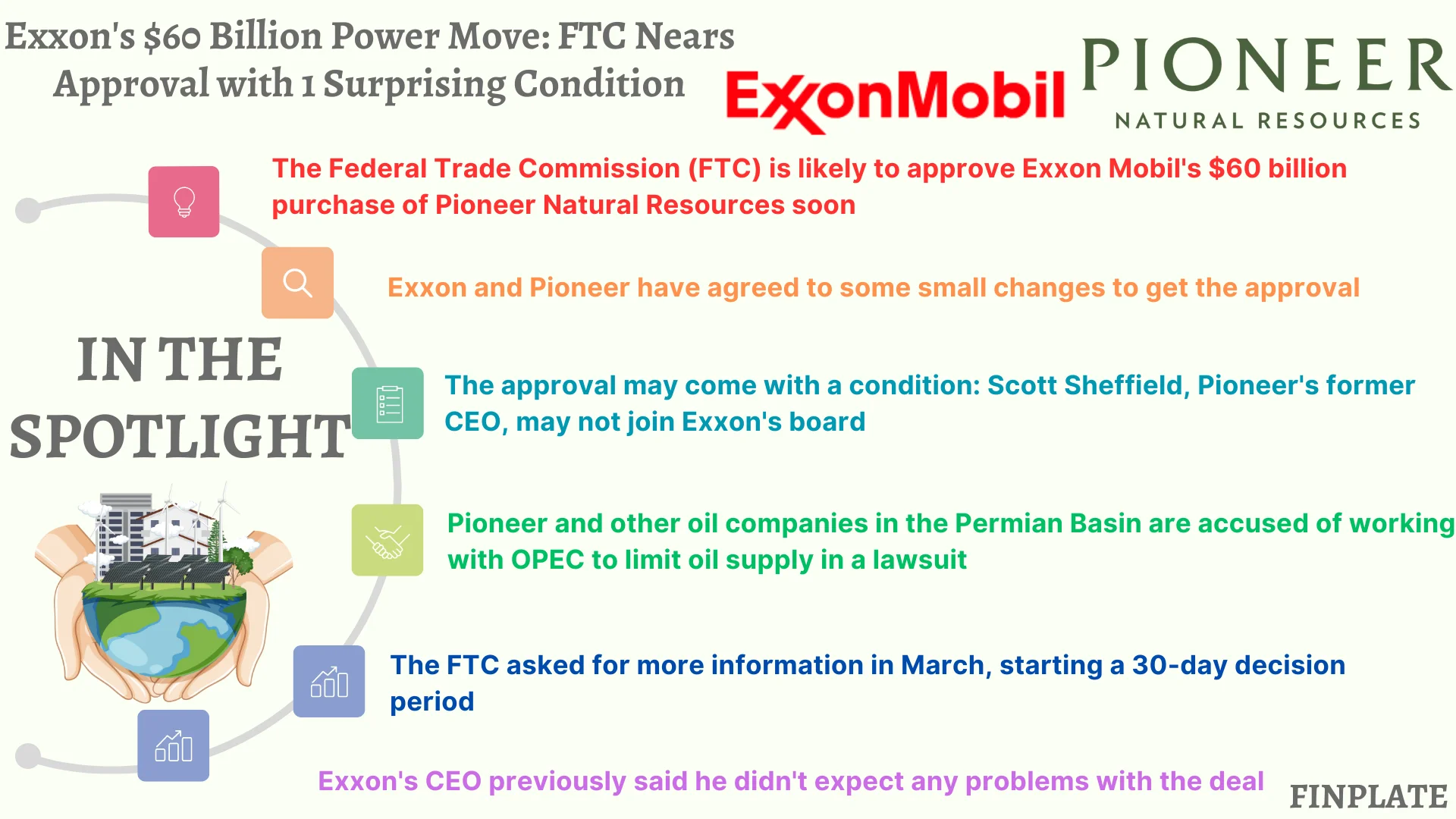

Federal Trade Commission (FTC) is likely to give the go-ahead for Exxon Mobil’s purchase of Pioneer Natural Resources, a deal worth $60 billion.

