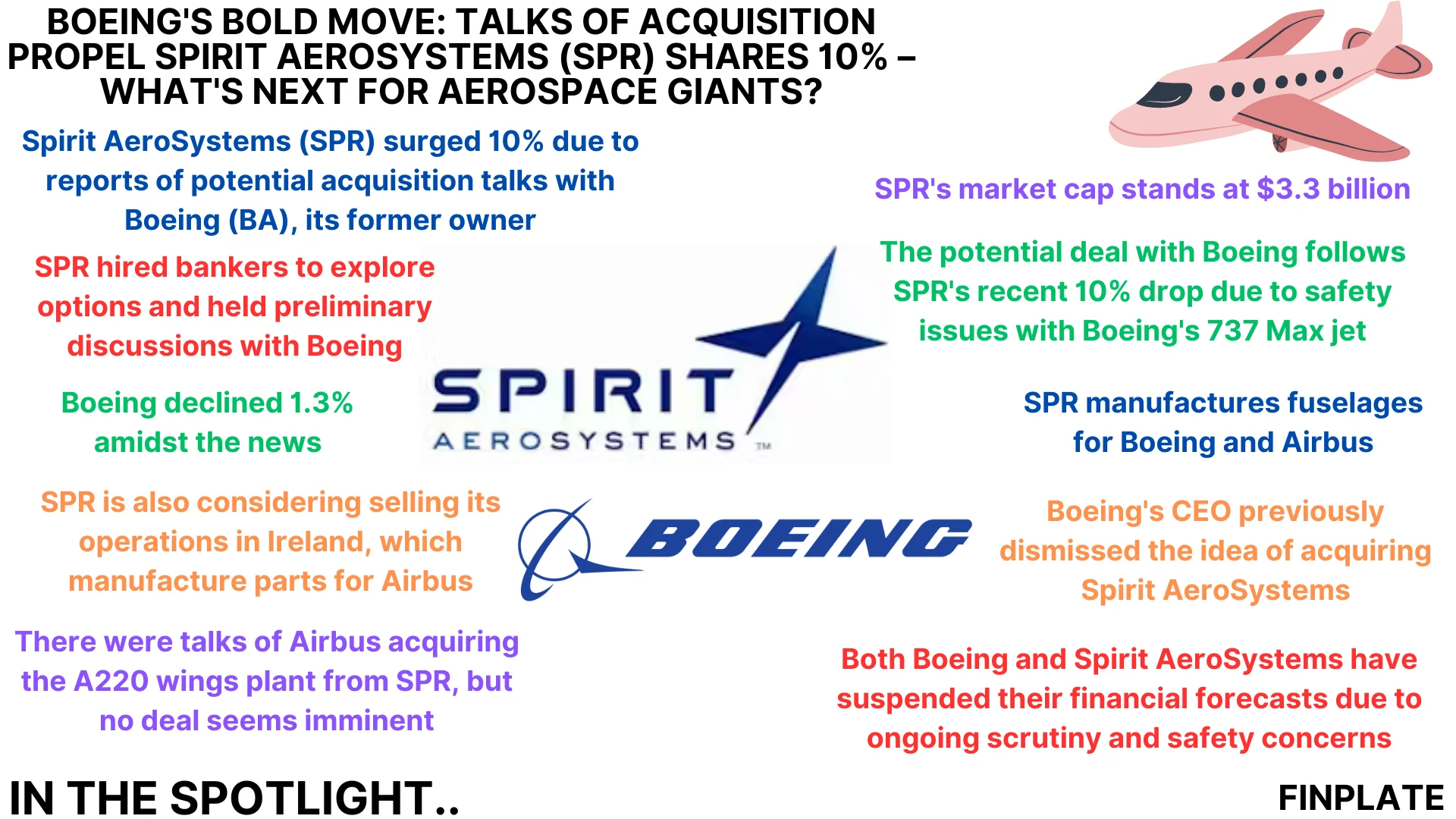

Spirit AeroSystems (NYSE: SPR) experienced a significant 10% surge in its stock amidst reports indicating discussions of a potential acquisition by Boeing (NYSE: BA), its former owner.

According to sources familiar with the matter cited in a report by The Wall Street Journal on Friday, Spirit has engaged bankers to explore various alternatives and has engaged in preliminary talks with Boeing. Bloomberg also reported Boeing’s interest in acquiring Spirit. Additionally, Spirit is considering selling its operations in Ireland that produce parts for Airbus, Boeing’s rival.

Talks regarding the acquisition of Spirit’s Belfast plant by Airbus for A220 wings production have been ongoing, although a deal in the short term seems unlikely. Such a deal would possibly require additional investments by Airbus to reduce the production cost of A220 wings. Spirit AeroSystems, established in 2005 after Boeing spun off its Wichita division and Oklahoma operations, currently holds a market cap of $3.3 billion.

The potential acquisition discussions come in the wake of a recent downturn in Spirit’s shares following safety concerns with Boeing’s 737 Max jet, notably after an incident involving an Alaska Airlines flight. Both Boeing and Spirit have suspended their financial forecasts, with Boeing’s CEO expressing previous reservations about acquiring Spirit, emphasizing a focus on resolving manufacturing process issues internally. This situation underscores the complex dynamics between Boeing and Spirit amid safety concerns and strategic business decisions.

Key Points:

- Spirit AeroSystems experienced a 10% surge in its stock following reports of potential acquisition talks with Boeing.

- Spirit is exploring alternatives and engaging in preliminary discussions with Boeing, its former owner, regarding a possible acquisition.

- Discussions also involve the sale of Spirit’s operations in Ireland, which manufacture parts for Airbus.

- Talks regarding Airbus potentially acquiring Spirit’s Belfast plant for A220 wings production are ongoing, with a focus on reducing production costs.

- The potential deal comes amidst safety concerns regarding Boeing’s 737 Max jet, leading to suspensions of financial forecasts by both Boeing and Spirit.

- Boeing’s CEO previously expressed reluctance about acquiring Spirit, emphasizing the need to resolve internal manufacturing process issues.

- The situation underscores the complex dynamics between Boeing and Spirit amid safety concerns and strategic business decisions.

About Spirit AeroSystems

Spirit AeroSystems defines and energizes modern aerospace manufacturing by delivering uncompromising quality, breakthrough innovations and high-skilled production expertise to commercial, defense and business aerospace programs. Spirit AeroSystems is the world’s largest tier-one manufacturer and supplier of aerostructures, a $7 billion global company with more than 14,800 employees worldwide. The company’s headquarters are located in Wichita, Kan. Other locations include Tulsa and McAlester, Okla.; Kinston, N.C.; Biddeford, ME; San Antonio, TX; Prestwick, Scotland; Belfast, Northern Ireland; Subang, Malaysia; Casablanca, Morocco and Saint-Nazaire, France.

About Boeing

As a leading global aerospace company, Boeing develops, manufactures and services commercial airplanes, defense products and space systems for customers in more than 150 countries. As a top U.S. exporter, the company leverages the talents of a global supplier base to advance economic opportunity, sustainability and community impact. Boeing’s diverse team is committed to innovating for the future, leading with sustainability, and cultivating a culture based on the company’s core values of safety, quality and integrity.

Summary