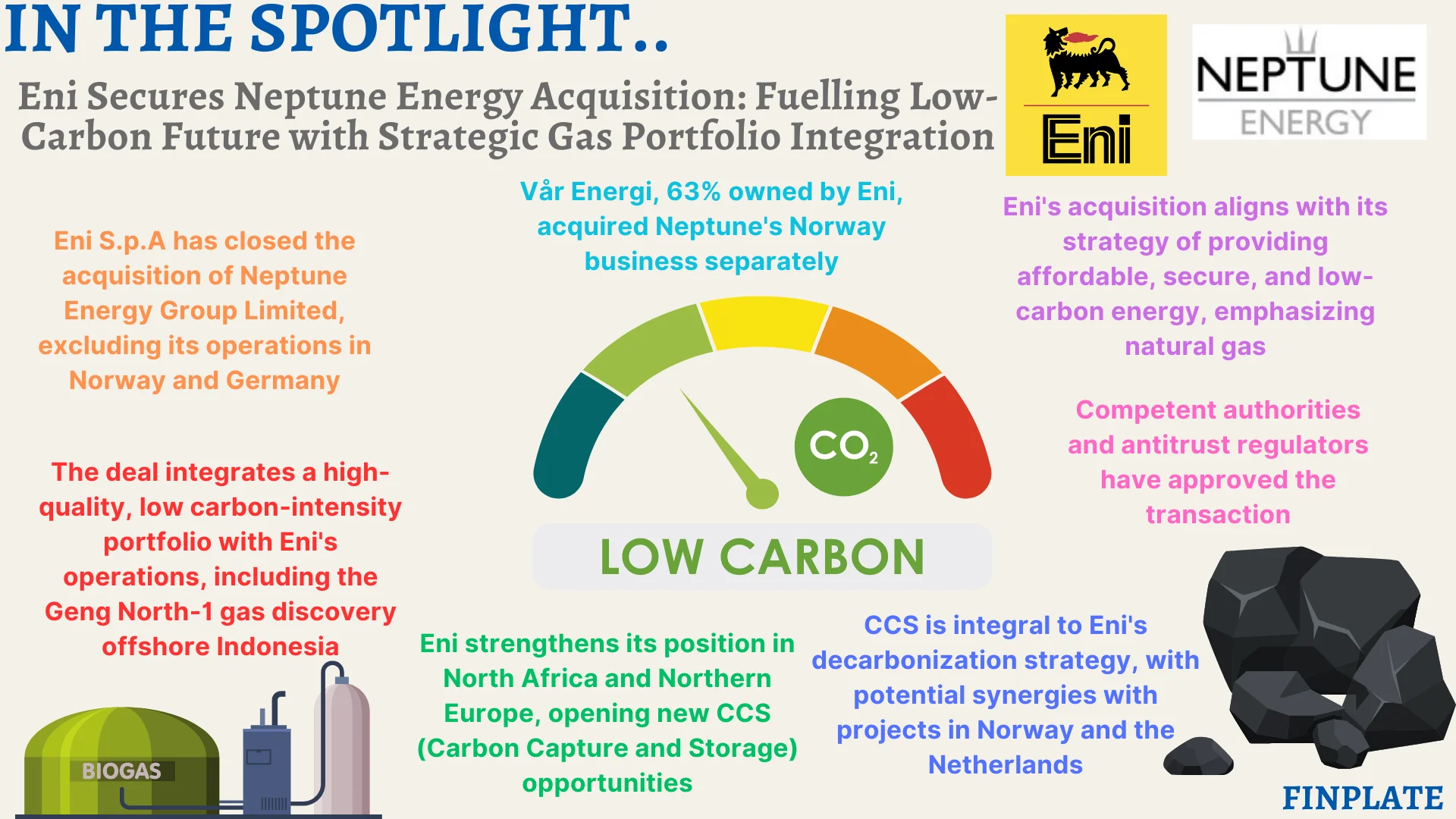

Eni S.p.A (“Eni”) has successfully finalized the acquisition of Neptune Energy Group Limited (“Neptune”), marking a significant step in its strategic expansion efforts. The acquisition encompasses Neptune’s entire portfolio, with the exception of its operations in Norway, which were concurrently purchased by Vår Energi, a company listed on the Oslo Stock Exchange and predominantly owned by Eni.

