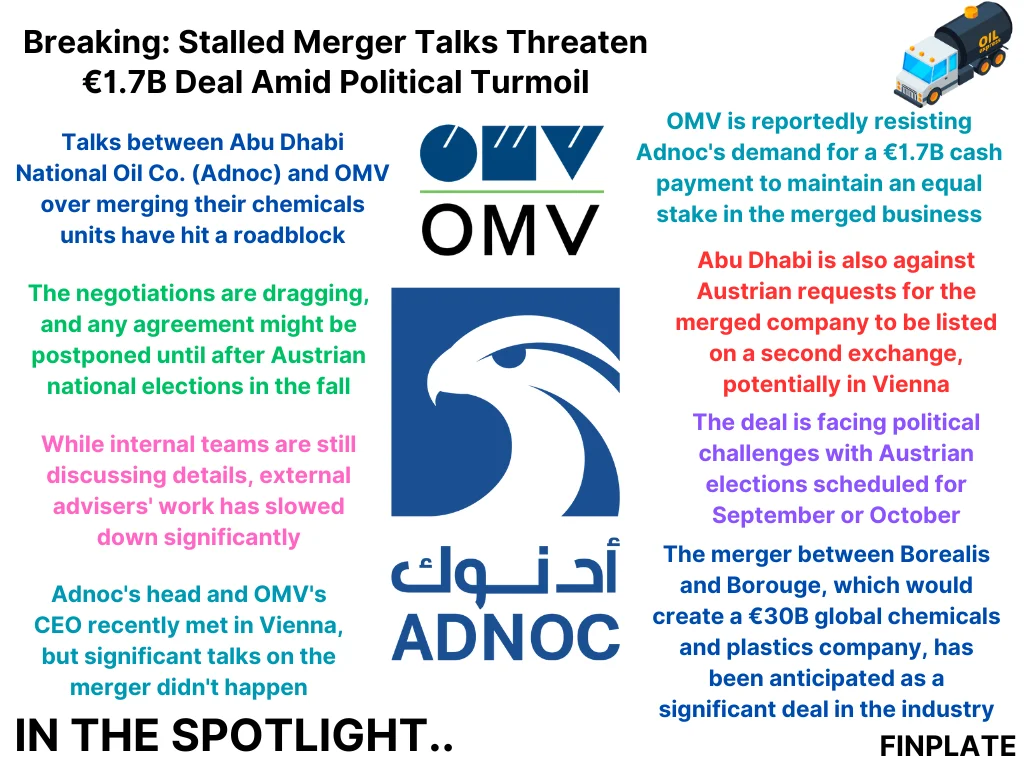

Abu Dhabi National Oil Co. (Adnoc) and OMV are discussing combining their chemical units, but the talks have been slow and may be delayed until after Austrian national elections. Adnoc wants OMV to pay €1.7 billion to keep an equal share in the merged company, but OMV is resisting.

Additionally, Abu Dhabi doesn’t agree with Austria’s request to list the merged company on a second stock exchange, possibly in Vienna. The merger involves Borealis and Borouge, aiming to create a massive €30 billion chemicals and plastics company. However, political factors related to the upcoming Austrian elections are complicating the negotiations.

Key Points:

- Background of the Talks: Abu Dhabi National Oil Co. (Adnoc) and OMV, an Austrian company, have been in discussions to merge their chemicals units. This merger aims to combine their resources and expertise to create a stronger entity in the chemicals industry.

- Stumbling Blocks: The negotiations have hit several roadblocks. OMV is hesitant to agree to Adnoc’s demand for a €1.7 billion cash payment to maintain an equal stake in the merged business. This disagreement indicates financial concerns and differing valuations between the two parties.

- Political Factors: The timing of the negotiations coincides with Austrian national elections expected in the fall. This adds a layer of complexity to the talks as political dynamics and priorities may influence decision-making. The upcoming elections could potentially delay any agreement until after the elections are concluded, as both parties may want to wait for a clearer political landscape.

- Reservations and Objectives: Abu Dhabi is also opposed to Austria’s suggestion that the merged company be listed on a second stock exchange, possibly in Vienna. This disagreement reflects conflicting interests regarding where the merged company should be headquartered and listed, which can have implications for regulatory compliance, taxation, and access to capital markets.

- Impact on Industry: The merger between Borealis and Borouge, if successful, would create a significant player in the chemicals and plastics industry, with an estimated value of €30 billion. This deal has been anticipated as one of the largest in the industry, indicating its potential impact on market dynamics, competition, and global supply chains.

- Uncertainty and Delays: The prolonged negotiations, coupled with political uncertainties, are leading to delays and uncertainty regarding the outcome of the merger. Both internal teams and external advisers are still discussing details, but progress has been slow in recent months, indicating the complexity and sensitivity of the negotiations.

In summary, the talks between Adnoc and OMV to merge their chemicals units are facing challenges due to financial disagreements, political uncertainties, and conflicting objectives. The outcome of the negotiations and the potential merger will not only affect the companies involved but also have broader implications for the chemicals industry and the global market.

About Abu Dhabi National Oil Co. (ADNOC)

Established in 1971, ADNOC stands as a prominent diversified energy conglomerate, fully under the ownership of the Abu Dhabi Government. Its comprehensive array of interconnected enterprises spans the entirety of the energy spectrum, facilitating the adept fulfillment of fluctuating market demands while upholding principles of sustainability.

Having already secured a distinguished status among the world’s foremost producers with the lowest carbon footprint, ADNOC is actively pursuing measures to enhance the environmental profile of contemporary energy sources. Concurrently, it is directing substantial resources towards fostering cleaner energy alternatives for the future, thus solidifying its reputation as a dependable and conscientious global energy supplier.

With an initial investment of $23 billion earmarked for the advancement and expeditious adoption of eco-friendly solutions, ADNOC is channeling funds into emerging energy sectors and cutting-edge decarbonization technologies. This strategic endeavor is geared towards realizing its ambitious target of achieving net-zero emissions by 2045, alongside a steadfast commitment to eliminating methane emissions entirely by 2030.

About OMV

OMV is a significant industrial entity in Austria, engaged in the production and marketing of oil, gas, and chemical products. Here are the key points about the company:

- Sales & Market Cap: In 2023, OMV achieved sales of EUR 39 billion and had a market capitalization of around EUR 13 billion.

- Employees: It employs approximately 20,600 people, primarily at its integrated European sites as of 31.12.2023.

- Polyolefin & Recycling: OMV is a leading provider of advanced and circular polyolefin solutions, selling 5.7 million tons of polyolefins in 2023. It’s also a market leader in base chemicals and plastics recycling in Europe.

- Emission Reduction Goals: The company aims to reduce emissions in operations (Scope 1 & 2) by 30% by 2030 and its product portfolio (Scope 3) by 20%, aligning with the Paris Agreement.

OMV’s operations span various sectors, including refining, marketing fuels, operating filling stations, and exploring and producing oil and gas across multiple core regions. The company is also involved in gas marketing and storage in Western Europe. It has taken significant steps towards sustainability and environmental responsibility.

Summary