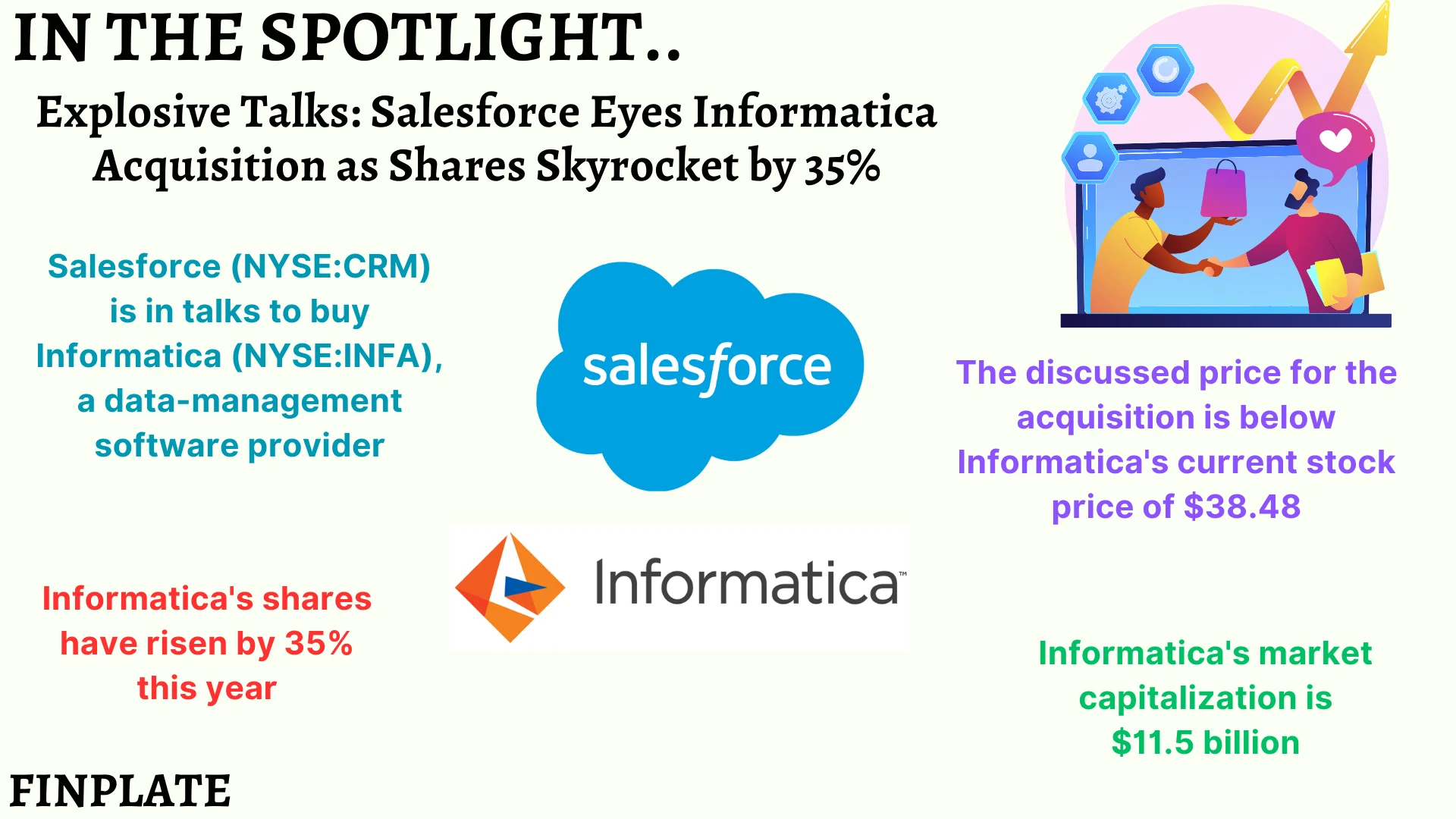

Salesforce, a company that provides various business software solutions, is in serious talks to buy Informatica, a company that specializes in data management software. The price being talked about for the acquisition is less than what Informatica’s shares are currently valued at in the stock market, which is $38.48 per share.

This information comes from a report by The Wall Street Journal, which was published late on a Friday. The report mentions people who are knowledgeable about the situation as its sources. Currently, Informatica’s market capitalization, which is the total value of all its outstanding shares, stands at $11.5 billion.

