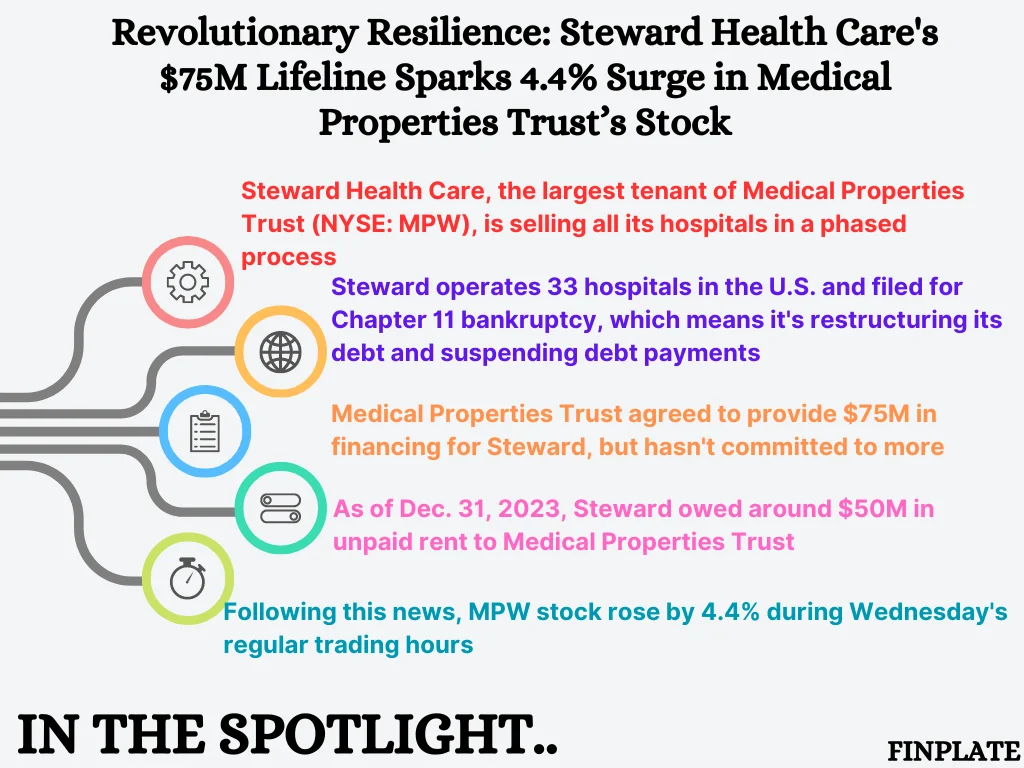

Steward Health Care, the biggest tenant of Medical Properties Trust (NYSE: MPW), has begun a process to sell all its hospitals, as reported by The Associated Press. This is because Steward Health Care filed for Chapter 11 bankruptcy, a type of bankruptcy that allows a company to restructure its debt while still operating. To help Steward during this time, MPW agreed to provide $75 million in financing. However, Steward was hoping for an additional $225 million, which MPW hasn’t committed to yet. By the end of 2023, Steward owed about $50 million in unpaid rent to MPW under their lease agreement. Despite Steward’s financial challenges, MPW’s stock saw a 4.4% increase in trading on Wednesday.

Key Points:

- Steward Health Care’s Situation: Steward Health Care, a major player with 33 hospitals across the U.S., is facing financial difficulties and has opted for Chapter 11 bankruptcy, which allows it to continue its operations while restructuring its debts. This decision indicates that the company is struggling to manage its financial obligations.

- Impact on Medical Properties Trust (MPW): MPW, the landlord for Steward Health Care’s hospitals, is affected by Steward’s financial troubles. MPW has agreed to provide $75 million in financing to support Steward during its bankruptcy proceedings. However, there’s uncertainty regarding whether MPW will provide the additional $225 million that Steward seeks. This uncertainty could pose risks to MPW’s financial stability and future earnings.

- Rent Arrears: Steward owes approximately $50 million in unpaid rent to MPW as of the end of 2023. This significant amount of unpaid rent highlights the financial strain on Steward and the potential impact on MPW’s revenue stream. The unpaid rent adds to Steward’s financial obligations and further complicates its financial restructuring efforts.

