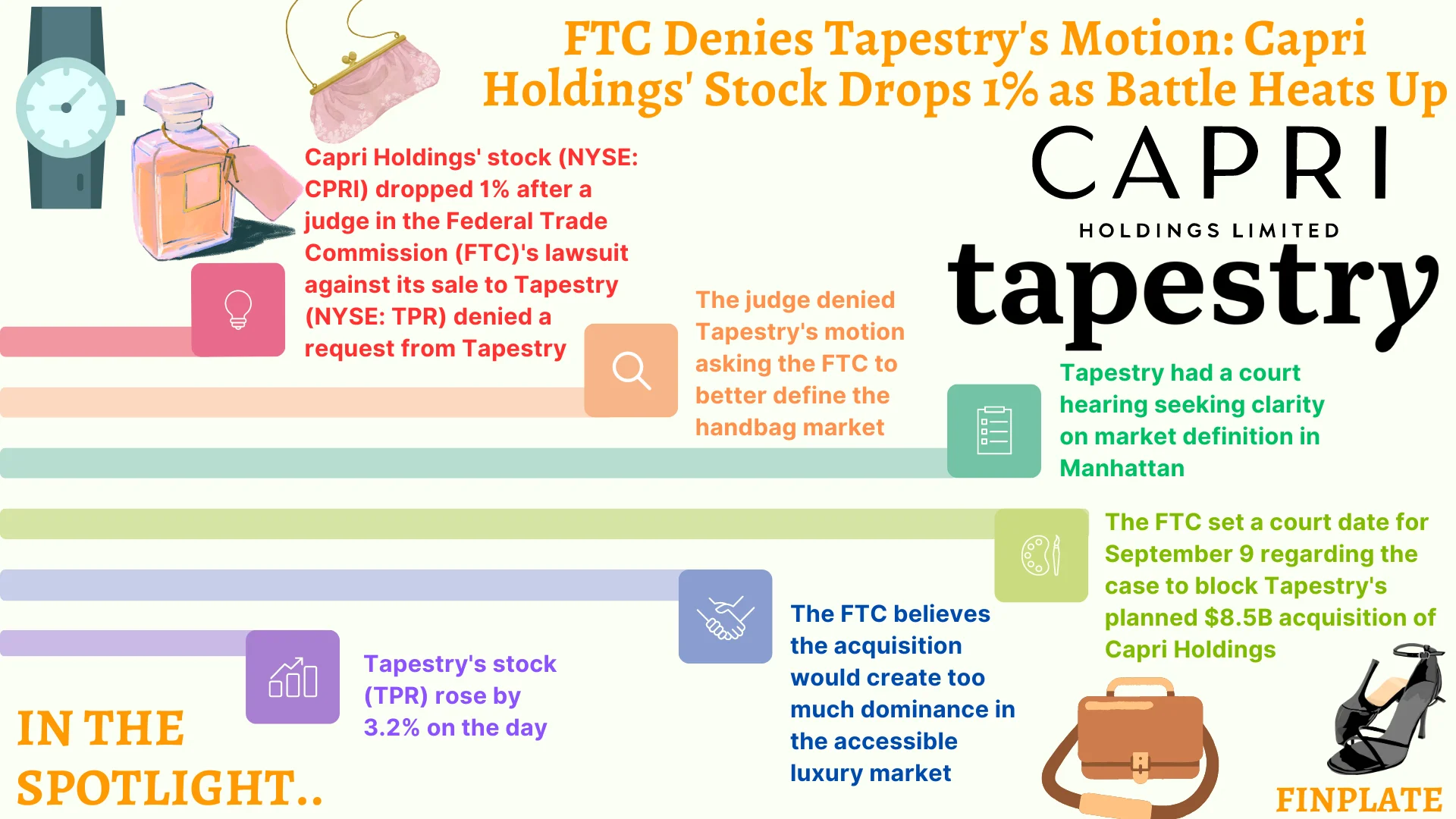

Capri Holdings’ stock, listed as CPRI on the New York Stock Exchange, dropped by 1% following a ruling by a judge in the Federal Trade Commission’s (FTC) lawsuit against its intended acquisition by Tapestry, traded as TPR on NYSE.

The judge, Jennifer Rochon, rejected a request from Tapestry for the FTC to provide a clearer definition of the handbag market. Tapestry had sought this clarification during a court hearing held in Manhattan, beginning at 3 pm. The lawsuit, initiated by the FTC, aims to halt Tapestry’s planned $8.5 billion purchase of Capri Holdings, which includes luxury brands such as Coach, Kate Spade, and Michael Kors.

According to Bloomberg, the FTC contends that the merger would excessively concentrate power in the accessible luxury market, leading to diminished competition. The dispute revolves around defining terms like “accessible luxury market” and establishing whether certain price ranges are relevant. Consequently, Tapestry saw a 3.2% increase in its stock value on Monday.

Key Points:

- Legal Battle and Market Concerns: The FTC is suing to prevent Tapestry from acquiring Capri Holdings because it believes the merger would reduce competition in the luxury handbag market. The FTC is concerned that the combined entity would control too much of the market, potentially leading to higher prices or reduced choices for consumers.

- Judge’s Ruling: Judge Rochon denied Tapestry’s motion to clarify the definition of the handbag market. This means that the legal proceedings will continue without further clarification from the FTC on the specific terms Tapestry requested.

- Market Reaction: Capri Holdings’ stock fell by 1% after the ruling, indicating that investors may be concerned about the outcome of the lawsuit and its potential impact on the company’s future.

- Tapestry’s Response: Despite the setback, Tapestry’s stock rose by 3.2% on Monday. This suggests that investors may be optimistic about Tapestry’s prospects, despite the legal challenges it faces.

- Importance of Market Definition: The crux of the dispute lies in how the market is defined. The FTC argues that the merger would lead to undue concentration in the accessible luxury market, but Tapestry contends that the market definition needs further clarification.

Overall, the ruling by Judge Rochon is a significant development in the legal battle between the FTC and Tapestry over the proposed acquisition of Capri Holdings. The outcome of this lawsuit will likely have far-reaching implications for the luxury handbag market and the companies involved.

About Capri Holdings

CAPRI HOLDINGS is a distinguished powerhouse in the world of fashion luxury, boasting a collection of esteemed brands such as Versace, Jimmy Choo, and Michael Kors, each founded and driven by visionary creators. At the heart of every label within our portfolio lies a dedication to opulence and precision in craftsmanship. Our reputation is built upon our capacity to create groundbreaking and exquisite pieces that span the breadth of luxury fashion. Our triumph is rooted in the unique identity and heritage of each brand, the vibrant diversity and passion of our team, and our steadfast dedication to meeting the needs of both clients and communities.

About Tapestry

Tapestry serves as a hub for renowned brands on a global scale. It brings together the allure of Coach, Kate Spade New York, and Stuart Weitzman. The company harnesses its top-tier skills, fulfills its corporate responsibility objectives boldly, and utilizes its advantages, ranging from financial prowess to digital proficiency. These efforts are directed towards nurturing talent, enhancing brand growth, and improving customer and community outreach.

Yet, this narrative is merely the starting point. With an ethos of inclusivity, encouragement of dialogue, fostering creativity, and embracing humanity, Tapestry aims to push boundaries and expand horizons.

Summary