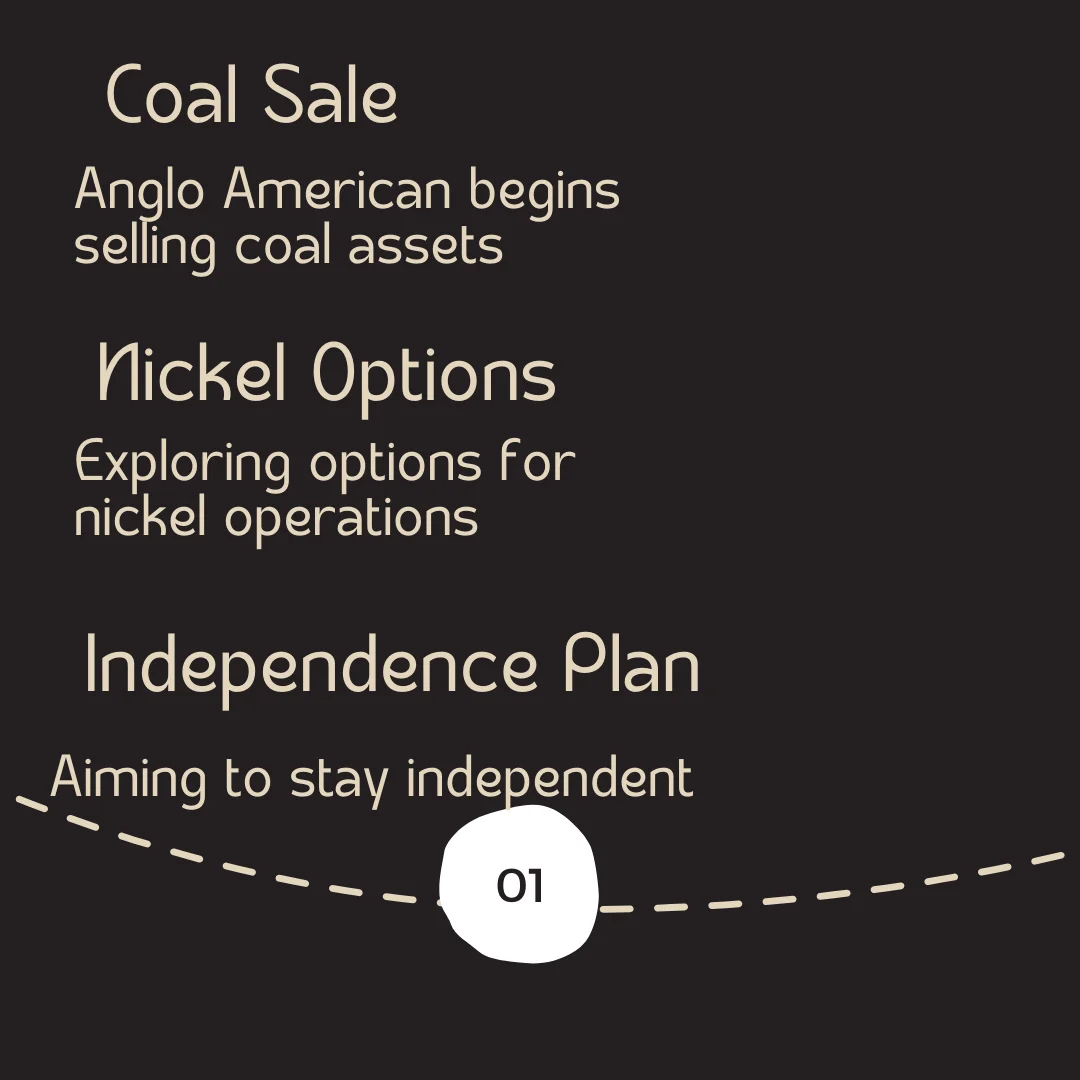

Anglo American (OTCQX:AAUKF) (OTCQX:NGLOY) is beginning a formal process to sell its coal assets and look into options for its nickel operations, as confirmed by CEO Duncan Wanblad after the company fended off a takeover attempt by BHP (BHP).

