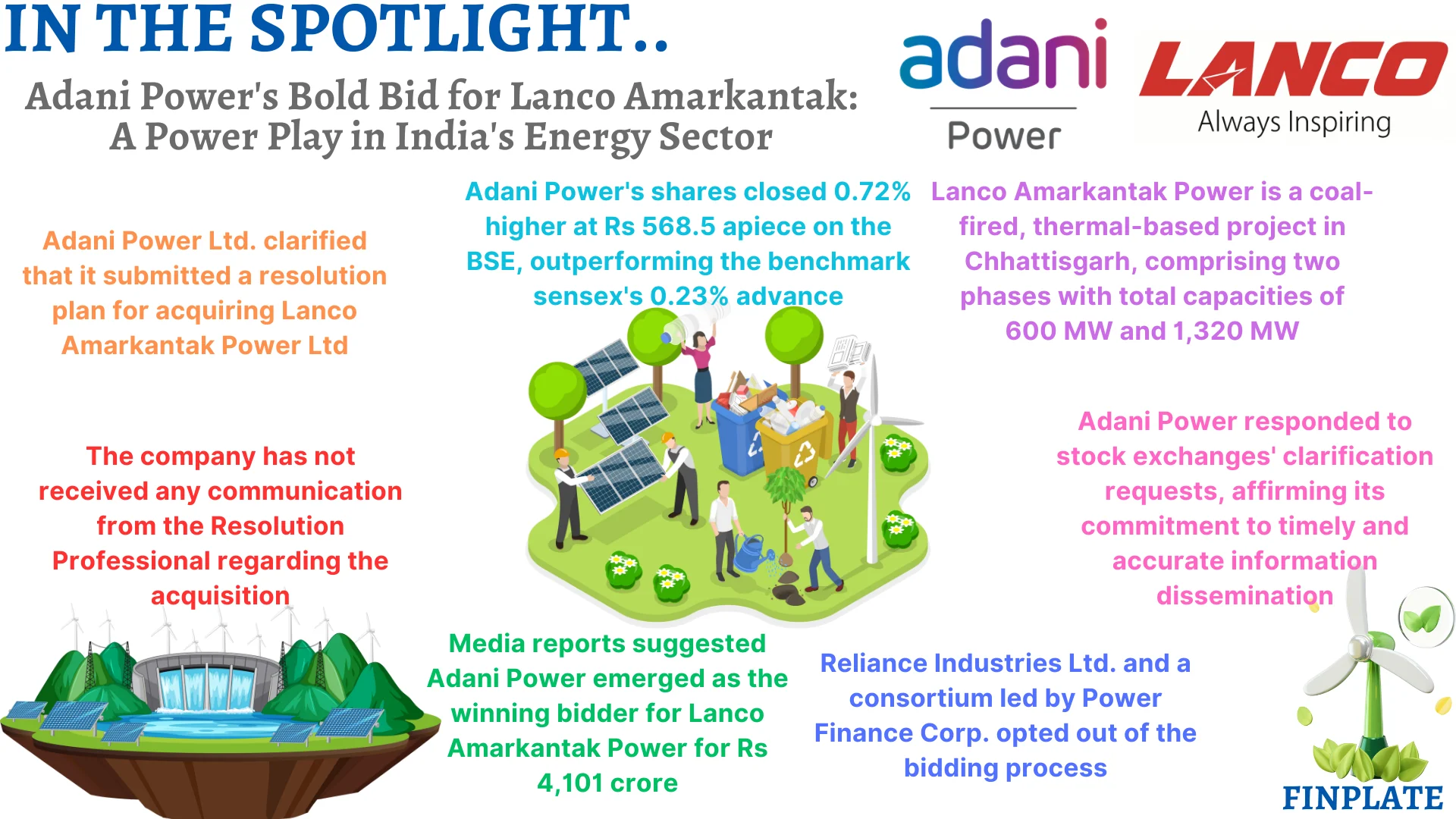

Adani Power Ltd. has officially stated that it has presented a resolution proposal for acquiring Lanco Amarkantak Power Ltd., yet it has not received any communication from the Resolution Professional regarding the status of the bid. Recent media reports suggested that Adani Group’s subsidiary emerged as the top bidder, offering Rs 4,101 crore to acquire the financially distressed Lanco Amarkantak Power. Notably, the auction process concluded after other contenders, including Reliance Industries Ltd. and a consortium spearheaded by Power Finance Corp., chose not to participate.

In its exchange filing on Friday, Adani Power emphasized its commitment to transparency and promptly addressing stock exchange queries. Lanco Amarkantak Power, situated near Pathadi Village along the Korba-Champa State Highway in Chhattisgarh, operates as a coal-fired, thermal-based project, segregated into two phases with a total capacity of 600 MW and 1,320 MW for Phase I and Phase II respectively, as outlined on the company’s website. Despite the positive development, Adani Power’s shares closed marginally higher at Rs 568.5 each on the BSE, compared to the 0.23% uptick in the benchmark sensex.

