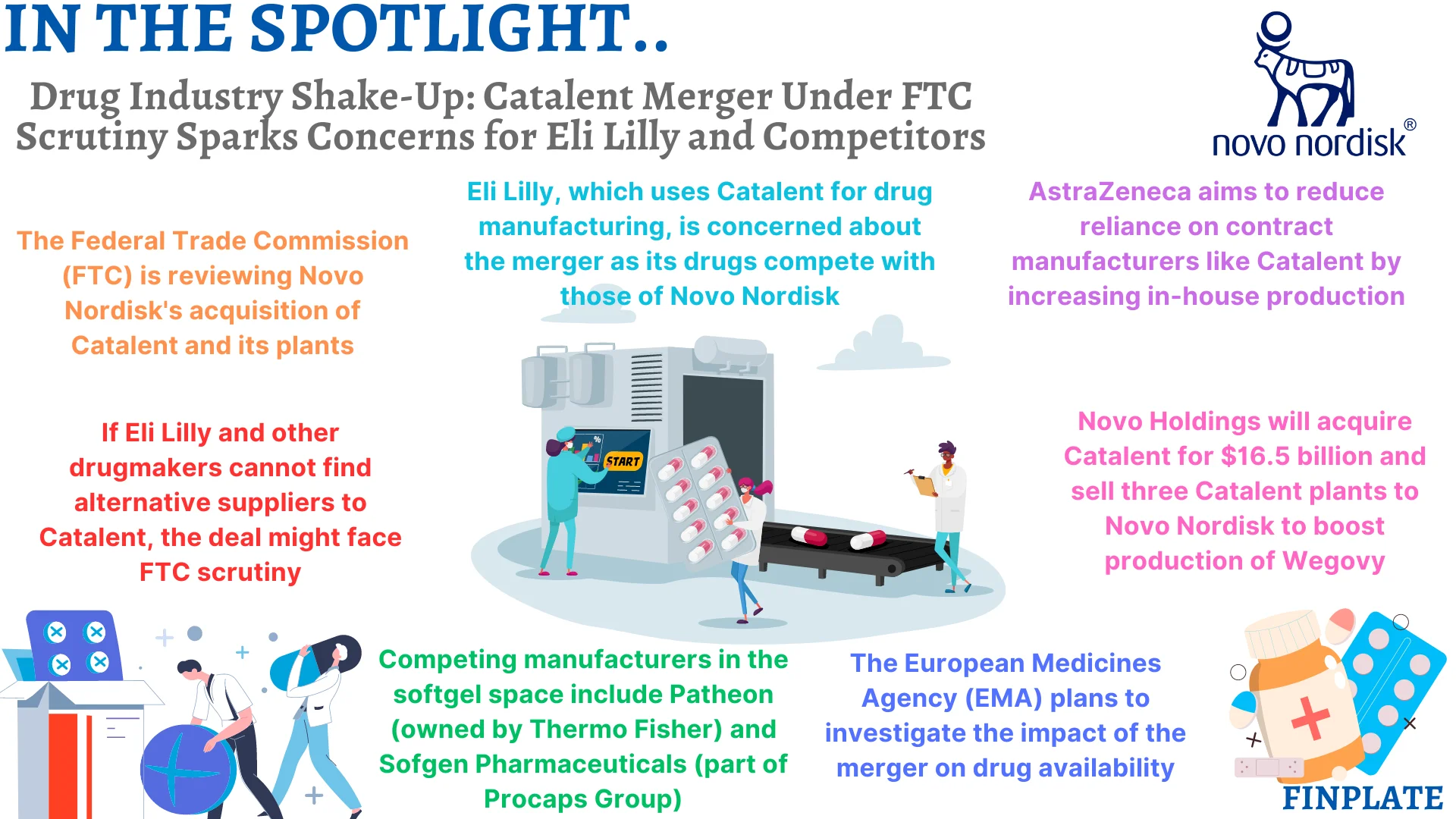

The Federal Trade Commission (FTC) is poised to examine whether Eli Lilly (LLY) and other pharmaceutical companies can secure alternative suppliers for drug manufacturing as part of its assessment of Novo Nordisk’s (NVO) proposed acquisition of Catalent (CTLT) and three of its production facilities.

According to a report from CTFN, industry experts and antitrust lawyers suggest that if it appears Eli Lilly (LLY) or other competitors cannot readily find substitutes for Catalent (CTLT), regulatory concerns may arise regarding the acquisition. Notably, within the softgel manufacturing sector, rival companies such as Patheon, a subsidiary of Thermo Fisher (TMO), and smaller entities like Sofgen Pharmaceuticals under the Procaps Group are present, as noted by CTFN.

