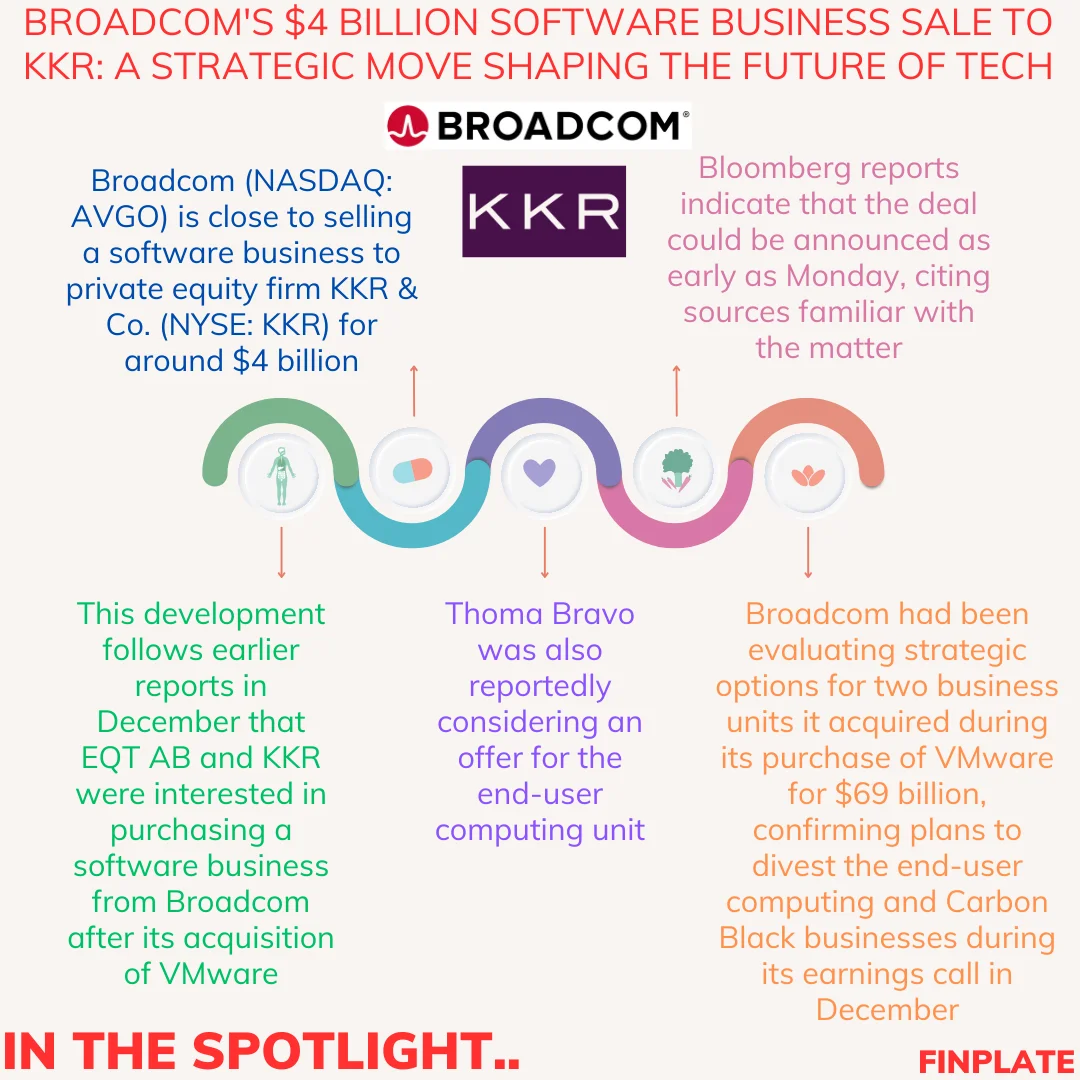

Broadcom (NASDAQ: AVGO) is on the brink of finalizing a deal to sell a software division to the private equity giant KKR & Co. (NYSE: KKR) for an estimated $4 billion, as reported by sources from Reuters and Bloomberg.

The announcement of this acquisition is anticipated to occur as early as Monday, as stated in a Bloomberg report over the weekend, citing individuals familiar with the situation. The development follows previous reports from Bloomberg in December, which indicated that EQT AB and KKR were among several private equity firms expressing interest in acquiring a software unit divested by Broadcom after its acquisition of VMware.

Another potential suitor, PE firm Thoma Bravo, was also reportedly exploring a bid for the end-user computing segment. Initial indications of Broadcom’s intentions to explore strategic options for two business segments acquired during its VMware purchase surfaced when Business Insider disclosed in late November that the company was evaluating alternatives. Broadcom later confirmed during its earnings call in December that it intended to divest both the end-user computing and Carbon Black businesses.

Key Points

- Acquisition Context: Broadcom, a prominent tech company listed on NASDAQ, is in the process of selling one of its software divisions to KKR & Co., a significant player in the private equity sector. The deal is valued at approximately $4 billion.

- Report Sources: The information regarding this impending transaction has been reported by reputable financial news outlets like Reuters and Bloomberg. These reports are based on insights from sources familiar with the negotiations.

- Timing of Announcement: The announcement of the deal is expected to be made soon, potentially as early as the upcoming Monday, according to Bloomberg. This highlights the immediacy and significance of the ongoing negotiations.

- Previous Interest and Reports: Prior to this development, there were indications of interest from various private equity firms, including EQT AB and Thoma Bravo, in acquiring Broadcom’s software business. Bloomberg’s earlier report in December had already hinted at the interest of these firms.

- Strategic Divestment: Broadcom’s decision to divest its software business units, particularly the end-user computing segment, stems from its strategic evaluation post the acquisition of VMware. The move reflects the company’s focus on refining its portfolio and optimizing its business operations.

In summary, the reports signify a significant development in Broadcom’s strategic restructuring efforts, with the potential sale of its software business unit to KKR & Co. offering insights into the evolving landscape of tech acquisitions and divestitures in the private equity domain.

About Broadcom

Broadcom Inc. is a global infrastructure technology leader built on more than 60 years of innovation, collaboration and engineering excellence. With roots based in the rich technical heritage of AT&T/Bell Labs, Lucent and Hewlett-Packard/Agilent, Broadcom focuses on technologies that connect our world. Through the combination of industry leaders Broadcom, LSI, Broadcom Corporation, Brocade, CA Technologies, Symantec’s enterprise security business and VMware, the company has the size, scope and engineering talent to lead the industry into the future.

About KKR & Co.

KKR stands as a prominent international investment enterprise providing diverse asset management services, capital market expertise, and insurance solutions. The core objective of KKR revolves around fostering lucrative investment outcomes through a steadfast commitment to patient, disciplined investment strategies. Central to its success is the employment of top-tier professionals and a steadfast dedication to nurturing growth within its portfolio companies and the broader communities it serves.

At the heart of its operations, KKR sponsors investment vehicles that specialize in private equity, credit, and real assets, alongside collaborative partnerships managing hedge funds. In addition, KKR’s insurance divisions, overseen by the Global Atlantic Financial Group, deliver a range of retirement, life, and reinsurance offerings. Notably, discussions regarding KKR’s investments often encompass the endeavors of its sponsored funds and insurance subsidiaries.

Summary