Key points

- Resolution Plan Submission: Adani Power has officially submitted a resolution plan for acquiring Lanco Amarkantak Power Ltd.

- Communication Status: Despite submitting the proposal, Adani Power has not received any updates or communication from the Resolution Professional regarding the bid’s status.

- Winning Bidder: Media reports indicated that Adani Group’s subsidiary emerged as the top bidder, offering Rs 4,101 crore to acquire Lanco Amarkantak Power, after other contenders refrained from participating.

- Transparency and Exchange Clarification: Adani Power emphasized its commitment to transparency and promptly addressed stock exchange queries regarding the acquisition bid.

- Project Details: Lanco Amarkantak Power, located in Chhattisgarh, operates as a coal-fired, thermal-based project divided into two phases with a combined capacity of 1,920 MW.

- Market Response: Despite the positive development for Adani Power, its shares closed marginally higher on the BSE, reflecting a modest market response compared to the benchmark sensex’s performance.

About Adani Power Ltd.

Adani Power Limited (APL), a constituent of the diversified Adani Group, stands as India’s foremost private thermal power producer, boasting a sizable capacity of 15,250 MW. Operating thermal power facilities across Gujarat, Maharashtra, Karnataka, Rajasthan, Chhattisgarh, Madhya Pradesh, and Jharkhand, Adani Power also oversees a 40 MW solar power initiative in Gujarat. Key facets of Adani Power include its public company status, trading symbols on BSE (533096) and NSE (ADANIPOWER), and its presence in the energy and renewable energy sectors since its inception on August 22, 1996.

The company, headquartered in Shantigram, Khodiyar, Ahmedabad, Gujarat, is helmed by Gautam Adani (Chairman) and Anil Sardana (MD & CEO). Its offerings encompass electricity generation and distribution, wind power, and energy trading, with significant financial metrics for 2023: revenue at ₹43,040 crore (US$5.4 billion), operating income at ₹12,044 crore (US$1.5 billion), net income at ₹10,726 crore (US$1.3 billion), total assets at ₹85,821 crore (US$11 billion), total equity at ₹29,875 crore (US$3.7 billion), and a workforce of 3,155 employees.

Adani Power has inked substantial long-term power purchase agreements amounting to about 9,153 MW with the administrations of Gujarat, Maharashtra, Haryana, Rajasthan, Karnataka, and Punjab. Its trajectory commenced in 1996 as a power trading entity and evolved into a significant force in India’s energy domain. Noteworthy is the Mundra Thermal Power Plant, one of the globe’s largest privately owned thermal power plants, boasting a capacity of 4,620 MW. Furthermore, Adani Power’s foray into renewable energy was marked by the inauguration of a 40 MW solar power project in Kutch, Gujarat, signifying its entry into the renewable sector. Adani Power remains instrumental in shaping the country’s energy landscape.

About Lanco Amarkantak Power Ltd.

Lanco Infratech Limited, a prominent Indian business entity, has played a pivotal role in driving progress across various sectors such as Engineering, Procurement and Construction (EPC), Power, Solar, Natural Resources, and Infrastructure for the past 25 years. The company’s relentless focus on innovation, expansion, and a steadfast commitment to quality has significantly propelled its rapid advancement. Today, the Lanco group, established 25 years ago, stands in a unique position to achieve leadership in its operational domains.

At the core of Lanco’s dynamic progress lies its strategic plan, known as “Lanco’s Vision,” which aims to establish an achievement-oriented and customer-centric organization dedicated to attaining industry leadership. The company has ambitious growth plans for its diverse business verticals. Lanco Infratech Limited became a publicly listed entity in November 2006 through an Initial Public Offering, achieving a gross revenue of Rs 9,999 Crores (USD 1.51 billion*) as of March 31, 2016.

The seamless integration of Lanco’s core competence in EPC with other sectors like infrastructure, construction, and power has yielded substantial dividends. The company’s expertise in constructing large civic and urban infrastructure projects has been leveraged for thermal and hydro power projects across India. In response to the country’s energy needs, Lanco has made significant strides in the solar power sector, emerging as a leading private sector power developer in India with 3,460 megawatts (MW) in operation and 4,636 MW under construction.

In a strategic move to enhance fuel security for its existing and future power projects, Lanco, through its Australian subsidiary, Lanco Resources Australia, acquired Griffin Coal Mining Company and Carpenter Mine Management. Griffin Coal owns the largest operational thermal coal mines in Western Australia, producing around 4 million tonnes per annum, with potential expansion up to 18 million tonnes per annum after developing evacuation infrastructure. Lanco has also forged strategic global partnerships with major power companies, including Genting, Harbin, GE, Dongfang, Doosan, among others.

With a workforce of over 3,734 individuals, Lanco, headquartered in Gurgaon near New Delhi, has a widespread presence in strategic locations across India and is gradually expanding its footprint in emerging global markets. As a privileged member of the World Economic Forum, Lanco has been recognized as an elite member among the top 200 “Global Growth Companies.”

Summary