September. So to calculate numbers till 30th Jun’23, nine months of 2022 will have to be deducted from annual numbers, and nine months numbers of 2023 will have to be added to annual numbers so that we get the latest 12 months’ numbers, which start from 1st Jul’22 to 30th Jun’23.

Difference between GAAP and non-GAAP Numbers.

In the ordinary course of action, a company has many expenses that are not recurring in nature but are taken into account while making the financial statements called GAAP numbers. So the company adds back all the non-recurring and non-cash expenses it reduced while calculating EBIT (e.g. inventory write-downs, COVID-related expenses, Business transformation and integration costs, Offering-related expenses) and reduces back all the non-recurring incomes added while calculating EBIT (e.g. Insurance claims, government grants, disposal of assets). When these adjustments are made, the final amount comes under non-GAAP numbers.

Equity Multiples

Equity multiples are essential financial metrics investors use to gauge a company’s valuation and performance. The price-to-sales ratio assesses market value against sales, reflecting investor perception based on revenue. The price-to-book ratio compares the market value to asset worth, aiding in evaluating stock pricing concerning its assets. P/E Ratio measures share price against earnings per share, indicating the value investors assign to earnings. Dividend Yield calculates returns from dividends relative to share price, helping investors choose stocks aligning with their investment goals.

- Price to Sales = Share Price / Total Sales

The multiple comprises two components, Share Price and Total Sales as of 31st Jul’23, which will be 30th Jun’23 ending because the latest numbers released till 31st Jul’23 were for the quarter ending 30th Jun’23.

So, we’ll first look at the per-share price.

As per Nasdaq data, the Share price of Brightview Holdings is $7.71

Since numbers given in annual and quarterly reports are in Millions, we’ll convert per-share data into millions. So, the value will be $0.00000771 Million.

And for Total Sales, we’ll visit the company’s 10K and 10Q reports.

So, following the path mentioned above, we’ll calculate the LTM Revenue as of 31st Jul’23.