Key Points:

- Strategic Plan to Stay Independent:

- Anglo American plans to reduce its size by:

- Selling its steelmaking coal assets.

- Separating its South African platinum business.

- Possibly closing its nickel mines.

- Selling or separating its De Beers diamond unit.

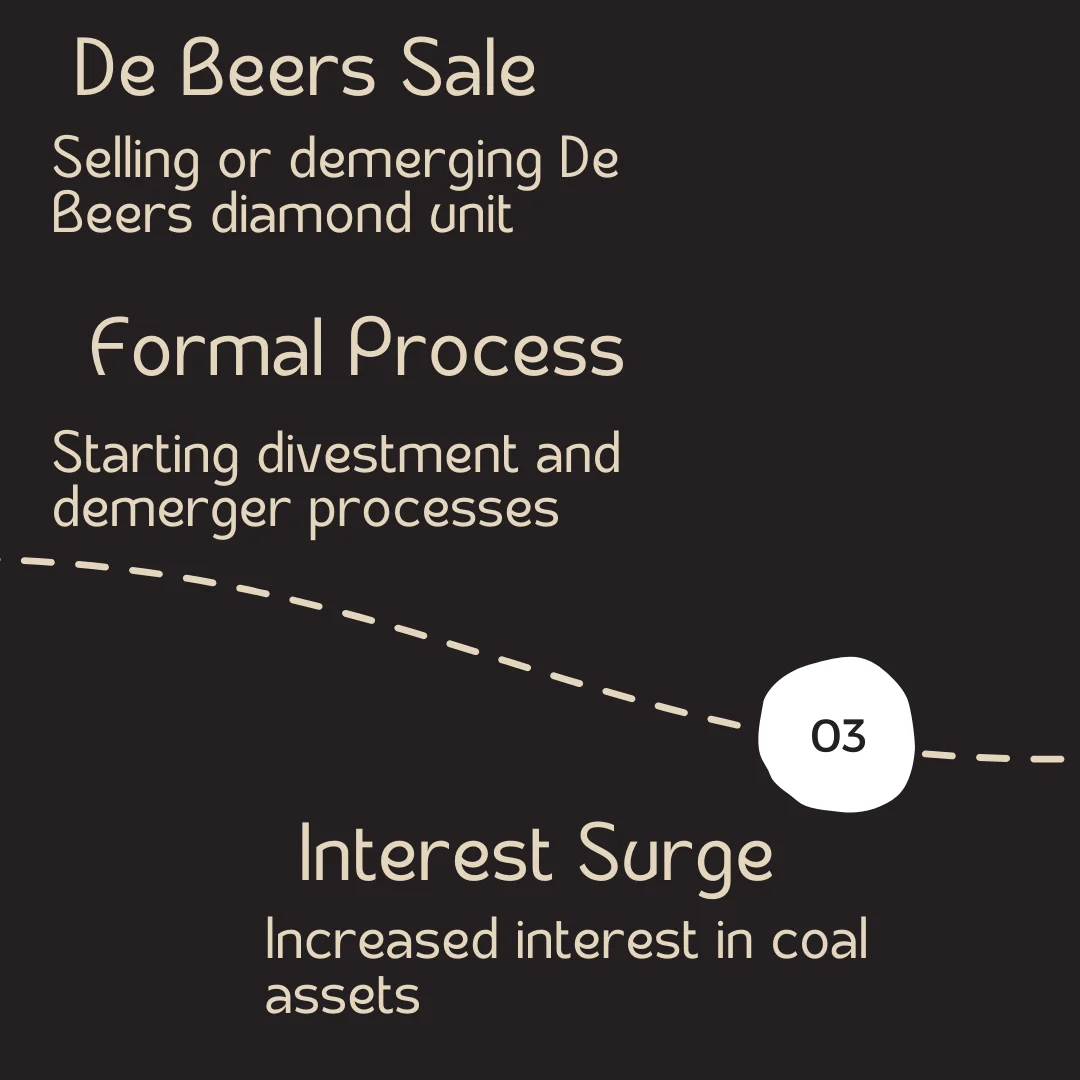

- Formal Processes Initiated:

- The company has started the formal procedures for selling or separating these businesses.

