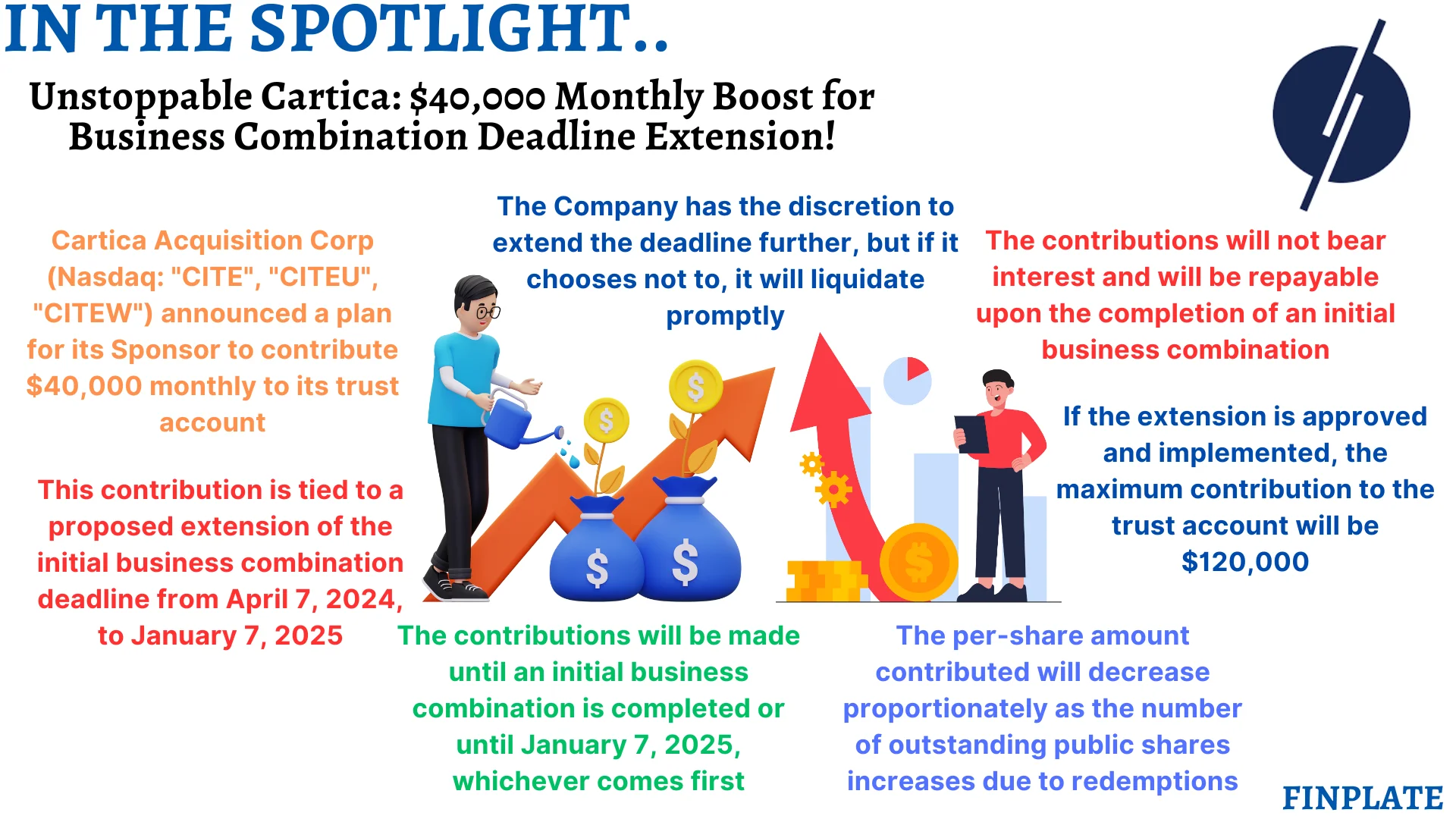

Cartica Acquisition Corp (referred to as “Cartica” or the “Company”), a special purpose acquisition company announced today a significant financial decision regarding its future operations. This decision involves a proposed amendment to the company’s charter, aiming to extend the deadline for completing its initial business combination from April 7, 2024, to January 7, 2025. The amendment, if approved by shareholders, will also grant the Company’s board of directors the authority to determine an earlier completion date if deemed necessary.