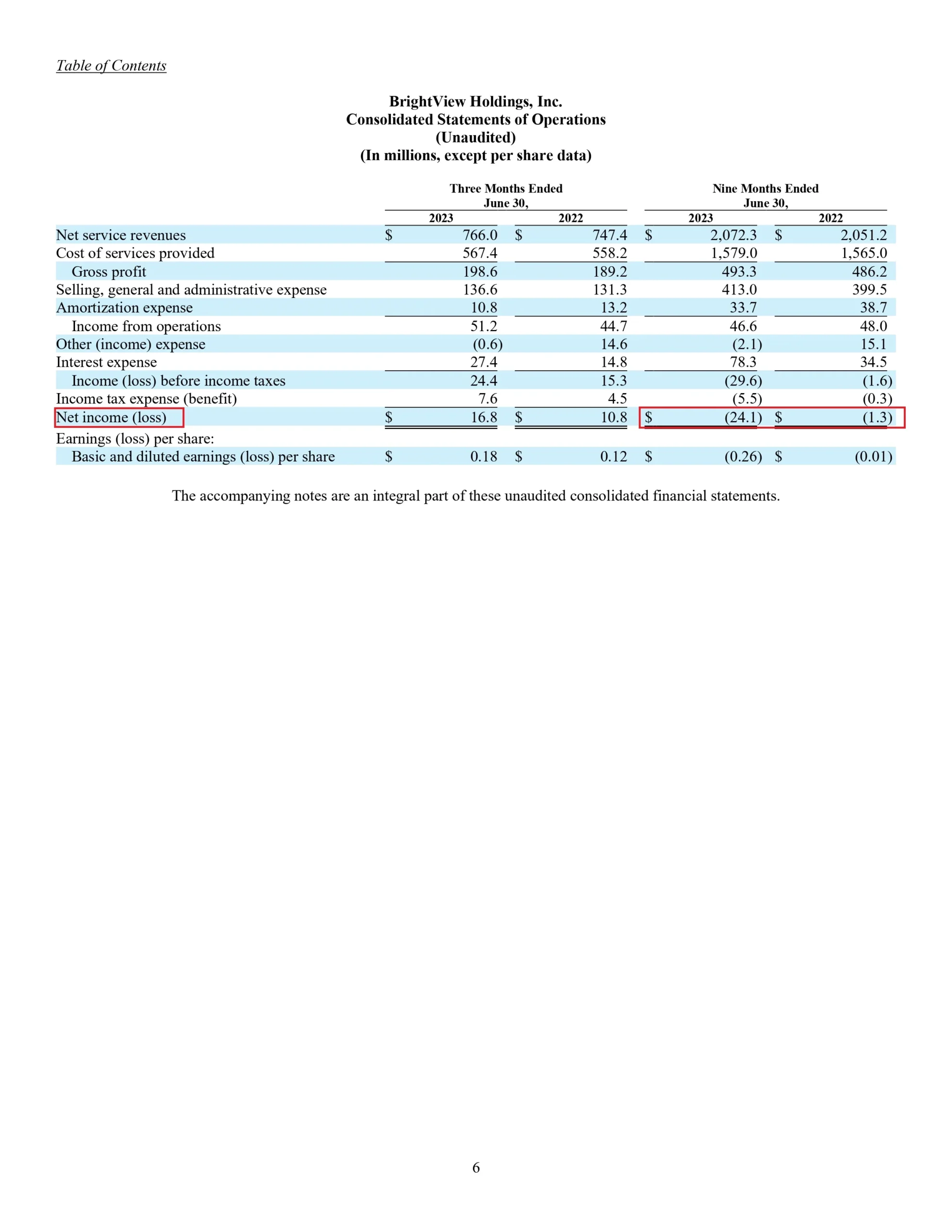

Visit page 6 of the 10Q Report and page 63 of the 10K Report. You’ll see “Consolidated Statements of Operations” on these pages of both reports. The first line item of the statement is “Net service revenues.” We’ll subtract nine months’ ending numbers as of 30 Jun’22, i.e. $2,051.2 Million, to 12 months’ numbers as of 30th Sep’22, i.e. $2,774.6 Million and add nine months ending numbers as of 30 Jun’23, i.e. $2,072.3 Million.

LTM Revenue as of 30th Jun’23 = 12 months ending 30th Sep’22 – 9 months ending 30th Jun’22 + 9 months ending 30th Jun’23

= $2774.6 – $2,051.2 + $2,072.3 Million

= $2795.7 Million

Since we have calculated the multiple components, we’ll now combine them.

Price to Sales = Share Price / Total Sales

= $0.00000771 Million / $2795.7 Million

= 0.000000002757806632 x

2. Price-to-Book = Share Price/ Book Value of Assets

The multiple comprises two components, Share Price and Book Value of Assets as of 31st Jul’23, which will be 30th Jun’23 ending because the latest numbers released till 31st Jul’23 were for the quarter ending 30th Jun’23.

So, we’ll first look at the per-share price.

As per Nasdaq data, the Share price of Brightview Holdings is $7.71. Since numbers given in annual and quarterly reports are in Millions, we’ll convert per-share data into millions. So, the value will be $0.00000771 Million.

The book value of Assets can be calculated in two ways:

- Total Assets – Total Liabilities

Take Total Assets according to the latest consolidated balance sheet and deduct Total liabilities.

Go to page 5 of the 10Q Report, and you’ll see that the value of the Total Assets given is $3,319.7 Million, and the value of the Total Liabilities given is $2,099.3 Million

Book value of Assets = Total Assets – Total Liabilities

= $3,319.7 Million – $2,099.3 Million

= $1220.4 Million

- Shareholder’s Equity – Preferred Stock

Take the shareholders’ equity and deduct preferred stock from it.

