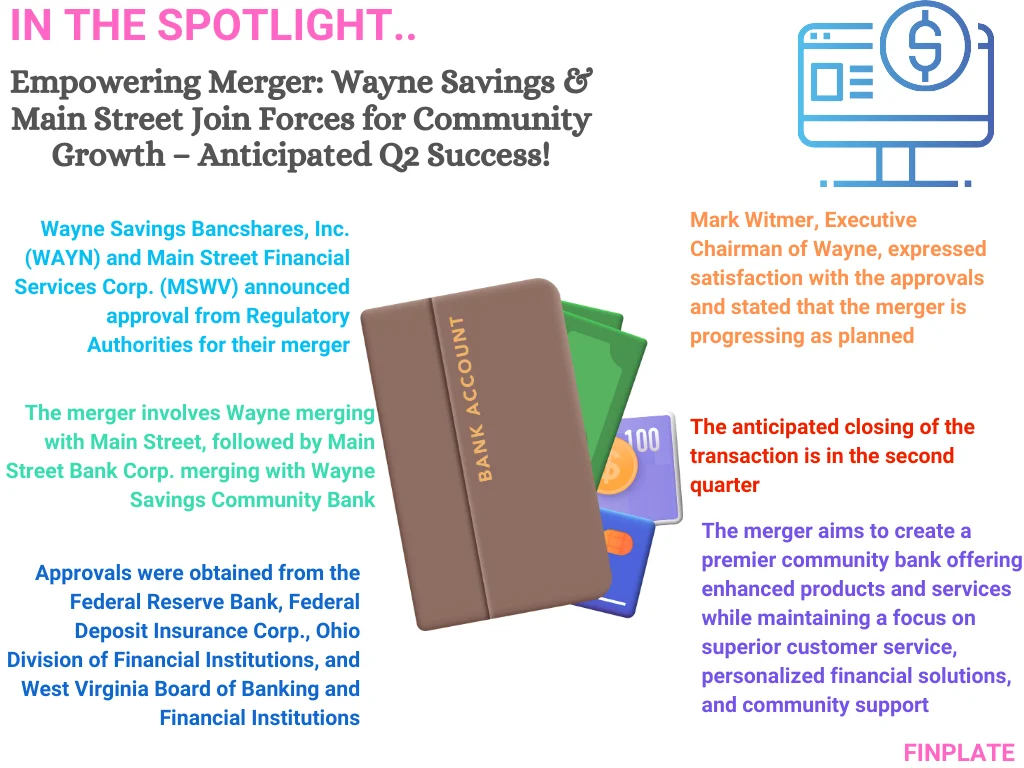

Wayne Savings Bancshares, Inc. and Main Street Financial Services Corp. have gotten the green light from various regulatory agencies to merge their operations. This means that Wayne Savings Community Bank will merge with Main Street Bank Corp. to form a stronger, combined entity. Mark Witmer, the Executive Chairman of Wayne, expressed satisfaction with the approvals received and mentioned that they’re on track to complete the merger in the second quarter. He highlighted the benefits of the merger, emphasizing improved products and services for customers, maintaining excellent customer service, providing tailored financial solutions, and continuing to support the community.

Key Points:

- Merger Approval: Wayne Savings Bancshares, Inc. and Main Street Financial Services Corp. have successfully obtained approval from multiple regulatory authorities, including the Federal Reserve Bank, the Federal Deposit Insurance Corp., the Ohio Division of Financial Institutions, and the West Virginia Board of Banking and Financial Institutions. These approvals are necessary steps in the process of merging their respective banking entities.

- Merging Operations: The merger involves Wayne Savings Community Bank merging with Main Street Bank Corp. This consolidation aims to combine their resources, expertise, and customer bases to create a more robust and competitive banking institution. By merging, both entities hope to achieve economies of scale and improve their overall market position.

- Timeline: Mark Witmer, the Executive Chairman of Wayne Savings Bancshares, Inc., has stated that the merger process is progressing according to plan. He anticipates that the transaction will be finalized in the second quarter, indicating that the merger is moving forward smoothly and efficiently.

- Benefits of Merger: Witmer emphasized the positive outcomes expected from the merger. This includes the creation of a premier community bank with enhanced products and services. By joining forces, the combined entity aims to offer a wider range of financial products and services to its customers, thus better meeting their needs and expectations.

- Customer Focus: Despite the merger, the commitment to superior customer service remains a top priority. Witmer emphasized the importance of providing personalized financial solutions and maintaining unwavering community support. This indicates that the merged entity will continue to prioritize customer satisfaction and community engagement as key pillars of its operations.

About Wayne Savings Bancshares, Inc.

Wayne Savings Bancshares, Inc. is a company that owns Wayne Savings Community Bank. This bank offers various banking services to individuals, businesses, and other groups. They provide different types of accounts like checking, savings, and certificates of deposit. They also offer loans for things like homes, businesses, and cars, as well as services like financial planning and insurance. The bank operates in several locations in Ohio, including Wooster, Ashland, and Millersburg. Wayne Savings Bancshares, Inc. started back in 1899 and is headquartered in Wooster, Ohio.

About Main Street Financial Services Corp.

Main Street Financial Services Corp. is like a big umbrella company that owns Main Street Bank Corp. Think of it as a parent company. They offer a bunch of different banking stuff, like checking and savings accounts, and they give out different kinds of loans for things like businesses, houses, and personal stuff. They also do things like wire transfers, ATM services, and Internet banking. They serve all kinds of people, from businesses to regular folks. They have five full-service bank branches in different towns in West Virginia and Ohio. Main Street Financial Services Corp. started in 2001 and is based in Wheeling, West Virginia.

Summary