Here’s a breakdown of the key points:

- Monthly Cash Contribution: Cartica Acquisition Partners, LLC (the “Sponsor”) commits to making a cash contribution of $40,000 per month to Cartica’s trust account. This contribution is contingent upon shareholder approval of the charter amendment.

- Purpose of Contributions: The monthly contributions, totaling $40,000 each, will serve as a loan (referred to as “Contributions”) to the Company. These funds will be utilized during the Extension Period, starting from April 7, 2024, and continuing until January 7, 2025, or any earlier determined completion date.

- Impact on Shareholder Value: The amount per share received by shareholders will decrease proportionately as the number of outstanding public shares increases due to redemptions related to the Charter Extension. For instance, if an initial business combination occurs on July 7, 2024, and no public shares are redeemed, each share will receive approximately $0.028 from the trust account.

- Scenario Analysis: The exact amount per share can vary depending on the number of shares redeemed. If, for example, 2,214,415 public shares are redeemed and 2,000,000 shares remain outstanding after redemptions, the amount per share for a three-month period would be approximately $0.06.

- Redemption Amount Calculation: In the event of an initial business combination, shareholders will receive a redemption amount per share. This amount will vary based on whether all public shares remain outstanding or a portion are redeemed, with adjustments for applicable interest.

- Conditions and Discretion: The Sponsor’s Contributions are contingent upon the approval and implementation of the Charter Extension. The Company holds the sole discretion to extend the timeline further, with a final deadline set for January 7, 2025. If the Company chooses not to utilize the entire Extension Period, it will proceed with liquidation, and the Sponsor’s obligation to make additional contributions will cease.

- Repayment Terms: Contributions made by the Sponsor will not accrue interest and must be repaid by the Company upon the completion of its initial business combination.

In summary, Cartica’s decision to extend its deadline for completing an initial business combination entails a structured approach to financial support, potential impacts on shareholder returns, and careful consideration of future operational timelines.

Special Purpose Acquisition Company

A special purpose acquisition company (SPAC) is like a special team created just to collect money from investors through a public offering. The goal of this team is to use that money to buy another company, or maybe a few companies, but they haven’t decided which ones yet. That’s why people often call it a “blank-check company.”

After the SPAC collects enough money from its public offering, it doesn’t do much else besides holding onto that money. It doesn’t run a business or sell anything. The money is kept safe in a trust until either a certain amount of time passes or they find a company to buy.If they can’t find a company to buy within a certain time frame, or if there are legal issues preventing the purchase, the SPAC has to give the money back to the investors. To read more about Special Purpose Acquisition Company, click here.

About Cartica Acquisition Corp

Cartica Acquisition Corp, a special purpose acquisition company registered as a Cayman Islands exempted entity, was established with the aim of facilitating mergers, share exchanges, asset acquisitions, reorganizations, or similar business combinations with one or more entities.

The company’s objective is to merge with a technology firm that can leverage the extensive global investment and operational expertise of its team, despite being open to opportunities in any industry or location.

In terms of business strategy, Cartica Acquisition Corp intends to seek out and finalize a business combination with a suitable partner in the technology sector. The company perceives numerous potential partners in this arena, particularly those with existing early-stage investors who could benefit significantly from accessing more mature capital markets in the United States. Cartica Acquisition Corp believes it can understand the growth and profitability prospects of such partners and facilitate connections with long-term capital providers from deeper, more liquid, and mature markets.

The team behind Cartica Acquisition Corp comprises seasoned investors and dealmakers with vast global experience spanning various industries, deal sizes, and structures. Their expertise encompasses identifying investment themes, devising and executing strategies, spotting investment opportunities, executing transactions, and offering post-investment guidance to support growth and development.

With a vast and profound network, both domestically and internationally, the directors and officers of Cartica Acquisition Corp are well-equipped to pinpoint appealing opportunities. With decades of investment and operational experience, proficiency in managing both public and private companies, and a rich history of engaging with global investors, the team is poised to facilitate introductions between high-growth technology firms and global capital market investors. They serve as credible intermediaries between these two groups, potentially enhancing the market reach and visibility of technology companies seeking investment.

Summary