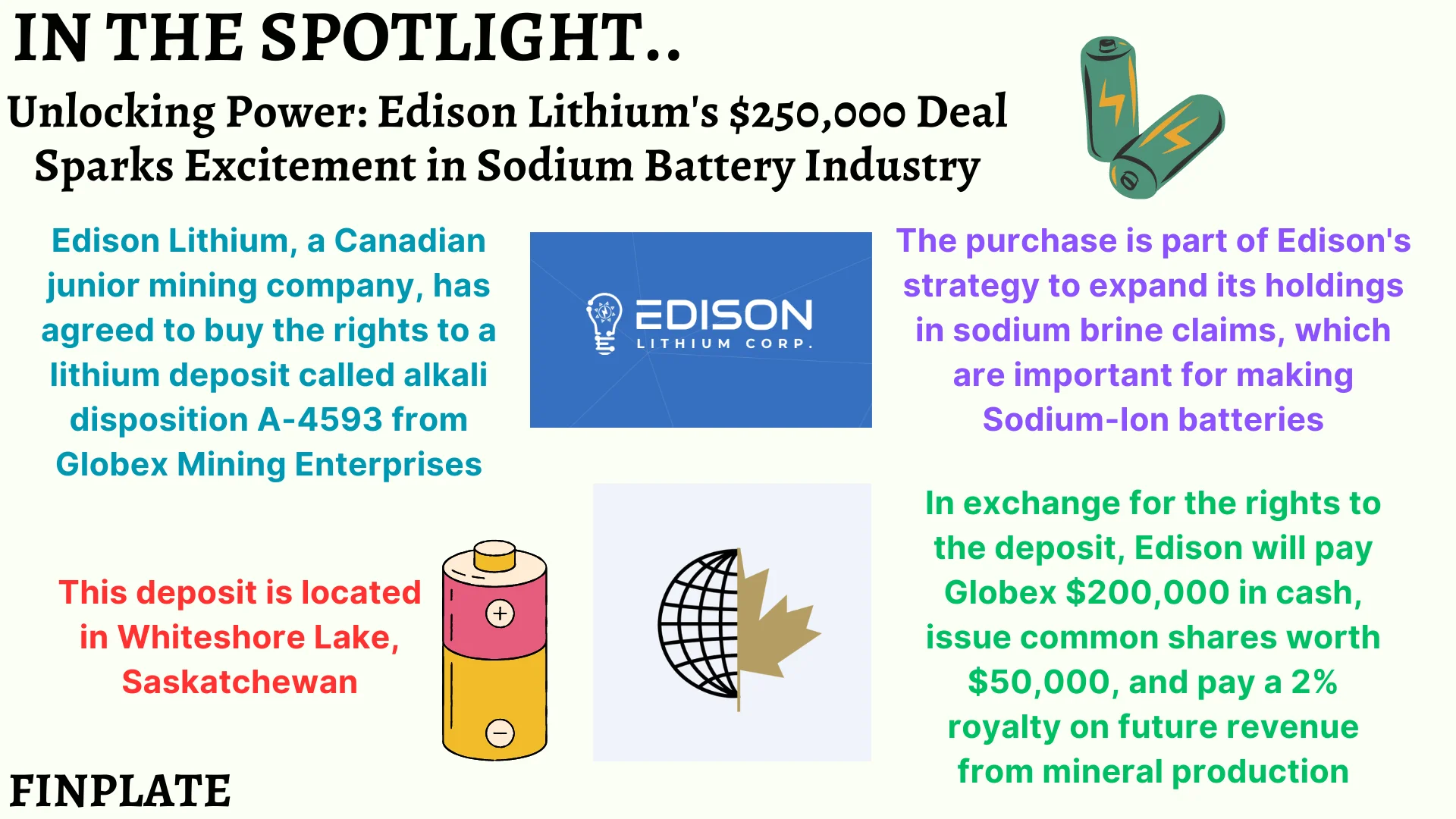

Canada-based junior mining company Edison Lithium has made an agreement with Globex Mining Enterprises to buy the rights to an area called alkali disposition A-4593 in Saskatchewan’s Whiteshore Lake area. This is part of Edison’s strategy to expand its holdings in sodium brine, which is used in making Sodium-Ion batteries.

