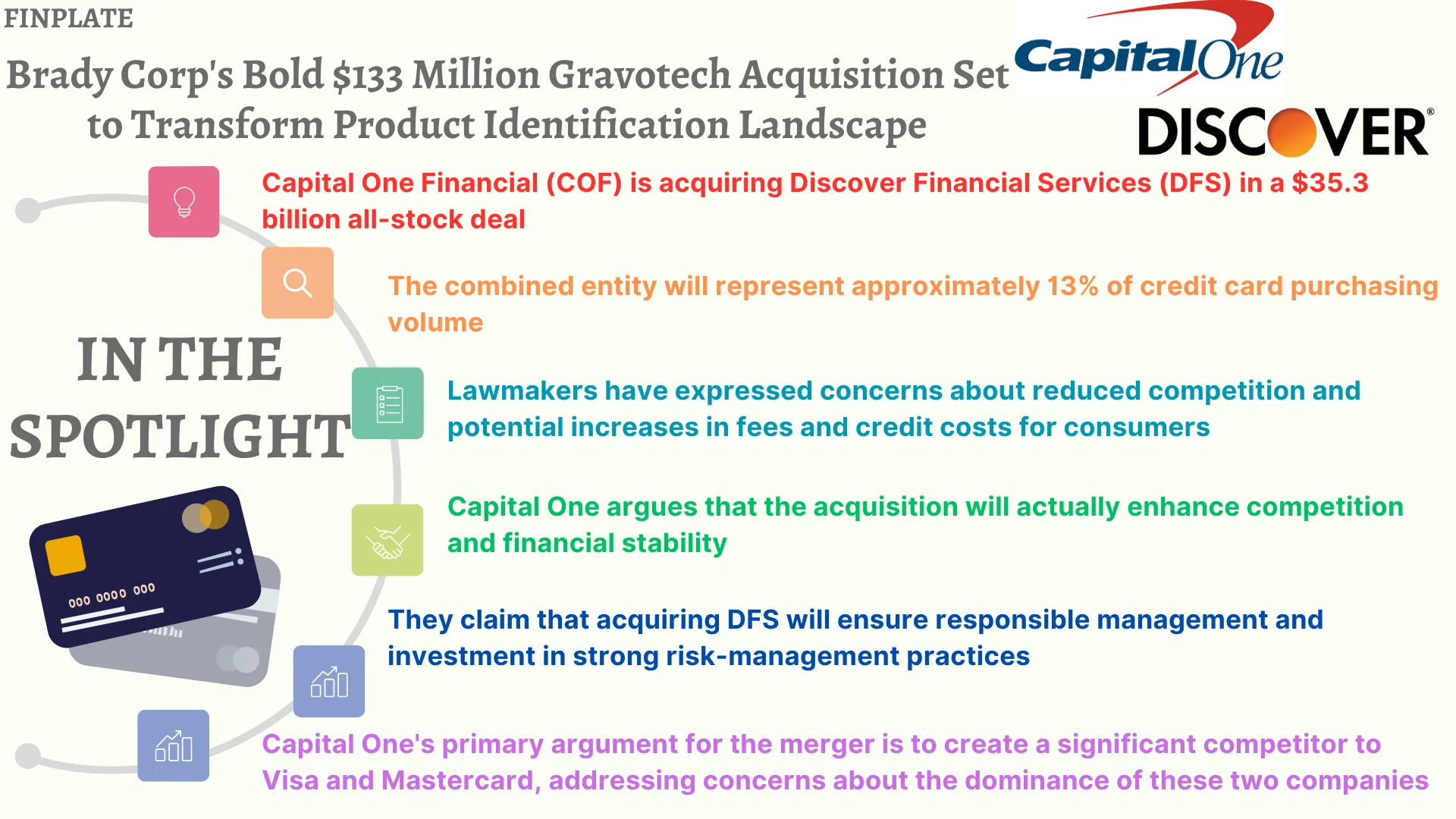

Capital One Financial (NYSE: COF) informed regulators that its planned acquisition of Discover Financial Services (NYSE: DFS) for $35.3 billion won’t harm competition in the credit card industry. According to a recent report, the combined company would only make up about 13% of all credit card purchases.