The investigation gains significance following reports by Reuters indicating that the European Medicines Agency (EMA) intends to scrutinize the impact of the merger between Catalent (CTLT) and Novo Nordisk’s (NVO) major stakeholder Novo Holdings on drug availability. Although the EMA has not specified the drugs affected, it plans to evaluate the consequences of Novo Nordisk’s acquisition of three Catalent plants. Catalent’s acquisition by Novo Holdings for $16.5 billion, with subsequent sale of three sites to Novo Nordisk, particularly aims to bolster production of the popular weight-loss drug Wegovy.

Additionally, AstraZeneca (AZN) seeks to decrease reliance on contract manufacturers like Catalent (CTLT) by boosting in-house production, as reported by Reuters.

The Wall Street Journal also highlighted concerns from Eli Lilly (LLY) regarding the merger, particularly as their drugs Zepbound and Mounjaro compete directly with Novo Nordisk’s (NVO) Wegovy and Ozempic, both of which are produced through Catalent (CTLT).

Key points

- FTC Review and Supplier Alternatives: The FTC is examining whether pharmaceutical companies, particularly Eli Lilly, have alternative suppliers for drug manufacturing in light of Novo Nordisk’s acquisition of Catalent.

- Regulatory Concerns: The potential inability of Eli Lilly and other firms to find substitutes for Catalent might raise regulatory red flags, highlighting concerns about monopolistic practices in the industry.

- Competing Manufacturers: Companies like Patheon and Sofgen Pharmaceuticals represent alternatives in the softgel manufacturing sector, potentially mitigating concerns about a lack of competition post-merger.

- EMA Scrutiny: The EMA is investigating the merger’s impact on drug availability, indicating broader regulatory scrutiny beyond the FTC’s purview.

- Strategic Acquisitions: Novo Nordisk’s acquisition of Catalent plants aims to boost production of Wegovy, a popular weight-loss drug, underlining strategic moves in the pharmaceutical market.

- Reducing Reliance on Contract Manufacturers: AstraZeneca’s move to increase in-house production signals a broader trend among pharmaceutical companies to reduce dependency on contract manufacturers like Catalent.

- Concerns from Eli Lilly: Eli Lilly’s concerns regarding the merger highlight potential competitive threats posed by Novo Nordisk’s expanded production capabilities, particularly in drugs directly competing with Eli Lilly’s offerings.

About Novo Nordisk

Novo Nordisk, a global healthcare enterprise with over nine decades of pioneering and leading advancements, specializes in uncovering and crafting treatments for severe, enduring ailments such as diabetes and obesity. Its primary focus lies on addressing these critical chronic conditions impacting hundreds of millions worldwide, posing urgent global health dilemmas. Through a synergy of innovation and commercial prowess, Novo Nordisk channels insights from patients and collaborators to translate audacious concepts into life-preserving and preventative medications.

Key indicators about Novo Nordisk include its production of half of the world’s insulin supply, serving over 36 million individuals with its diabetes care products, crafting 600 million insulin pens, and conducting clinical trials across more than 50 nations. The company’s dedication transcends mere treatment, extending to ensuring access to economical diabetes care, particularly for vulnerable populations, notably children with type 1 diabetes. Moreover, it invests in averting chronic diseases, with an ambitious goal to stave off type 2 diabetes in over 100 million individuals by 2045.

Collaboration forms the cornerstone of Novo Nordisk’s approach. It forges alliances with like-minded entities committed to transforming patients’ lives. From fostering open innovation challenges to exchanging molecular compounds for preclinical exploration, Novo Nordisk cultivates novel ecosystems that expedite drug discovery and digital healthcare solutions. United in purpose, these endeavors aspire to make tangible improvements in the lives of those grappling with chronic ailments.

About Catalent

Catalent is recognized globally for its role in supporting pharmaceutical, biotech, and consumer health partners in optimizing the entire life cycle of product development and supply for patients worldwide. Leveraging their proficiency in development sciences, delivery technologies, and diverse manufacturing capabilities, Catalent emerges as a top choice Contract Development and Manufacturing Organization (CDMO) for tailored medications, blockbuster drugs, and expansions of consumer health brands.

Their unwavering dedication to upholding high standards of business ethics underscores the importance of responsible and integrity-focused operations, which are essential for sustaining their achievements. In essence, Catalent specializes in developing and producing solutions for various sectors including drugs, biologics, therapies, vaccines, and consumer health products. Their extensive knowledge across development sciences, delivery technologies, and diverse manufacturing modalities reflects their expertise, while their commitment to responsible and ethical business practices ensures trust and reliability among customers, investors, and suppliers alike.

Summary