Go to page 5 of the 10Q Report, and you’ll see that the value of the Shareholder’s Equity given is $3,319.7 Million, and the value of the Preferred Stock given is $0 Million

Book value of Assets = Shareholders’ equity – Preferred Stock

= $1,220.4 Million – $0 Million

= $1220.4 Million

We can calculate the Book Value of Assets either way. The answer we’ll get will be identical.

Returning to the multiple, we now have both components, so let’s put the values together.

Price-to-Book = Share Price/ Book Value of Assets

= $0.00000771 Million / $1220.4 Million

= 0.000000006317600787x

3. Price to Earnings = Share Price / Earning Per Share

The multiple comprises two components, Share Price and Book Value of Assets as of 31st Jul’23, which will be 30th Jun’23 ending because the latest numbers released till 31st Jul’23 were for the quarter ending 30th Jun’23.

So, we’ll first look at the per-share price.

As per Nasdaq data, the Share price of Brightview Holdings is $7.71. Since the numerator and denominator account for per-share data, we won’t convert Share price into Millions.

For Earning Per Share, Visit page 6 of the 10Q Report and page 63 of the 10K Report. You’ll see “Consolidated Statements of Operations” on these pages of both reports. The last line item of the statement is “(Loss) earnings per share: Basic and diluted (loss) earnings per share.”

EPS for 30th Sep’22 is $0.14, 30th June’22 is $(0.01) and 30th June’23 is $(0.26).

LTM EPS as of 30th Jun’23 = 12 months annual nos. – 9 months ending 30th Jun’22 + 9 months ending 30th Jun’23

= $0.14 – $(0.01) + $(0.26)

= $0.39

Putting together the elements of the multiple,

Price to Earnings = Share Price / Earning Per Share

= $7.71 / $0.39

= 19.76923 x

Price to Earnings(P/E) = Market Capitalization / Total Net Earnings

Another variation of Price to Earnings is Market Capitalization / Total Net Earnings.

Let’s calculate it and check if it is the same as the other variation of the P/E Ratio.

As we have already calculated the company’s Market Capitalization, we’ll simply pick the value from there. To visit the page, click here. It was $720.114 Million.

To calculate the LTM Net Earnings, we’ll take the Net Earnings ending the Fiscal Year from the 10K Report and the nine months ending from the 10Q Report. Go to pages 6 of the 10Q Report and 63 of the 10K Report. In the “Consolidated Statements of Operations” on these pages of both reports, The second last line item of the statement is “Net (loss) income attributable to common stockholders” and Net income (loss), respectively.

Total Net Earnings for 30th Sep’22 is $14.0 Million, 30th June’22 is $(1.3) Million and 30th June’23 is $(24.1) Million.

LTM Total Net Earnings as of 30th Jun’23 = 12 months annual nos. – 9 months ending 30th Jun’22 + 9 months ending 30th Jun’23

= $14 – $(1.3) + $(24.1)

= $36.8 Million

Putting together the elements of the multiple,

Price to Earnings(P/E) = Market Capitalization / Total Net Earnings

= $720.114 Million / $36.8 Million

= 19.5683 x

Multiples values came out to be more or less similar from both the variations:

Price to Earnings = Share Price / Earning Per Share is 19.76923 x

Price to Earnings(P/E) = Market Capitalization / Total Net Earnings is 19.5683 x

Instead of using regular Net Income, we’ll use Adjusted Net Income, which is different. Adjusted Net Income helps to make a company’s profits and expenses more consistent because companies might have unique types of spending. But we need to be clear about this. You should read about the variations between GAAP (standard accounting rules) and non-GAAP numbers in the first part of the article, where essential concepts are explained. This will help you understand better.

To find the LTM Adjusted Net Earnings, we’ll use the Adjusted Net Earnings at the end of the Fiscal Year from the 10K Report and the nine months ending from the 10Q Report. Look at pages 32 of the 10Q Report and 39 of the 10K Report. In the tables of Non-GAAP Financial Measures on these pages, you’ll find the values for Adjusted Net Income. Use those values.

