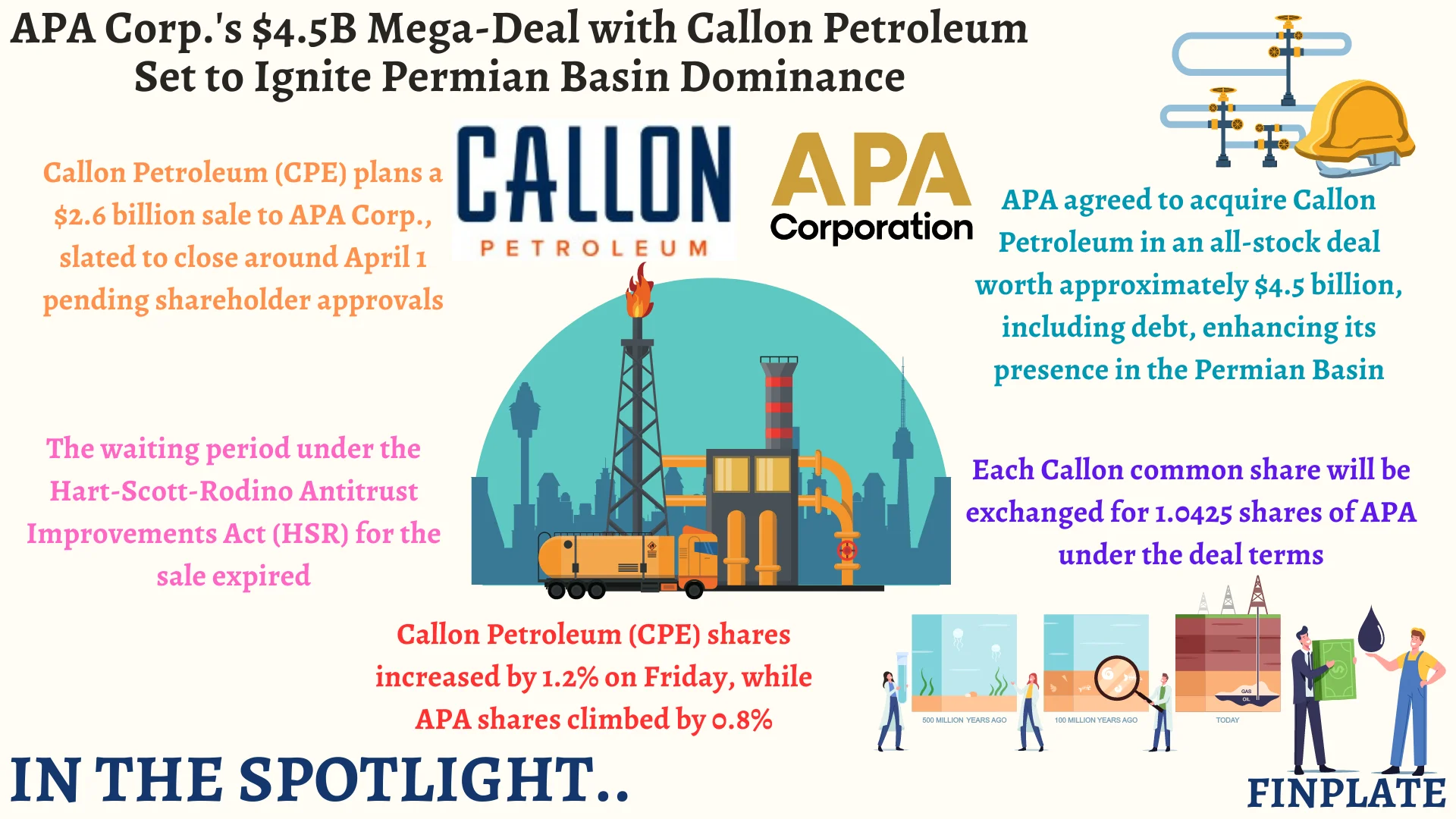

Callon Petroleum (NYSE:CPE) is poised to finalize its $2.6 billion acquisition by APA Corp.(NASDAQ:APA), with the transaction expected to conclude around April 1 pending approval from both sets of shareholders. The expiration of the HSR waiting period for Callon’s sale to APA, reported in an 8-K filing on Friday, indicates progress towards the deal’s completion.

APA’s agreement to purchase Callon Petroleum in an all-stock arrangement, valued at approximately $4.5 billion inclusive of debt, was reached last month, marking a strategic move to enhance its presence in the Permian Basin. As per the terms of the agreement, each Callon common share will be swapped for a fixed ratio of 1.0425 shares of APA. The market responded positively to the news, with Callon Petroleum (CPE) shares witnessing a 1.2% increase on Friday, while APA’s stock climbed by 0.8%.

Key Points

- Acquisition Details: Callon Petroleum, a publicly traded company, is set to be acquired by APA Corp. for $2.6 billion. APA Corp. is expanding its portfolio by acquiring Callon, which will bolster its operations in the Permian Basin, a significant oil-producing region in the United States.

- Shareholder Approval: The acquisition process requires approval from the shareholders of both Callon Petroleum and APA Corp. Once the approval is obtained from both sides, the acquisition is expected to be finalized around April 1.

- HSR Waiting Period: The expiration of the HSR (Hart-Scott-Rodino) waiting period is a regulatory milestone in the acquisition process. It indicates that the antitrust review period for the acquisition has concluded, paving the way for further progress towards completing the deal.

- Transaction Structure: The acquisition is structured as an all-stock deal, wherein Callon Petroleum shareholders will receive shares of APA Corp. The fixed exchange ratio of 1.0425 shares of APA for each Callon share provides clarity on the terms of the transaction.

- Market Response: The positive response from the market is evident in the rise of both Callon Petroleum and APA Corp. stock prices following the announcement. This reflects investor confidence in the strategic direction and potential synergies of the acquisition for both companies.

In summary, the planned acquisition of Callon Petroleum by APA Corp. represents a significant strategic move in the energy sector, with implications for shareholders, operations, and market dynamics in the Permian Basin.

About Callon Petroleum

Since 1950, Callon Petroleum has directed its attention towards exploring, developing, acquiring, and producing unconventional oil and natural gas resources. In 2009, the company expanded its portfolio by acquiring 8,800 net acres of oil and gas properties in the Permian Basin. Since then, Callon has persistently expanded its footprint in West Texas, and today boasts an extensive acreage totaling approximately 145,000 net acres strategically located in the heart of the Permian Basin.

About APA Corp.

APA Corporation‘s subsidiaries conduct operations across various regions, including the United States, Egypt’s Western Desert, the United Kingdom’s North Sea, and exploration ventures offshore Suriname.

Since its establishment in 1954, APA’s team has remained united by its core values, dedication to enhancing shareholder value, and a corporate culture that empowers all employees to contribute to the company’s objectives. The global workforce shares a sense of ownership and recognizes that optimal solutions prevail. The company endeavors to generate shareholder returns while addressing global energy demands and pioneering sustainable operational practices. APA strives to be a responsible community partner, prioritizing the safety and well-being of its employees, local communities, and the environment.

In 2021, Apache Corporation transitioned into a holding company structure under APA Corporation, a publicly traded entity on the Nasdaq stock exchange. APA acquired subsidiaries in Suriname and the Dominican Republic from Apache. Apache Corporation now operates as a direct, wholly-owned subsidiary of APA, maintaining assets in the U.S., subsidiaries in Egypt and the U.K., and economic stakes in Altus Midstream Company and Altus Midstream LP.

Summary