Key Points:

- Salesforce and Informatica: Salesforce is a well-known company that offers cloud-based software solutions for customer relationship management (CRM) and other business operations. Informatica is also a recognized name in the tech industry, specializing in data management software.

- Acquisition Talks: Salesforce is in advanced discussions to acquire Informatica. This means that both companies are seriously considering and negotiating the terms of the acquisition.

- Price Discussion: The price being discussed for the acquisition is less than the current market price of Informatica’s shares. This implies that Salesforce is looking to buy Informatica at a price lower than what investors are currently valuing the company.

- Market Performance: Informatica’s shares have seen a significant increase in value this year, jumping by 35%. This indicates that the company is performing well in the market and may have attracted the attention of potential buyers like Salesforce.

- Source of Information: The information about the acquisition talks and the proposed price comes from a report by The Wall Street Journal. The report cites sources who are familiar with the matter, suggesting that the information is credible and based on insider knowledge.

- Market Capitalization: Informatica’s market capitalization, which is the total value of all its outstanding shares, is $11.5 billion. This gives an idea of the size and worth of the company in the stock market.

In essence, Salesforce is considering acquiring Informatica at a price lower than its current market value, as reported by The Wall Street Journal. This move indicates strategic interest from Salesforce in expanding its portfolio of business software solutions, particularly in the realm of data management.

About Salesforce

Salesforce, Inc., formerly known as Salesforce.com, Inc., is an American cloud-based software company headquartered in San Francisco, California. It specializes in providing customer relationship management (CRM) software and applications. Let’s delve into some key details about Salesforce:

- Founding and Growth:

- Salesforce was founded in February 1999 by former Oracle executive Marc Benioff, along with Parker Harris, Dave Moellenhoff, and Frank Dominguez.

- Initially, Salesforce faced challenges during the dot-com bubble burst but continued to thrive. Its revenue increased significantly from $5.4 million in fiscal year 2001 to over $100 million by December 2003.

- Notably, Salesforce gained attention for its “the end of software” marketing campaign, which included actors holding signs with the slogan outside a Siebel Systems conference.

- Services and Offerings:

- Salesforce provides a comprehensive suite of services, including:

- Cloud Computing: Their cloud-based solutions cover various aspects such as sales, customer service, marketing automation, e-commerce, analytics, and application development.

- Customer 360 Service Platform: This platform encompasses customer data cloud services, marketing, automation, integration, commerce, and artificial intelligence.

- Salesforce provides a comprehensive suite of services, including:

- Financial Standing:

- As of January 31, 2024, Salesforce’s financials are as follows:

- Revenue: $34.86 billion

- Operating Income: $5.011 billion

- Net Income: $4.136 billion

- Total Assets: $99.82 billion

- Total Equity: $59.65 billion

- Number of Employees: 72,682

- As of January 31, 2024, Salesforce’s financials are as follows:

- Global Impact:

- Salesforce ranks 491st on the 2023 Fortune 500 list, with revenues of $31,352 million.

- In 2022, it became the world’s largest enterprise software firm and is currently the 61st largest company globally by market capitalization, valued at nearly US$153 billion.

About Informatica

Informatica is an American software development company founded in 1993. It is headquartered in Redwood City, California. The company specializes in enterprise cloud data management and data integration. Here are some key details about Informatica:

- Founders: Informatica was co-founded by Gaurav Dhillon and Diaz Nesamoney.

- CEO: The current CEO of Informatica is Amit Walia.

- Products: Informatica’s core products include:

- Data warehousing tools

- ETL (Extract, Transform, Load) tools

- Big data tools

- And more related to data management and integration.

- Financials:

- Revenue (2022): Approximately US$1.51 billion.

- Operating income (2022): US$25.6 million.

- Net income (2022): US$−54 million.

- Total assets (2022): US$4.97 billion.

- Total equity (2022): US$2.05 billion.

- Employees: Informatica has a workforce of 6,000+ as of December 2022.

- History:

- In 1999, Informatica went public with its Initial Public Offering (IPO) on the Nasdaq stock exchange under the ticker symbol INFA.

- In 2015, it was acquired by a company controlled by the Permira funds and the Canada Pension Plan Investment Board for approximately US$5.3 billion.

- In the same year, Microsoft and Salesforce Ventures also invested in Informatica.

- In 2021, Informatica became publicly traded again, this time on the New York Stock Exchange (NYSE) with the stock symbol INFA.

Informatica’s mission is to empower businesses by providing intelligent data solutions that enable them to harness the transformative power of their critical assets. With over 9,500 customers, Informatica continues to play a significant role in the data management landscape.

Summary