In this deal, Globex will give up all its rights to the alkali disposition to Edison. In return, Edison will pay Globex $200,000 in cash, issue common shares worth $50,000, and also pay Globex a 2% royalty on any money made from selling minerals produced in that area.

Key details:

- Parties involved:

- Edison Lithium: A junior mining company based in Canada.

- Globex Mining Enterprises: A mining company that currently holds the rights to the alkali disposition A-4593 in Saskatchewan.

- Asset Purchase Agreement:

- Edison Lithium is acquiring the rights to alkali disposition A-4593 from Globex Mining Enterprises.

- This agreement allows Edison to take control of the area in Whiteshore Lake, Saskatchewan.

- Purpose of Acquisition:

- Edison Lithium’s interest in acquiring sodium brine claims is driven by its focus on Sodium-Ion battery formulations.

- Sodium brine is a key component used in the production of Sodium-Ion batteries, which are increasingly important in the renewable energy sector.

- Terms of the Deal:

- Edison will pay Globex $200,000 in cash as part of the agreement.

- Additionally, Edison will issue common shares valued at $50,000 to Globex.

- Globex will also receive a 2% royalty on gross revenue generated by Edison from commercial production of mineral products in the acquired area.

- Implications:

- For Edison Lithium: This acquisition expands its portfolio of sodium brine claims, strengthening its position in the Sodium-Ion battery market.

- For Globex Mining Enterprises: The sale provides immediate financial compensation and ongoing royalties, potentially diversifying its revenue streams.

- Future Prospects:

- Edison’s strategic move to acquire these rights positions them to capitalize on the growing demand for Sodium-Ion batteries, which are expected to play a significant role in the transition to renewable energy sources.

- The success of this acquisition will depend on Edison’s ability to effectively extract and process minerals from the acquired area, as well as the demand for Sodium-Ion batteries in the market.

About Edison Lithium

Edison Lithium Corp. is a Canadian-based junior mining exploration company with a focus on procuring, exploring, and developing cobalt, lithium, and other energy metal properties. Their acquisition strategy centers around obtaining affordable, cost-effective, and highly regarded mineral properties in areas with proven geological potential.

Here are some key facts about Edison Lithium Corp.:

- Lithium Properties:

- The company completed the acquisition of Resource Ventures S.A., an Argentina corporation that owns or controls the rights to over 148,000 hectares (365,708 acres) of prospective lithium brine claims in the province of Catamarca, Argentina.

- These claims are primarily located in the geological basins known as the Antofalla Salar and the Pipanaco Salar within South America’s famed Lithium Triangle.

- The property hosts brines containing elevated concentrations of lithium (Li), potassium (K), and boron (B).

- Cobalt Properties:

- In late 2017, Edison Lithium Corp. acquired an additional 100% interest in 10 unpatented mining claims totaling 140 units (approximately 2,240 hectares).

- Eight of these new claims are contiguous to the Kittson Property, which is interpreted to host the western extension of the Shakt-Davis and Edison mine structures.

- Two additional claims, located 5 km south of the Kittson property, cover a cobalt showing that returned up to 0.14% Cobalt and 0.68 g/t gold.

- The company also acquired the Historic Thomas Edison Mine in May 2018, which was developed by Thomas Edison in the early 1900s.

- The Kittson Property consists of 216 unpatented claims and 1 patented claim, totaling 4,440 hectares.

In summary, Edison Lithium Corp. is actively building a portfolio of quality assets capable of supplying critical materials to the battery industry.

About Globex Mining Enterprises

GLOBEX, a corporation listed on the Toronto Stock Exchange, Frankfurt Stock Exchange, and OTCQX, boasts a diverse portfolio across North America, including mid-stage exploration, development, and royalty properties. These properties encompass various categories such as Precious Metals (gold, silver, platinum, palladium), Base Metals (copper, zinc, lead, nickel), Specialty Metals and Minerals (manganese, titanium oxide, iron, molybdenum, lithium, rare earths, and antimony), as well as Industrial Minerals and Compounds (mica, silica, apatite, talc, magnesite, potassic feldspar, pyrophyllite).

Globex conducts exploration both independently and through partnerships, offering options for other companies to invest in its projects. These companies compensate Globex with cash, shares, and royalties while undertaking extensive exploration to earn an interest in Globex’s projects.

Summary