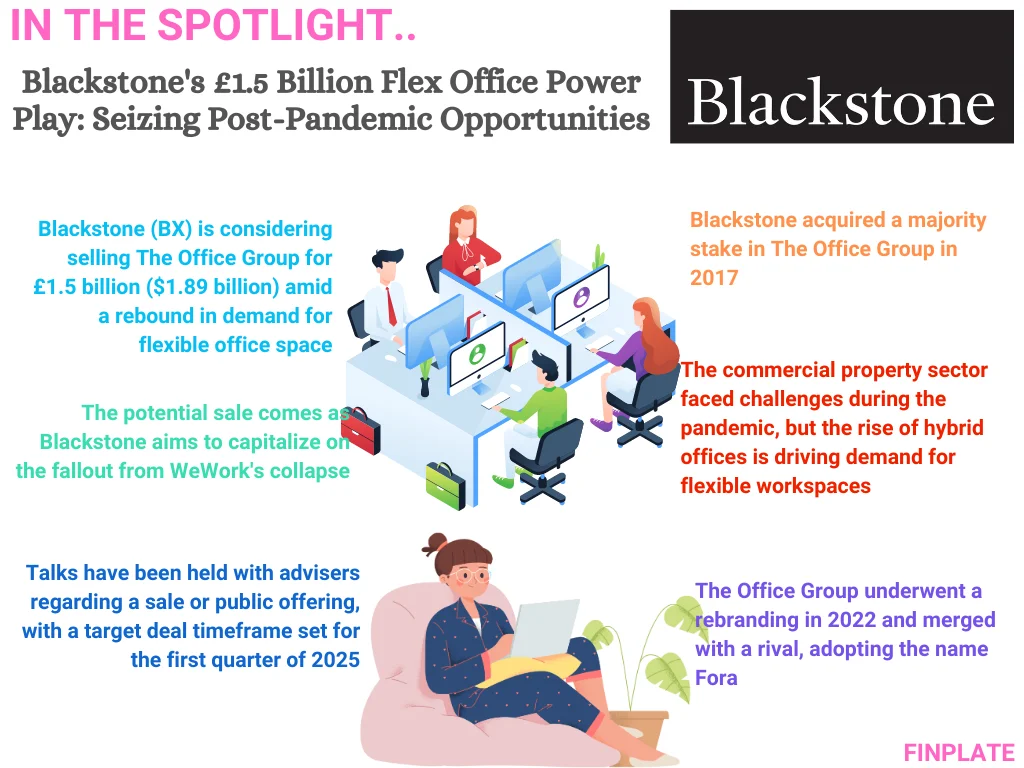

Blackstone, a big investment company, is thinking about selling The Office Group for about £1.5 billion (that’s about $1.89 billion). They’re doing this because they want to make money after a similar company, WeWork, had problems. The Office Group provides flexible office spaces, and now that more people are starting to go back to work but also want flexibility, these kinds of spaces are becoming popular again.

Key Points:

- Background and Motivation: Blackstone, a private-equity firm, is considering selling The Office Group, a company it acquired a majority stake in back in 2017. The move comes as Blackstone aims to capitalize on the current market conditions and potentially make gains following the troubles faced by WeWork, a competitor in the flexible office space industry.

- Exploring Options: Blackstone has been in discussions with advisors to weigh the possibility of either selling The Office Group outright or launching a public offering. This indicates that Blackstone is actively exploring various avenues to divest its ownership in The Office Group.

- Market Dynamics: The commercial property sector, including flexible office space providers like The Office Group, took a hit during the COVID-19 pandemic due to widespread remote working. However, with the gradual return to offices and the rise of hybrid work models, there’s a renewed demand for flexible workspace solutions. This shift in demand dynamics likely influences Blackstone’s decision to consider divesting The Office Group now, as the market conditions become more favorable.

- Rebranding and Merger: The Office Group underwent a rebranding in 2022, becoming Fora, following a merger with another office-space rival. This indicates a strategic move by The Office Group to potentially strengthen its position in the market and adapt to changing industry trends. It also suggests a potential revaluation of the company’s assets, which could impact Blackstone’s decision-making process regarding its ownership stake.

In summary, Blackstone’s exploration of a sale or public offering of The Office Group reflects strategic considerations amidst shifting market dynamics and aims to leverage emerging opportunities in the flexible office space sector.

About Blackstone

Blackstone Inc. is an American alternative investment management company headquartered in New York City. Let me provide you with some key details about Blackstone:

- Founding and History:

- Blackstone was founded in 1985 by Peter G. Peterson and Stephen A. Schwarzman with an initial seed capital of $400,000.

- The name “Blackstone” was derived from a cryptogram based on their names: “Schwarz” (German for “black”) and “Peter” (meaning “stone” or “rock” in Greek).

- Initially, Blackstone operated as a mergers and acquisitions advisory boutique.

- Notably, it advised on the 1987 merger of investment banks E. F. Hutton & Co. and Shearson Lehman Brothers.

- Over the years, Blackstone has expanded its focus beyond M&A to various investment strategies.

- Business Segments:

- Private Equity: Blackstone’s private equity business has been a major player in leveraged buyouts for the past three decades.

- Real Estate: The company actively acquires commercial real estate in this segment.

- Credit: Blackstone is involved in credit investments.

- Infrastructure: It participates in infrastructure projects.

- Hedge Funds: Blackstone manages hedge funds.

- Insurance: The company has interests in the insurance sector.

- Secondaries: Blackstone deals with secondary market transactions.

- Growth Equity: It invests in growth-stage companies.

- Financial Snapshot (as of June 2023):

- Total Assets Under Management (AUM): Approximately US$1 trillion, making it the largest alternative investment firm globally.

- Revenue: US$8.02 billion.

- Net Income: US$2.44 billion.

- Total Equity: US$6.82 billion.

- Number of Employees: 4,735.

- Leadership:

- Stephen Schwarzman: Chairman and CEO.

- Jonathan Gray: President and COO.

- Joseph Baratta: Head of Private Equity.

- David Blitzer: Global Head of Tactical Opportunities.

Blackstone’s prominence in alternative investments and its substantial global presence have solidified its position as a key player in the financial services industry.

Summary