Despite the widespread availability of information detailing the formula and methodology for computing Enterprise Value across various online platforms, there persists a level of confusion when attempting to calculate it specifically for a given company. Fortunately, Finplate offers assistance in navigating this complexity.

Enterprise Value, commonly denoted as EV, stands as a pivotal financial gauge utilized to determine the overall worth of a company. It represents a comprehensive evaluation considering multiple financial components such as debt, equity, market capitalization, and cash reserves to derive a singular valuation. Distinguished from other valuation techniques, EV is favored for its ability to provide a comprehensive overview of a company’s financial position and attractiveness to potential investors or in the context of mergers and acquisitions.

The computation involves aggregating a company’s market capitalization, incorporating debt, minority interest, and preferred stock, and then deducting cash holdings. This method operates on the assumption that the company’s available cash will be utilized to settle its debts. This metric forms the cornerstone for negotiation strategies during acquisitions, aiding in establishing the true value of a business and facilitating competitive bidding processes, especially when multiple buyers express interest.

Precise knowledge of the enterprise value plays a vital role in making informed decisions regarding premium offerings, ensuring fairness in acquisition prices, and avoiding situations of undervaluation or excessive payment during corporate transactions.

After calculating Enterprise Value of BrightView Holdings, Inc., Let’s take another example of company SiteOne Landscape Supply, Inc.

SiteOne Landscape Supply, Inc. stands as the primary and largest wholesale distributor of landscaping items across the United States and Canada. Our extensive experience spans catering to both residential and commercial landscape professionals specializing in crafting, installing, and maintaining various outdoor spaces such as lawns, gardens, and golf courses.

Spanning over 500 branches across 45 states and five provinces, our network provides an extensive array of more than 90,000 products. These offerings encompass irrigation supplies, fertilizers, control products, nursery goods, hardscapes, landscape lighting, drainage and erosion control solutions, tools, as well as other landscaping essentials. Our team comprises over 4,200 industry experts committed to delivering top-notch services and business support, tailored to the unique needs of each customer. These services not only complement our product range but also aid our customers in effectively managing and expanding their businesses.

In the 10Q report, required values will be provided to calculate the Enterprise Value as of 31st July 2023.

STEP 1: Gather the Financial Data

Visit the company’s website first. Scroll down and in company’s information section, you’ll find the option of Investor Relations. With this link, you’ll reach the Investors section of the company website. Among many options like Company Profile, Stock Info, Events and Presentations , SEC Filings etc. on top, select SEC Filings. Now, you’ll see certain filters, among all, just click in the box given below “Select Form”. Select Quarterly Reports from the drop down. You’ll get all the quarter reports sorted on the basis of Most Recent ones showing on the top. Select the 10Q report which was filed on 08/02/2023(2nd August 2023). Since we are calculating the Enterprise Value as on 31st Jul 2023, this is the most recent quarterly report available where June quarter numbers will be given.

NOTE:

In order to calculate Enterprise Value, certain assumptions must be specified:

1. The Enterprise Value will be calculated as of 31st July 2023

2. All values are in Millions Dollars except for per share data.

To calculate Enterprise Value, elements of information we need to gather are Market Cap (shares outstanding x share price), Preferred stock, Outstanding debt, Minority interest, and Cash and Cash Equivalents. All the information is available in Financial Reports of 10Q report. Let’s look at each component individually.

STEP 2: Calculate Market Capitalization

Let’s start calculating Market Capitalization first. For this latest numbers of shares outstanding as per Quarterly report(10Q) and closing share price of SiteOne Landscape Supply, Inc. as on 31st July 2023 will be used.