Despite concerns from lawmakers about reduced competition and possible higher fees for consumers, Capital One believes the acquisition will actually improve competition and financial stability. The deal, which involves an exchange of stocks and was announced last month, aims to create the largest U.S.-based credit card issuer by balances.

Key points:

- Acquisition Details: Capital One intends to acquire Discover Financial Services for $35.3 billion, making it the largest credit card issuer in the United States based on balances. This acquisition will be made through an all-stock deal.

- Competition Concerns: Lawmakers have expressed worries about decreased competition and potential consequences such as increased fees and credit costs for consumers due to this acquisition.

- Regulatory Application: Capital One filed an application with regulators arguing that the acquisition would not harm competition. Instead, they claim it will enhance competition and financial stability.

- Enhancing Stability: Capital One’s argument focuses on how acquiring Discover Financial Services would enhance financial stability by ensuring that it is under the control of a responsible entity committed to robust risk-management practices.

- Rival to Visa and Mastercard: One of the main points Capital One is making is that the merger could create a stronger competitor to Visa and Mastercard, addressing concerns about the dominance of these two companies in the credit card market. This suggests that the acquisition could ultimately benefit consumers by offering more choices and potentially keeping fees in check.

Overall, Capital One is trying to reassure regulators and lawmakers that the acquisition of Discover Financial Services will not stifle competition but rather enhance it, while also providing more stability and potentially offering consumers more options in the credit card market.

About Capital One Financial (NYSE: COF)

Capital One, a financial institution specializing in credit cards, banking, and payment solutions, embodies the following key points:

- Mission and Vision: Capital One endeavors to empower its customers by infusing innovation, simplicity, and empathy into banking. It aspires to stand out as the premier digital bank and payments collaborator.

- Founder and CEO: Richard Fairbank, the founder and guiding force behind Capital One, has steered the company’s evolution from its inception to its current stature as one of the United States’ largest banks and corporations. He shapes its strategic course and fosters innovation.

- Products and Services: Capital One provides a wide range of financial offerings to individuals, small enterprises, and commercial entities across the United States, Canada, and the United Kingdom. These encompass credit cards, checking and savings accounts, loans, mortgages, investment opportunities, and more.

- Commitments and Impact: Capital One is dedicated to fostering financial inclusivity, championing customer interests, promoting environmental sustainability, nurturing diversity and inclusivity, and engaging with communities. It actively supports various initiatives and endeavors aimed at positively impacting the lives of its customers, employees, and the broader society.

About Discover Financial Services (NYSE: DFS)

Discover Financial Services, an American financial institution, is the parent company of Discover Bank, an online banking platform offering various financial products such as checking and savings accounts, personal loans, home equity loans, student loans, and credit cards. It also oversees the Discover and Pulse networks and possesses Diners Club International. Established in 1986, Discover has emerged as one of the largest card issuers in the United States, serving nearly 50 million cardholders. Here are some key aspects of Discover:

- Mission: Discover is committed to assisting individuals in making wiser spending choices, managing debt effectively, and increasing savings for a better financial future.

- Customer-Centric Approach: The company prioritizes customer needs in all its endeavors.

- Mobile App: Discover offers a mobile application enabling customers to handle their banking requirements at their convenience.

- Community Development: Discover actively participates in fostering community development.

- ESG (Environmental, Social, and Governance): Discover aims to create a positive societal impact through its actions.

- Investor Relations: Those interested in financial updates and outcomes can explore Discover’s investor relations segment.

Discover Financial Services strives to be a premier digital bank and payments service provider, delivering innovative solutions for a brighter financial future.

Summary