This means they’re probably going to say it’s okay for Exxon Mobil, a big company, to buy Pioneer, another big company. But there are some conditions. One condition is that a person named Scott Sheffield, who used to be the boss of Pioneer, won’t be allowed to join Exxon’s board of directors as originally planned. This decision comes after some concerns were raised about Pioneer and other companies working together with OPEC, an organization that controls oil production, to keep oil prices high.

Although Scott Sheffield isn’t directly involved in this issue, he’s linked to it because of his role at Pioneer. Exxon Mobil provided extra information to the FTC in March, which is part of the process for getting approval for a big business deal. Despite some hurdles, Exxon Mobil’s CEO is confident that the deal will eventually get approved.

Key Points:

- FTC Approval: The Federal Trade Commission, a government agency responsible for ensuring fair competition and protecting consumers, is likely to give the green light for Exxon Mobil’s acquisition of Pioneer Natural Resources. This means they’re probably going to say it’s okay for Exxon Mobil to buy Pioneer.

- Conditional Approval: The approval comes with conditions. One major condition is that Scott Sheffield, the former CEO of Pioneer, won’t be allowed to join the board of directors at Exxon Mobil as initially planned. This condition is imposed due to concerns related to allegations of collusion between Permian Basin producers, including Pioneer, and OPEC to limit oil supplies.

- Background on Allegations: Pioneer and other companies operating in the Permian Basin are facing accusations in a class-action lawsuit alleging collusion with OPEC. While Scott Sheffield isn’t directly involved in the lawsuit, his association with Pioneer makes him relevant to the issue.

- Compliance and Information Request: Exxon Mobil provided additional information to the FTC in March, responding to their request for more details about the acquisition. This step is part of the regulatory process, where the FTC examines the deal’s potential impact on competition and consumers.

- CEO’s Confidence: Despite the regulatory scrutiny and conditions, Exxon Mobil’s CEO, Darren Woods, expressed confidence earlier that the deal would not face significant regulatory hurdles. This suggests that the company is optimistic about ultimately securing approval for the acquisition.

So, in summary, while the FTC is likely to approve the Exxon Mobil-Pioneer deal, there are conditions attached, particularly regarding Scott Sheffield’s involvement, stemming from concerns about alleged collusion in the oil market. Exxon Mobil remains optimistic about the deal’s approval despite regulatory scrutiny.

About Exxon Mobil (NYSE:XOM)

ExxonMobil uses innovation and technology to deliver energy to a growing world. We explore for, produce, and sell crude oil, natural gas, and petroleum products.

- Emission Reduction Solutions: The company is actively involved in reducing emissions by offering solutions for carbon capture and storage, hydrogen, and biofuels.

- Innovative Products: It integrates downstream and chemical operations to develop lower-emission fuels and products essential to society.

- Energy Security: It focuses on enhancing energy security by expanding low-cost-of-supply oil and gas operations.

- Corporate Values: The company holds itself accountable to a set of values that guide its work and operations. It uses high-resolution data and advanced computational analysis for informed decisions in exploration, development, and production.

About Pioneer Natural Resources

In 1962, a pair of adventurous oil entrepreneurs from West Texas embarked on a journey to establish a company distinct from the multitude of opportunistic wildcatters chasing fleeting prospects. Howard Parker and Joe Parsley, armed with determination, a battered car, and ample courage, joined forces to create a company that would carve its own path in the industry.

Their partnership, sealed with a handshake and a coin toss determining the order of their names in the company’s title, resulted in the birth of Parker & Parsley, a venture characterized by astute decision-making, prudent risk management, and savvy negotiations as it acquired land and pursued drilling ventures. While rivals poured resources into global ventures, Parker & Parsley remained committed to its roots in the Permian Basin, a fidelity that endures to this day.

In 1997, Parker & Parsley merged with MESA Inc., forming Pioneer. MESA’s significant natural gas assets, offshore drilling proficiency, and employee-centric corporate culture were instrumental in persuading Parker & Parsley’s leadership to embrace the merger. Although the name changed to Pioneer Natural Resources, the essence of the original companies persists. Our operations in the Permian Basin continue, guided by our unwavering belief that people come first, and the oil business follows suit.

Summary