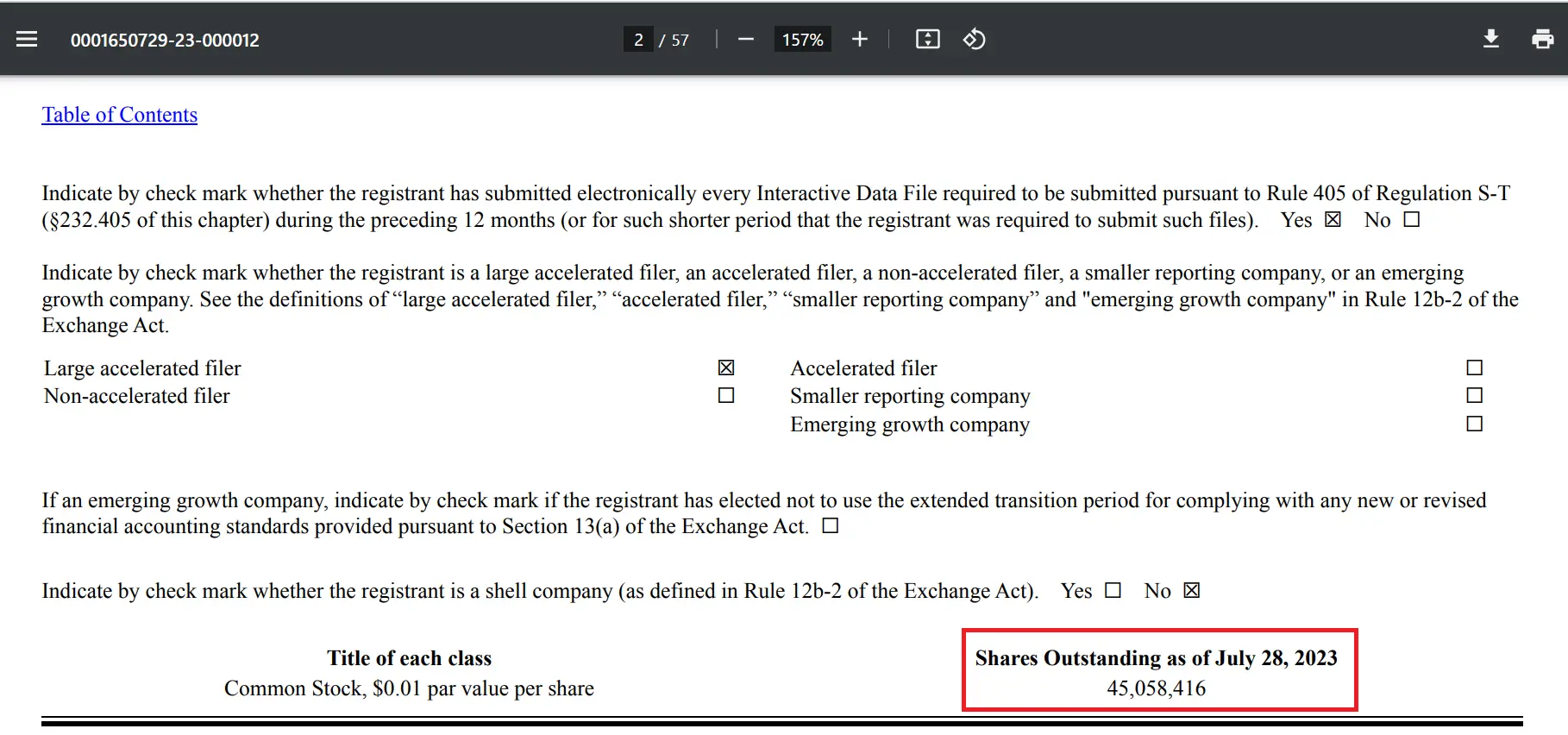

So, for latest number of shares, go to 2nd page of 10Q report and there on the bottom right, you’ll get to see the information i.e. 45,058,416 shares as shown below in the screenshot.

Closing price company’s share as on 31st Jul 2023 was $170

Source: https://www.nasdaq.com/market-activity/stocks/site/historical, Pg 5

To calculate the market capitalization, we’ll simply multiply the total number of outstanding shares as on 31st July 2023 as per the quarter report with closing share price as per the date.

