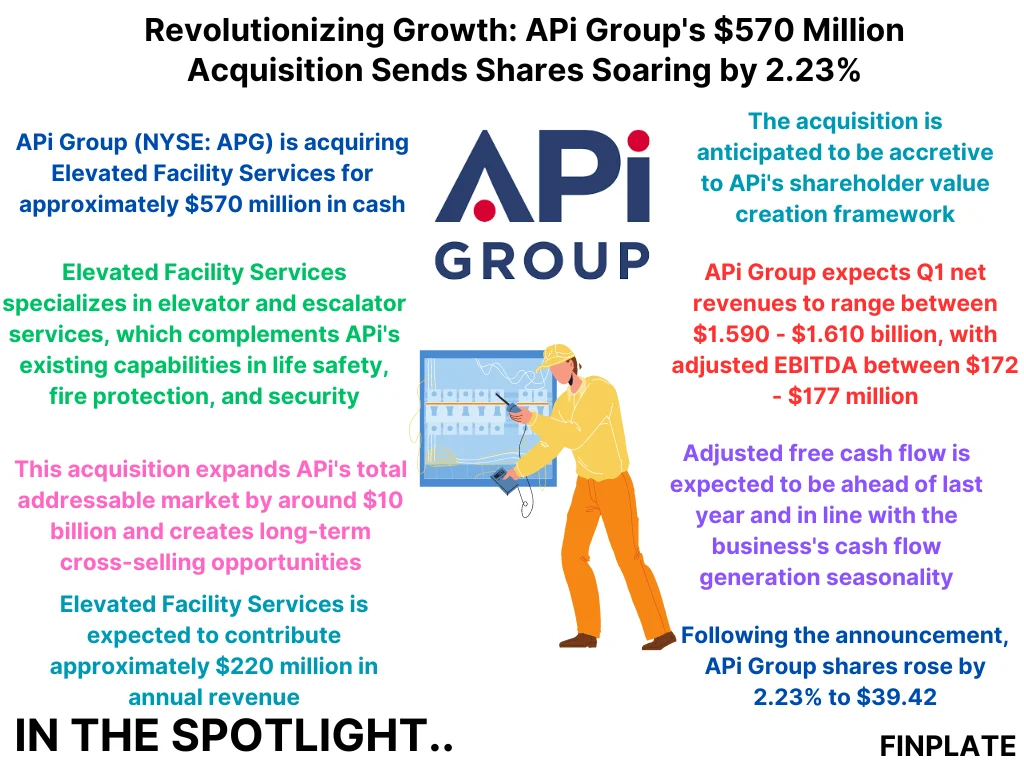

APi Group, a company listed on the New York Stock Exchange (NYSE) under the ticker symbol APG, is planning to buy Elevated Facility Services. Elevated Facility Services is a company that offers maintenance services for elevators and escalators. This purchase will cost APi Group approximately $570 million in cash. Elevated Facility Services specializes in servicing elevator and escalator equipment from various well-known brands. This acquisition is significant for APi Group because it aligns with their current focus on life safety, fire protection, and security services. By adding elevator and escalator services to their portfolio, APi Group expands its potential market by approximately $10 billion.

Key Points:

- Acquisition Details: APi Group will acquire Elevated Facility Services from a fund managed by L Squared Capital Partners for $570 million in cash.

- Market Expansion: Elevated Facility Services’ expertise in elevator and escalator services complements APi Group’s existing services, broadening their market potential by around $10 billion.

- Cross-selling Opportunity: The acquisition creates opportunities for cross-selling services between APi Group’s existing offerings and Elevated Facility Services’ elevator and escalator maintenance services.

- Financial Impact: The acquisition is expected to contribute around $220 million in annual revenue. It is also anticipated to enhance APi Group’s shareholder value creation framework, particularly through Elevated’s EBITDA margin profile, which includes approximately 70% of revenue from inspections, service, and repair.

- Financial Forecast: APi Group anticipates first-quarter net revenues ranging between $1.590 billion and $1.610 billion, with adjusted EBITDA expected to be between $172 million and $177 million. Adjusted free cash flow is projected to surpass last year’s figures and align with the seasonal cash flow patterns of the business.

- Market Response: Following the announcement, APi Group’s shares experienced a 2.23% increase, reaching $39.42.

Overall, the acquisition of Elevated Facility Services represents a strategic move by APi Group to expand its service offerings, tap into new markets, and enhance shareholder value. This acquisition not only strengthens APi Group’s position in the industry but also presents opportunities for revenue growth and synergies through cross-selling. The financial forecast indicates confidence in the company’s performance and its ability to generate value for shareholders.

About APi Group

APi Group is a global market-leading business services provider specializing in safety and specialty services. Here are some key points about the company:

- Mission and Approach:

- APi Group encourages leaders within its family of companies to continue their mission, culture, and business relationships while leveraging the added power of APi Group to deliver innovative solutions for customers.

- The company’s approach to entrepreneurial leadership, focus on customer relationships, financial strength, and strategic planning has fueled its outstanding success.

- History:

- APi Group’s journey began in 1926 as the Reuben L. Anderson-Cherne mechanical company.

- Initially, it operated as an insulation contracting and distribution division known as A.P.I. Inc..

- In 1964, Lee R. Anderson Sr. was appointed as president, and by 1980, he diversified A.P.I. Inc. for the construction and construction-related industries.

- The business expanded to key markets, establishing a strong national and global presence.

- In 1997, the company rebranded as APi Group.

- Current Status:

- Today, APi Group is a global market leader, providing safety and specialty services across over 500 locations worldwide.

- The company’s services include fire protection, alarm monitoring, access control, pipeline integrity repairs, pipe insulation, oil terminal facility construction, equipment erection, and maintenance, among others.

- APi Group continues to fund promising acquisitions and new ventures while supporting its current subsidiaries to excel in their respective domains.

- Leadership:

- APi Group boasts a strong leadership team, including individuals like:

- Monica Seme (Vice President, Learning and Leadership Development)

- Mike Shands (Vice President of Learning and Leadership Development)

- Andrew White (Senior Vice President, APi International, and CEO of Chubb)

- APi Group boasts a strong leadership team, including individuals like:

Summary