- Interest in Coal Assets:

- The five operating coal mines and associated projects in Australia have attracted increased interest since the divestment announcement.

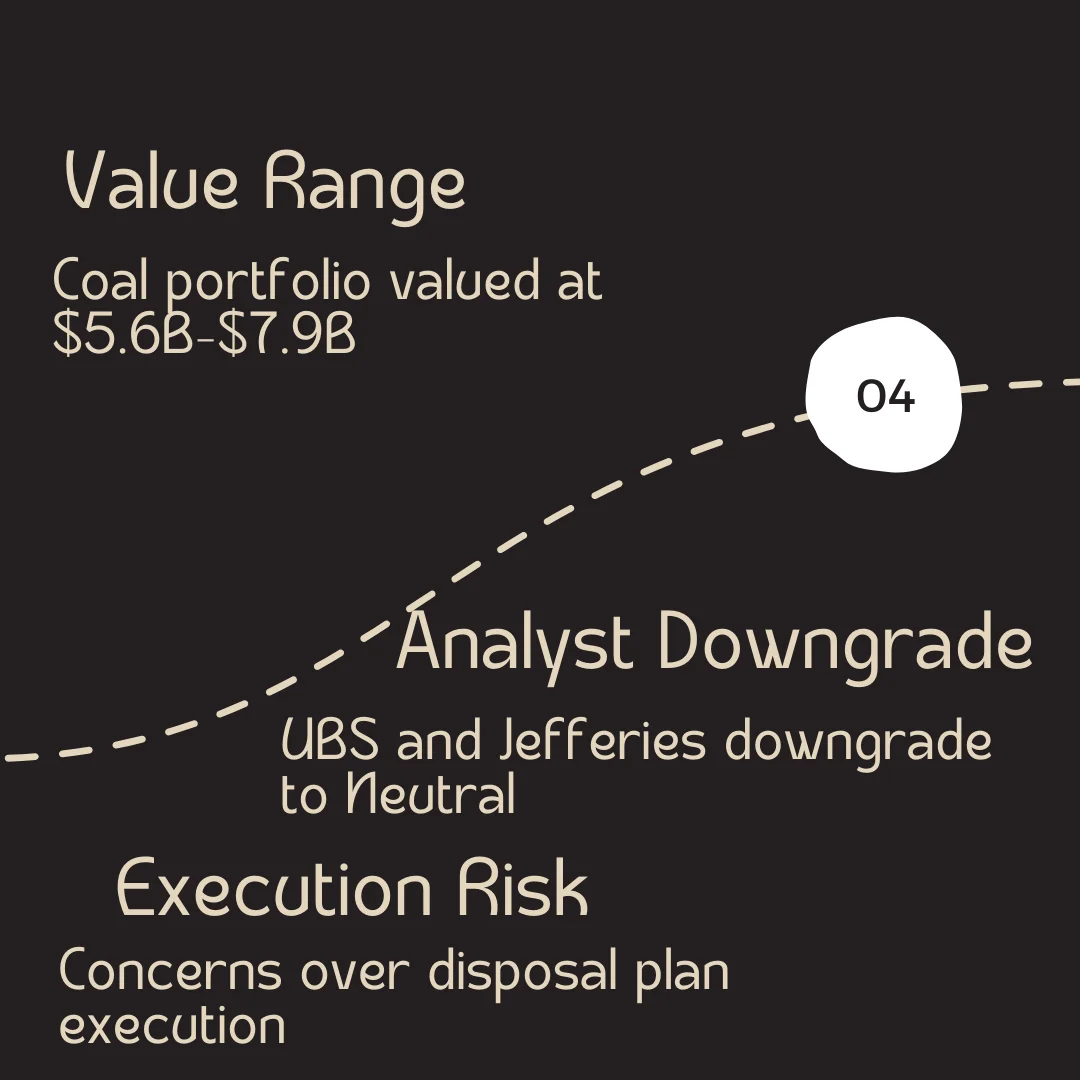

- Analysts from Bank of America value these coal assets between $5.6 billion and $7.9 billion.