Market Cap = Number of Shares Outstanding Share Price

= 45,058,416 $170

= $765.993072 Million

Sometimes, Market Cap alone is a used as an indicator of a company’s value. Looking at SiteOne Landscape Supply’s market cap shows that it is such a big company. Having a market cap of $765.99 Million is in itself an achievement. In order to decide whether to invest in a company or not, you can compare the companies using this metrix too. In the stock market, companies fall into three main categories based on their market capitalization:

1. Large-Cap Companies: These are businesses with a market capitalization of $10 billion or more. They are recognized for consistent growth, regular dividend payouts, and a strong customer base. Investors often view them as safer investments compared to companies with smaller market caps due to their industry prominence and stability.

2. Mid-Cap Companies: Falling within the market cap range of $2 billion to $10 billion, these companies are experiencing steady growth and have secured a place in the market. They offer a middle ground between large-cap and small-cap stocks, presenting more growth potential than large-caps and lower risk than small-caps.

3. Small-Cap Companies: With a market cap ranging from $300 million to $2 billion, these companies are considered riskier investments. They are typically newer in the market and still establishing themselves. Their limited market presence and resources make them more susceptible to macroeconomic disruptions. While short-term price fluctuations are common, investors might expect potential long-term price increases.

Now an investor may have a personal choice whether to invest in which category of companies. For eg. SiteOne Landscape Supply, Inc. falls in Small Cap companies category and the investor according to this information can invest in the company. Now what do an investor do with the information of SiteOne Landscape Supply, Inc. being a small cap company?

Small Cap Companies come with certain features which include:

- Volatility: These companies get highly affected with the market fluctuations because of which they are called as volatile in nature. This means the stock of these companies perform very well during high market phase but underperform when market is not doing well. This makes it a riskier investment also.

- Limited Market Activity: Small-cap stocks exhibit lower liquidity compared to mid-cap and large-cap stocks, meaning fewer investors trade in these stocks. Nonetheless, the liquidity of small-cap stocks might increase as price discovery improves over time.

- Taxation: Taxation applies to profits earned from selling small-cap shares, regarded as income according to Section 80C. If the shares were held for less than a year, the profits are subject to a 15% short-term capital gain tax. On the other hand, gains from shares held for over a year incur a long-term capital gain tax at a rate of 10%.

- Investment Outlook: Over time, small-cap companies have the potential to evolve into medium-sized enterprises. However, realizing gains from investments in small-cap stocks requires patience. Seasoned investors with a longer investment horizon may consider small-cap stocks for their potential to yield higher returns.

So, investment in SiteOne Landscape Supply, Inc. will come with the features listed above. An investor should keep all these points in mind while investing in this company or any other small cap company.

STEP 3: Add Total Debt

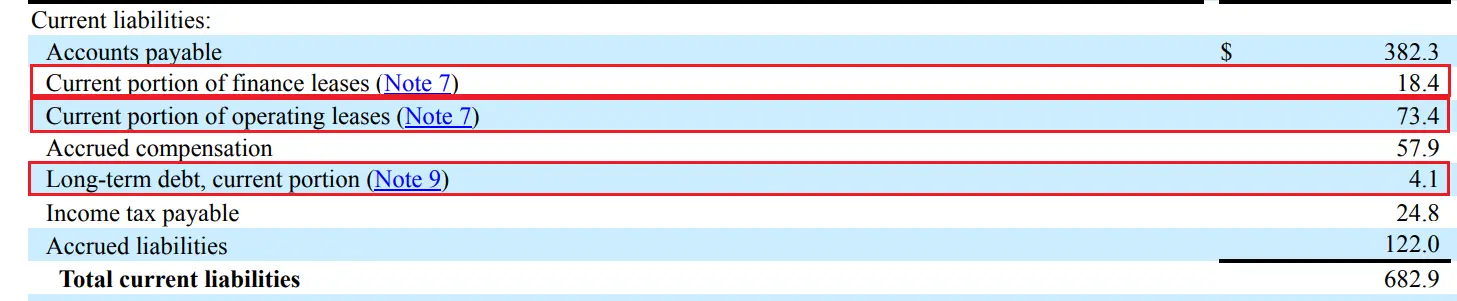

For debt portion of Enterprise Value formula, move to balance sheet of the quarterly report which is given on 7th page of PDF(you can search the page number from top). Look at Liabilities under the head of Current liabilities section. You’ll see “Current portion of Operating Leases” i.e. 73.4 Million, “Current portion of finance leases” i.e. $18.4 Million and “Long-term debt, current portion” i.e. 4.1 Million.