The Total Net Earnings for September 30, 2022, is $100.9 million; for June 30, 2022, it’s $66.4 million. And for June 30, 2023, it’s $33.5 million.

LTM Total Adjusted Net Earnings as of 30th Jun’23 = 12 months annual nos. – 9 months ending 30th Jun’22 + 9 months ending 30th Jun’23

= $100.9 Million – $66.4 Million + $33.5 Million

= $68 Million

Putting together the elements of the multiple,

Price to Earnings(P/E) = Market Capitalization / Total Net Earnings

= $720.114 Million / $68 Million

= 10.58991 x

4. Dividend Yield = Dividend Per Share / Price Per Share

No dividend was declared to common stockholders in the fiscal year ended September 30, 2021 and September 30, 2022. We’ll have to visit 10K reports of both years to check this information. For FY 2021, information is given on page 32; for FY 2022, information is given on page 31.

The common question at this stage is why we check the 10K report for the Fiscal year ending 30th Sep’21.

So the answer to this question is that if I want to know if dividends were declared in 2023 in July, I’ll go back to the 10K report ending Sep’22, which would have this information because the company’s Fiscal year ends on 30th September. But if I want to know whether dividends were declared in July 2022, I must return to the 10K report ending Sep’21. That’s why we have to consider for financial reports ending Sep’22 and Sep’21.

Enterprise Multiples

Enterprise multiples are financial metrics used to assess a company’s value in relation to various aspects of its operations. These multiples include EV/Revenue, which measures a company’s value against its revenue and is useful for high-growth businesses lacking positive earnings. EV/EBIT compares enterprise value to earnings before interest and taxes, gauging a stock’s potential overvaluation or undervaluation based on profitability. EV/EBITDA assesses a company’s operational efficiency by considering earnings before interest, taxes, depreciation, and amortization. Adding rental costs, EV/EBITDAR is relevant in industries with prevalent asset leasing. Finally, EV/Invested Capital evaluates fixed asset efficiency by dividing enterprise value by invested capital, commonly used in capital-intensive sectors.

- EV/Revenue = Enterprise Value / Total Revenue

I have already calculated the Enterprise Value of Brightview Holding. We’ll simply fetch the value from there, i.e. $2149.814 Million. If you want to understand how to calculate Enterprise Value step by step, click here.

For Revenue, we’ll have to calculate LTM Revenue, which will be:

Revenue 12 months ending as of 30th Sep’22 – Revenue 9 months ending 30th Jun’22 + Revenue 9 months ending 30th Jun’23.

Please refer to pages 6 of the 10Q Report and 63 of the 10K Report. Look for the “Consolidated Statements of Operations” section on both pages. The initial line in this statement is labelled “Net service revenues.” We will calculate LTM Revenue by subtracting the figures for the nine months ending on June 30, 2022, which amount to $2,051.2 million, from the twelve-month figures ending on September 30, 2022, i.e. $2,774.6 million. Then, we will add the figures for the nine months ending on June 30, 2023, which equals $2,072.3 million.

LTM Revenue = $2,774.6 Million – $2,051.2 Million + $2,072.3 Million

= $2795.7 Million

Putting together the components of the multiple,

EV/Revenue = Enterprise Value / Total Revenue

= $2149.814 Million / $2795.7 Million

= 0.7689 x

2. EV/EBIT = Enterprise Value / Earning Before Interest and Taxes

EV being, i.e. $2149.814 Million, we’ll move further towards calculating LTM EBIT.

LTM EBIT = EBIT 12 months ending as of 30th Sep’22 – EBIT 9 months ending 30th Jun’22 + EBIT 9 months ending 30th Jun’23.

Visit pages 6 of the 10Q Report and 63 of the 10K Report. Locate the “Consolidated Statements of Operations” section on both pages. Look for the line item “Income from operations.” To determine the LTM (Last Twelve Months) EBIT, subtract the nine months ending on June 30, 2022 numbers, $48 million, from the twelve-month total ending on September 30, 2022, $88.4 million. Then, add the nine months ending on June 30, 2023, which is $46.6 million.