- Analysts’ Views:

- UBS and Jefferies downgraded Anglo American to Neutral from Buy, citing risks in executing the disposal plan and concerns about the future value of the company’s remaining core operations (copper, iron ore, and nutrients) and proceeds from the potential sale of De Beers.

- Optimistic Outlook:

- Analyst Jamie Maddock from Quilter Cheviot believes that Anglo American’s breakup plan could generate more value than BHP’s offer. The takeover attempt has highlighted the company’s valuable assets, potentially increasing interest from other parties.

- Potential for Future Offers:

- Maddock suggests that Anglo American might still face takeover bids if the breakup process takes too long, indicating that other companies might take advantage of any management missteps.

- However, he remains hopeful due to the high quality of Anglo American’s assets.

About BHP

BHP (formerly known as BHP Billiton) is a world-leading resources company headquartered in Melbourne, Australia. Here are some key points about BHP:

- Purpose: BHP’s purpose is to bring people and resources together to build a better world.

- Business Overview:

- BHP is the world’s largest mining company by market capitalization.

- We are a leading producer of various commodities, including:

- Iron Ore: Used for global infrastructure and the energy transition.

- Copper: Essential for renewable energy.

- Metallurgical Coal: Preferred by steelmaking customers.

- Nickel: Used in electric vehicles.

- Potash: Supports sustainable farming.

- Global Presence:

- BHP operates in more than 90 locations worldwide.

- Our products are sold globally, contributing to the world economy.

- Leadership and Values:

- Our leaders are required to live by Our Charter values.

- We prioritize responsible management of a resilient long-term portfolio of assets.

- Historical Impact:

- Since 1851, BHP has been contributing to the industry, communities, and economies globally.

- We have played a vital role in creating better standards of living and facilitating greater prosperity.

- Key Statistics:

- Employees: More than 80,000 employees and contractors work at BHP.

- Economic Contribution (FY2023): BHP’s total economic contribution was US$54.2 billion.

- Female Workforce Representation: 35.2% of our workforce were female as of June 2023.

- Operational Greenhouse Gas Emissions: We achieved an 11% decrease from FY2022 to FY2023.

- Indigenous Suppliers: We spent US$332.6 million with Indigenous suppliers globally in FY2023.

- Commodity Focus:

- Iron Ore: BHP is the world’s lowest-cost major iron ore producer.

- Copper: We are the world’s largest copper mineral resources producer.

- Potash: We are developing one of the world’s largest potash mines, with first production expected in late 2026.

- Ethical Operations:

- Wherever we operate, we are committed to working with integrity and doing what is right.

In summary, BHP continues to play a significant role in shaping the global resources industry while prioritizing sustainability and value creation.

About Anglo American

Anglo American is a multinational mining company with significant interests in various resources. Here are some key points about the company:

- Purpose and Approach:

- Anglo American aims to improve people’s lives by re-imagining mining. Their purpose is to create sustainable value for their stakeholders.

- They focus on responsible mining practices, safety, and environmental stewardship.

- Products and Operations:

- Anglo American is a leading global mining company. Their products are essential ingredients in almost every aspect of modern life.

- They have interests in:

- Copper

- Iron ore

- Metallurgical coal

- Nickel

- Thermal coal

- Platinum group metals

- Diamonds

- Headquarters and Listing:

- The company is headquartered in London.

- It is listed in the FTSE 100 index.

Summary