The leasing company is called as lessor and the company which is going to use the asset is called as lessee. So, Operating lease is a contract in which a lessor allows lessee to use an asset for a particular period which transferring any ownership right to the lessee. Examples of Operating Lease include aircraft, land and buildings, equipment which have long useful life like office equipment, vehicles, heavy machinery etc. To read more about Operating lease, click here.

All the equipment and properties which have been rented for less than 12 months are categorized under “Current portion of Operating Leases”. This means that company owns those asses for just 12 months, after which these will have to returned to its original owner at the end of the lease tenure.

Finance lease is also included in total debt for the calculation of Enterprise Value. Operating leasee and finance lease both are leases but reported separately. What is the difference between the two. The major difference between Operating lease and Finance lease is the transfer of ownership. At end of the lease tenure, the asset is returned to the lesser by lessee in case of operating lease but in case of finance lease, ownership of the asset gets transferred to the lessee at the end of lease tenure. To know more about finance lease, click here.

Finance lease whose tenure is less than an year is considered as Current portion of finance leases. Here the lessee has this benefit that ownership of the asset will get transferred to it after the lease tenure ends.

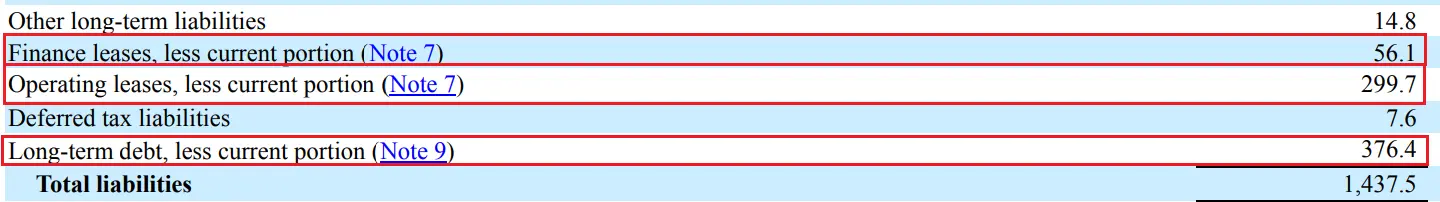

After this, look at Long term portion of Debt. For this, we’ll move to next section and value is given with line item “Operating leases, less current portion” which is 299.7 Million, “Finance leases, less current portion” i.e. $56.1 Million and “Long-term debt, less current portion” i.e. 376.4 Million.

“Operating leases, less current portion” includes all the equipment and properties which have been rented for a long period of time (more than 12 months). This implies that the company has the right to use that asset in long term, just the rent has to be paid on regular intervals. Now in case of long term Finance leases, the tenure exceeds an year and at the end of tenure, the ownership of assets will get transferred to lessee.

So Total Debt of the SiteOne Landscape Supply, Inc. is

= $73.4 + $18.4 + $4.1 + $299.7 + $56.1+ $376.4 Million

= $828.1 Million

Step 4: Add Minority Interest

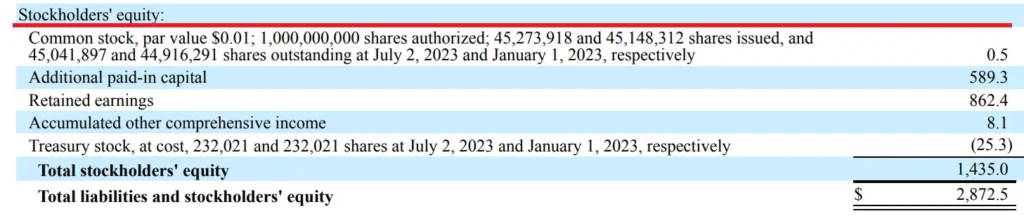

Now let’s check if there is any Minority Interest in SiteOne Landscape Supply’s Balance Sheet. It is given after Total Shareholder’s Equity if there is any. In this company’s case also, there is no Minority Interest. So we’ll leave it and move forward to next components of Enterprise Value formula.