- Market Response: Despite the challenging situation faced by Steward Health Care and the uncertainty surrounding MPW’s additional funding, MPW’s stock saw a 4.4% increase in trading on Wednesday. This could be due to various factors, such as investor optimism about the healthcare sector or confidence in MPW’s ability to navigate through the challenges posed by its largest tenant’s bankruptcy.

Overall, the news indicates a complex financial situation involving a major healthcare provider and its landlord. Steward’s bankruptcy filing and efforts to sell its hospitals, along with MPW’s involvement and the impact on its financial performance, reflect the interconnectedness of the healthcare and real estate sectors and the complexities of managing financial distress in these industries.

About Medical Properties Trust

Medical Properties Trust (MPT) is a significant player in the healthcare real estate industry. Here are some key details about the company:

- Global Reach and Expertise:

- MPT is the second-largest non-governmental owner of hospitals in the world.

- They have extensive experience in unlocking the value of hospital real estate for growth.

- Their financial resources make them a preferred partner for top healthcare operators globally.

- Portfolio Mix:

- MPT’s global portfolio is well-diversified:

- 61.0% of their assets are in the United States.

- 23.3% in the United Kingdom.

- Other holdings in Switzerland, Germany, Spain, and additional countries.

- Their total asset value has grown significantly, reaching $18.3 billion since the end of 2018.

- MPT’s global portfolio is well-diversified:

- Industry Firsts:

- MPT is the first and only company to focus exclusively on hospital facilities in the U.S. and around the world.

- They are the second-largest owner of hospital beds worldwide, with approximately 43,000 beds and a U.S. portfolio valued at $11.2 billion.

- Additionally, they were the first U.S. company to invest in hospitals globally, with $7.1 billion currently invested internationally.

- Growth and Performance:

- MPT has achieved impressive growth:

- 21% compound annual growth since the end of 2012, coinciding with their international expansion.

- Their total assets have more than doubled since 2018.

- MPT has achieved impressive growth:

- Capital Solutions:

- MPT provides up to 100% of a hospital’s real estate value to fund facility expansions, investments in technology, and long-term growth strategies.

- Their goal is to help hospitals serve patients better worldwide through their capital solutions.

About Steward Health Care

Steward, is a unique healthcare company that has made significant strides in transforming the industry.

- Background and Growth:

- Steward was initially a collection of struggling hospitals in Massachusetts. However, it has evolved into something remarkable.

- Today, Steward is the largest private, tax-paying hospital operator in the United States. It operates 33 community hospitals across nine states and employs over 30,000 people.

- The company’s journey from adversity to prominence showcases its commitment to excellence and innovation.

- Physician-Led Approach:

- Steward stands out as the only physician-led, tax-paying health care organization. This unique structure ensures alignment with the interests of both doctors and patients.

- Physicians are rewarded for keeping patients healthy and out of the hospital, emphasizing preventive care and overall well-being.

- Integrated Care Model:

- Steward’s fully integrated model represents a new beginning for America’s health care system and beyond.

- The company combines hospitals, primary care locations, managed care services, and health insurance to deliver comprehensive care.

- Network and Services:

- Steward’s Health Care Network includes physicians who care for approximately 2.2 million patients annually and provide more than 12 million patient encounters per year.

- Steward Medical Group, the employed physician group, contributes to over six million patient encounters annually.

- The network encompasses:

- 25+ Urgent Care Centers

- 107 Preferred Skilled Nursing Facilities

- 7,900+ Beds Under Management

- Values and Purpose:

- Champions of the Best Health Care: Steward believes that everyone deserves great health, regardless of their background or location.

- Hard-Charging Transformers: The company has created a seamless gateway to extraordinary health care, emphasizing high quality and affordability.

- Good Stewards: Steward invests in the communities where its employees and patients live, work, and play, advocating for improved quality of life.

- Purpose-Driven: Every member of the Steward family is committed to revolutionizing health care delivery, one person, one family, and one neighborhood at a time.

- World-Changing: Steward aspires to be more than a symbol of excellence; it aims to provide access to affordable, high-quality care for every human being, positively impacting entire communities and the world.

Summary