LTM EBIT = $88.4 Million – $48 Million + $46.6 Million

= $87 Million

EV/EBIT = Enterprise Value / Earning Before Interest and Taxes

= $2149.814 Million / $87 Million

= 24.7105 x

To be more particular and take valuations at a different level of precision, we’ll take Adjusted EBIT in place of regular EBIT.

Adjusted EBIT is not the same as regular EBIT. It helps make a company’s earnings and spending more standard because different companies might have different kinds of spending special to them.

Still, it needs to be clarified?

Read the differences between GAAP and non-GAAP numbers, which have been appropriately explained in the first section of the article where necessary concepts for the article have been mentioned.

The company discloses the Adjusted EBITDA in the financial statements. We can pick that and add Depreciation and Amortization to it.

LTM Adjusted EBIT = (12 months ending Adjusted EBITDA as of 30th Sep’22 – (12 months ending Depreciation and Amortization as of 30th Sep’22)) – (9 months ending Adjusted EBITDA 30th Jun’22 – (9 months ending Depreciation and Amortization 30th Jun’22)) + (9 months ending Adjusted EBITDA 30th Jun’23 – (9 months ending Depreciation and Amortization 30th Jun’23)).

Let’s break the whole formula into smaller chunks.

The first one is,

12 months ending Adjusted EBITDA as of 30th Sep’22 – 12 months ending Depreciation and Amortization as of 30th Sep’22

Visit page 39 of the 10K Report. The tables clearly show the values of Adjusted EBITDA, which are $287.9 Million for 30th Sep’22.

Now, visit page 66 of the 10K Report. The cash flow statement would be given there, and depreciation and amortization would be considered the 4th and 5th line items. Depreciation is $98.9 Million, and Amortization is $51.5 Million.

So, the first part of the formula is:

= $287.9 Million – ($98.9 Million + $51.5 Million)

= $137.5 Million

The second one is,

9 months Adjusted EBITDA ending 30th Jun’22 – 9 months ending Depreciation and Amortization 30th Jun’22

Visit page 32 of the 10Q Report. The tables clearly show the values of Adjusted EBITDA, which are $196.6 Million for 30th June’22.

Now, Visit page 9 of the 10Q Report. The Cash flow statement will be given there and look for Depreciation and Amortization as the 4th and 5th line items. Depreciation is $71.5 Million, and Amortization is $38.7 Million.

So, the second part of the formula is:

= $196.6 Million – ($71.5 Million + $38.7 Million)

= $86.4 Million

The third one is,

9 months Adjusted EBITDA ending 30th Jun’23 – 9 months ending Depreciation and Amortization 30th Jun’23

Visit page 32 of the 10Q Report. The tables clearly show the values of Adjusted EBITDA, which are $197.1 Million for 30th June’23.

Now, Visit page 9 of the 10Q Report. The Cash flow statement will be given there and look for Depreciation and Amortization as the 4th and 5th line items. Depreciation is $80.9 Million, and Amortization is $33.7 Million.

So, the third part of the formula is:

= $197.1 Million – ($80.9 Million + $33.7 Million)

= $82.5 Million

Putting all the chunks together,

LTM Adjusted EBIT = 12 months ending Adjusted EBIT as of 30th Sep’22 – 9 months ending Adjusted EBIT 30th Jun’22 + 9 months ending Adjusted EBIT 30th Jun’23

= $137.5 Million – $86.4 Million + $82.5 Million

= $133.6 Million

Now, calculate the multiple with Adjusted EBIT.

EV/Adjusted EBIT = Enterprise Value / Adjusted Earning Before Interest and Taxes

= $2149.814 Million / $133.6 Million

= 16.0914 x

3. EV/EBITDA = Enterprise Value / Earning Before Interest, Taxes, Depreciation, and Amortization

As the Enterprise Value has already been calculated, which is $2149.814 Million, let’s move on to calculating the denominator part.