Step 5: Add Preferred Stock

Under the head of Shareholder’s Equity in Balance Sheet, Preferred Stock is given as first line item, If there is any. In this company’s case, there is no Preferred Stock too.

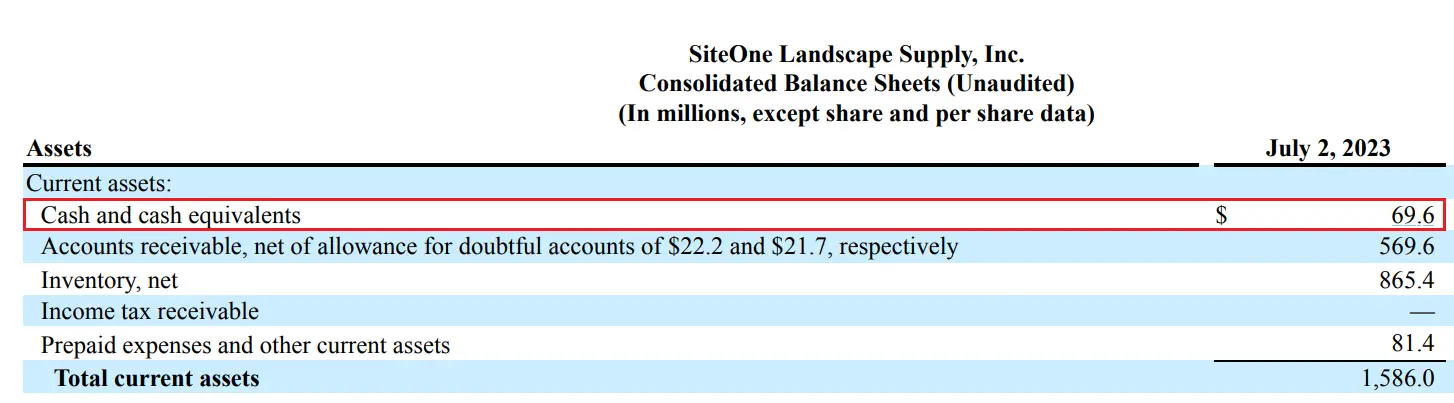

Step 6: Deduct Cash

Looking at the balance sheet, under Current Assets section, Cash and Cash Equivalents is the first line item where company shows the amount of cash it holds and all the liquid assets it possesses. In the SiteOne Landscape Supply’s case, company has $69.6 Million Cash and Cash Equivalents. We’ll deduct it from the formula because it is considered that the acquirer will use this cash in order to pay the debt of SiteOne Landscape Supply, Inc..

Step 7: Combine all values and Put in formula of Enterprise Value

After finding values of all the components of Enterprise Valuation formula in financial statements of SiteOne Landscape Supply, we’ll combine all the values and put them in formula.

Enterprise Value = Market capitalization + Outstanding debt + Minority interest + Preferred Stock – Cash and cash equivalents

Enterprise Value = Market Capitalization + Outstanding Debt + Minority Interest + Preferred Stock – Cash and Cash Equivalents

= $765.993072 + $828.1 + 0 + 0 – $69.6 Million

= $1,524.49 Million

If any company or an individual wants to purchase SiteOne Landscape Supply, Inc., then it is supposed to pay $1,524.49 Million on the basis of valuation as on 31st Jul 2023. It may make payment via stocks or cash or cash + stock.

To learn more about Enterprise Valuation, click here.