Additionally, Neptune’s activities in Germany were excluded from the transaction. This milestone transaction, initially announced in June 2023, underscores Eni’s commitment to delivering accessible, secure, and environmentally sustainable energy solutions, primarily driven by natural gas. By integrating Neptune’s portfolio, characterized by its high quality and low carbon footprint, Eni enhances its operational scope, benefiting from geographical and operational synergies.

Notable assets acquired include Neptune’s stake in the Eni-operated Geng North-1 gas discovery offshore Indonesia, unveiled in October 2023. The strategic significance of this acquisition lies in bolstering gas production in North Africa, solidifying Eni’s position as a premier international energy player, and fostering new opportunities for Carbon Capture and Storage (CCS) initiatives in Northern Europe. Eni views CCS as pivotal in its decarbonization strategy, foreseeing potential synergies with Neptune’s ventures in Norway and the Netherlands.

Prior to the completion of the Eni transaction, Vår Energi independently acquired Neptune’s Norwegian business, while the carve-out of Neptune’s German activities was concluded beforehand. Crucially, the transaction has received regulatory approval from pertinent authorities in the concerned jurisdictions and antitrust regulators, ensuring its compliance with legal standards and regulations.

Key Points

- Strategic Acquisition: Eni’s acquisition of Neptune aligns with its strategy to offer affordable, secure, and low-carbon energy solutions, focusing on natural gas.

- Portfolio Exclusions: The transaction excludes Neptune’s operations in Norway, acquired by Vår Energi, and activities in Germany.

- Operational Synergies: The integration of Neptune’s assets enhances Eni’s portfolio with high-quality, low-carbon assets and expands its geographic footprint.

- Strategic Assets: Eni gains access to key assets such as the Eni-operated Geng North-1 gas discovery offshore Indonesia.

- Geographical Expansion: The acquisition strengthens Eni’s gas production capabilities in North Africa and presents new opportunities for CCS initiatives in Northern Europe.

- Decarbonization Strategy: Eni views CCS as crucial in its decarbonization efforts and anticipates synergies with Neptune’s projects.

- Pre-Transaction Activities: Vår Energi separately acquired Neptune’s Norwegian business, and the carve-out of Neptune’s German activities was completed before the Eni transaction.

- Regulatory Approval: The transaction has secured regulatory approval from relevant authorities and antitrust regulators, ensuring compliance with legal requirements.

About Eni S.p.A

Eni, a leading energy entity, operates within the oil and gas sector, engaging in the exploration, development, and production of crude oil, natural gas, and condensates. Additionally, Eni participates in the trading, supply, and transportation of various energy products such as natural gas, liquefied natural gas, electricity, fuels, and chemical goods. Its commitment to decarbonization is evident through a comprehensive strategy that integrates renewable energy, electrification, and energy efficiency alongside CO₂ capture and the advancement of novel technologies. Eni’s dedication extends to fostering a socially equitable energy transition while striving to generate sustainable long-term value.

Neptune Energy Group Limited (“Neptune”)

Neptune Energy, an autonomous exploration and production enterprise, operates in the North Sea, mainland Europe, North Africa, and the Asia-Pacific region. Established in 2015 by Sam Laidlaw, who currently serves as the Executive Chairman, alongside private equity investors, the company boasts a varied, gas-focused collection of assets and extensive industry knowledge, presenting robust avenues for value generation. Positioned to become the premier independent E&P entity, Neptune Energy aims to fulfill society’s energy demands while delivering value to its diverse stakeholders.

Incorporating offshore oil and gas fields, onshore gas processing facilities, and renewable energy initiatives, Neptune Energy maintains a diversified asset portfolio. Pledging to curtail its carbon footprint, the company has established a goal of achieving net-zero emissions by 2050.

To summarize