Here, in place of EBITDA, Adjusted EBITDA will be used. Adjusted EBITDA is separately reported in the company’s financial statements.

Adjusted EBITDA differs from standard EBITDA, as it aims to standardize a company’s earnings and expenses by accounting for various unique spending patterns that different companies may have. We have already understood the difference between GAAP and non-GAAP numbers. So we’ll consider Adjusted EBITDA in place of Normal EBITDA.

Also, the company separately reports Adjusted EBITDA; we’ll simply pick the values from the financial statement. So visit pages 32 of the 10Q Report and 39 of the 10K Report. The tables clearly show the values of Adjusted EBITDA, which are $287.9 Million for 30th Sep’22, $196.6 Million for 30th June’22 and $197.1 Million for 30th June’23.

LTM EBITDA = EBITDA 12 months ending as of 30th Sep’22 – EBITDA 9 months ending 30th Jun’22 + EBITDA 9 months ending 30th Jun’23.

= $287.9 Million – $196.6 Million + $197.1 Million

= $288.4 Million

Now, let’s put all the elements of the multiple together.

EV/EBITDA = Enterprise Value / Earning Before Interest, Taxes, Depreciation, and Amortization

= $2149.814 Million / $288.4 Million

= 7.45427 x

4. EV/Invested Capital = Enterprise Value / Invested Capital

I’ve already computed Brightview Holding’s Enterprise Value. We’ll just retrieve that figure, which is $2149.814 Million. If you want to understand how to calculate Enterprise Value step by step, click here.

Now, let’s move on to calculating invested capital. As we have already discussed, there are two methods of calculating invested capital.

- Operating Approach where Invested Capital is calculated using the Net Working Capital, Plant, Property & Equipment and Goodwill & Intangibles Assets.

Invested Capital = Net Working Capital + Plant, Property & Equipment + Goodwill & Intangibles Assets

Where Net Working Capital = Current operating assets – Non-interest bearing current liabilities.

- Financing Approach where Invested Capital is calculated using Total debt and leases, Total Equity and Equity Equivalents and Non-Operating Cash & Investments.

Invested Capital = Total debt & Leases + Total Equity and Equity Equivalents + Non-Operating Cash & Investments

We’ll use the first method to calculate Invested Capital.

Invested Capital = Net Working Capital + Plant, Property & Equipment + Goodwill & Intangibles Assets

Let’s first calculate Net Working Capital,

- Net Working Capital = Current operating assets – Non-interest bearing current liabilities

For this, visit page 5 of the 10Q Report. You’ll see the company’s consolidated balance sheet. Current Assets are given on the 7th line item of the statement, which is $686.7 Million, and Total current liabilities are given on the 22nd line item, which is $516.4 Million.

Net Working Capital as of 30th Jun’23 = $686.7 Million – $516.4 Million

= $170.3 Million

It is also readily available on Page 37 of the 10Q Report, which is $170.3 Million.

- Plant, Property & Equipment is also given in the balance sheet as the 8th line item, which is $330.7 Million.

- Goodwill and Intangible Assets are reported separately on the balance sheet itself. So we’ll add both. Values are given on the 9th and 10th line items, which are $143.0 Million and $2,021.5 Million, respectively. Together, they sum to $2164.5 million.

Goodwill and Intangible Assets = $143.0 Million +$2,021.5 Million

= $2164.5 million

Since we have all the elements to calculate the Invested capital, let’s put them together.

Net Working Capital = Current operating assets – Non-interest bearing current liabilities

Invested Capital = Net Working Capital + Plant, Property & Equipment + Goodwill & Intangibles Assets

= $170.3 Million + $330.7 Million + $2164.5 million

= $2665.5 Million

Now, let’s combine the values to compute the multiple,

EV/Invested Capital = Enterprise Value / Invested Capital

= $2149.814 Million / $2665.5 Million

= 0.8065 x