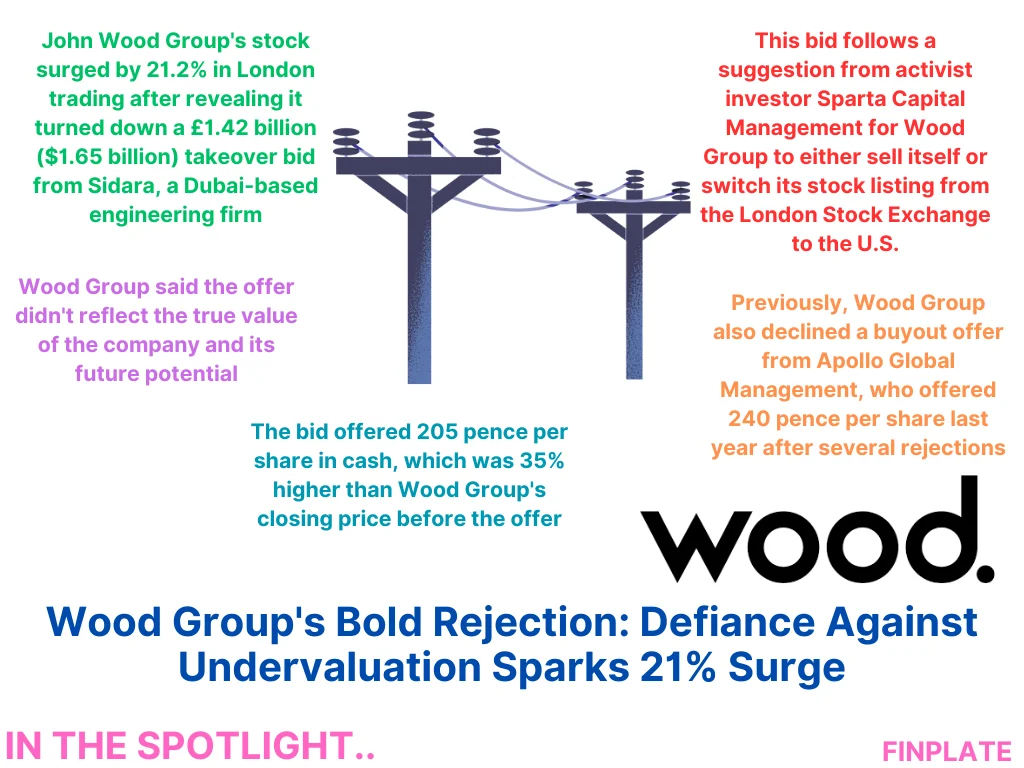

John Wood Group’s stocks surged by 21.2% in London trading on Wednesday because they revealed they turned down a takeover offer from a company in Dubai called Sidara. The offer was for £1.42 billion, which is about $1.65 billion. John Wood Group said no to the offer because they thought it didn’t reflect the true value of their company and its future potential.

The offer was for 205 pence per share in cash, which was 35% higher than John Wood Group’s stock price before the offer. Sidara’s offer came after a month of pressure from an activist shareholder named Sparta Capital Management, who suggested that John Wood Group should either sell itself or switch its stock listing from the London Stock Exchange to the U.S. This isn’t the first time John Wood Group has rejected a buyout offer; last year, Apollo Global Management made a bid of 240 pence per share, but it was also turned down after several attempts.

Key Points:

- Surge in Stock Price: John Wood Group’s stocks rose significantly by 21.2% in London trading after they disclosed the rejection of a takeover bid.

- Takeover Offer: A Dubai-based engineering firm called Sidara made a bid to take over John Wood Group for £1.42 billion, offering 205 pence per share in cash. This offer represented a 35% premium over Wood Group’s closing price before the offer.

- Reasons for Rejection: John Wood Group declined the offer because they believed it didn’t accurately reflect the true value of their company and its potential for growth in the future.

- Activist Shareholder Pressure: Prior to Sidara’s offer, Sparta Capital Management, an activist shareholder, had been pressuring John Wood Group to either sell itself or switch its stock listing from the London Stock Exchange to the U.S.

- Past Rejections: This is not the first time John Wood Group has rejected a buyout offer. Last year, Apollo Global Management made a bid of 240 pence per share, but it was also turned down after multiple offers were rejected.

About John Wood Group PLC

John Wood Group, a global leader in consulting and engineering across energy and materials markets.

- Mission: John Wood Group’s mission is to design, build, and advance the world, all while being trusted by clients. Their remarkable team of professionals works tirelessly to achieve this goal.

- Carbon Capture and Storage (CCS): John Wood Group has worked on more than half of the world’s carbon capture and storage projects. This technology helps reduce greenhouse gas emissions by capturing CO₂ from industrial processes and storing it underground.

- Pipeline Upgrades: In a UK digital transformation project, John Wood Group upgraded a staggering 8,000 kilometers of pipeline. This effort contributes to efficient energy transportation and distribution.

- Saskatchewan Potash Mine: John Wood Group designed a potash mine in Saskatchewan, Canada, capable of producing 2.86 million tonnes per year. Potash is a crucial mineral used in fertilizers.

- Energy and Materials Markets: John Wood Group operates across various sectors, including:

- Energy: Covering carbon capture, distribution, storage, hydrogen, and oil and gas (both upstream and midstream).

- Materials: Encompassing chemicals, circular economy, life sciences, manufacturing, minerals, and metals.

With 35,000 professionals across 60 countries, John Wood Group is at the forefront of unlocking solutions for critical global challenges.

Summary