What are Mergers?

A merger occurs when two or more companies unite to form a single entity. Typically, these entities are either of equal size, scale, and product offerings, or they operate within the same market. A merger serves as an expedited path to expansion and growth, where each participating company brings valuable assets to the table. It represents a mutually agreed-upon integration and differs from a hostile takeover.

To be precise, A hostile takeover occurs when a company acquires another company without obtaining consent from its management, typically employing cunning strategies.

Furthermore, if a company were to grow inorganically (i.e., without resorting to mergers or acquisitions, but rather by establishing a presence in a new market or geography from scratch), this process would be time-consuming and fraught with challenges. It would entail tasks such as comprehending the local market dynamics, understanding customer preferences, and adapting to the specific operational processes of the new geography. Additionally, there would be a risk of making costly missteps.

In contrast, merging with an existing business streamlines the expansion process. The groundwork for the establishment has already been laid, and the company is already operational, with tangible signs of growth and achievement. Essentially, the merger strategy empowers companies to broaden their reach into new geographies or product segments while offering advantages such as cost savings, access to a fresh customer base, and a reduction in operational expenses.

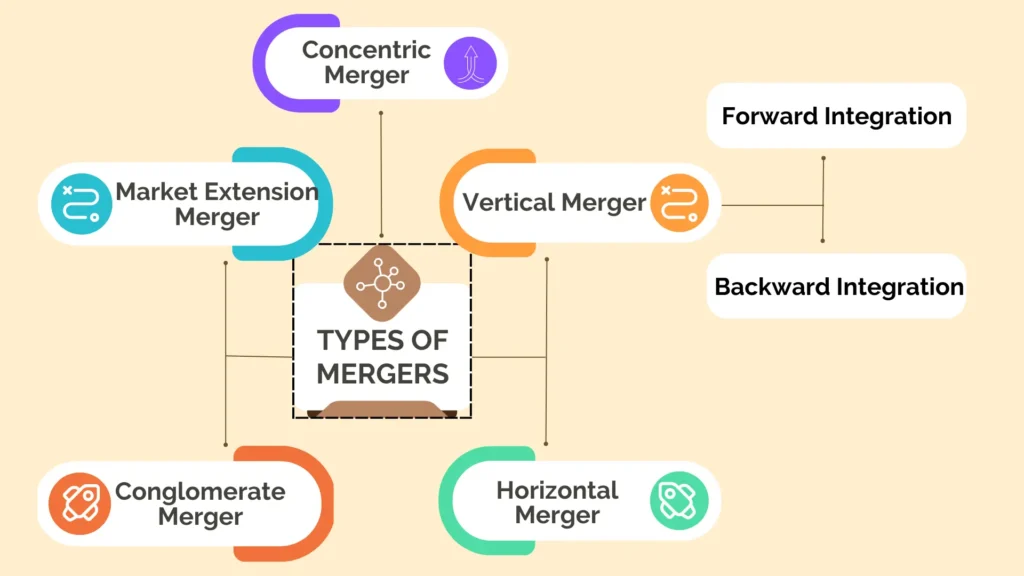

TYPES OF 5 MOST PREVALENT MERGERS

Mergers can be categorized on the basis of the benefit which the company intends before getting merged.

The most prevalent types of mergers are listed below:

Congeneric/ Product Extension/ Concentric Merger

A merger involving two or more companies within the same or related industry, yet offering distinct products, is commonly referred to as a Congeneric, Concentric, or Product Extension Merger. The expansion of product lines brings forth several advantages, such as diversification, a broader market presence, the acquisition of new customer bases, and the pooling of production processes, technology, and distribution channels, thereby leading to cost reduction. At times, the products of both companies synergistically complement one another.

The primary motivating factors in this scenario revolve around shared elements, including distribution channels, marketing strategies, Research and Development (R&D), employee expertise, and consumer behavior, among others.

Live industry example:

In 1998, Citigroup was made with the merger of 2 companies, Citicorp and Travelers Group. Both of these companies were previously active in the same sector, but they had distinct product offerings. Citicorp focused on traditional banking services and credit cards, while Travelers operated in the same industry but specialized in providing insurance and brokerage services. This remained the case until the merger that led to the formation of Citi Group.

Advantages of Congeneric/ Product Extension/ Concentric Merger

Advantages associated with this type of merger are:

- Diversification of Product Portfolio: By merging with a company in the same industry but with different products or services, a business can diversify its product offerings. This can help reduce the risk associated with relying on a single product or service line.

For example, Company A specializes in producing shampoo, while Company B focuses on skin moisturizers. Both companies operate within the personal care industry and get merged.

- Increased Market Share: The combined entity can potentially capture a larger share of the market, as it can offer a broader range of products or services. This can lead to increased competitiveness and potentially higher revenues.

For example, Company A operates a paper manufacturing unit catering to carton producers, while Company B also operates in paper manufacturing, but its clientele primarily consists of notebook producers. So together they can increase the market share by offering broader range of products.

- Cross-Selling Opportunities: When two companies merge, they often gain access to each other’s customer base. This provides an opportunity to cross-sell products or services, potentially leading to increased sales and revenue.

- Cost Synergies: There may be opportunities to realize cost savings through economies of scale. This can include streamlining operations, reducing duplication of functions, and negotiating better deals with suppliers.

- Enhanced R&D and Innovation: Combining the expertise and resources of two companies in the same industry can lead to increased investment in research and development. This can result in the development of new and innovative products or services.

Live industry example:

In 2015, Heinz and Kraft joined forces in a monumental $100 billion agreement. Kraft, a prominent manufacturer of items like mayonnaise and cheese, and Heinz, a leading producer of pasta and meat sauces as well as frozen appetizers, merged to form one of the largest entities in the food industry known as KraftHeinz.

Disadvantages of Congeneric/ Product Extension/ Concentric Merger

Disadvantages associated with this type of merger are:

- Customer Confusion or Resistance: Customers may be accustomed to the existing product lines and may be resistant to change. There may also be confusion if the merged entity does not effectively communicate the benefits of the new product offerings.

In this scenario, For example, Company A primarily focuses on producing bread, while Company B specializes in butter production. Following their merger, the combined entity now offers both bread and butter. However, consumers have become accustomed to exclusively using the company’s butter and regard it as the superior product in this category. Although they give the bread a try, it doesn’t provide the same level of enjoyment and contentment as the butter. Therefore, in this case, the customer exhibits resistance to change and is hesitant to develop a preference for the company’s other products.

- Corporate Cultural Differences: Companies in the same industry can still have different corporate cultures, which can lead to clashes and difficulties in aligning employees toward common goals.

- Overlapping or Redundant Operations: In some cases, there may be significant overlap between the operations of the two merging companies. This can lead to redundancy and the need for downsizing, which can be demoralizing for employees and lead to a loss of institutional knowledge.

Market Extension Merger

A Market Extension Merger occurs when two or more companies that offer identical products or services but cater to distinct markets or audiences combine forces. This strategic move aims to access a broader customer base by venturing into a new market.

Advantages of Market Extension Merger

Market extension mergers offer several key advantages:

- New Team Members: When two companies merge, their teams become part of a new entity. This introduces a fresh set of perspectives and ideas. It leads to changes in products, processes, and problem-solving approaches, as diverse minds collaborate.

- Expanded Clientele and Customer Base: Merging with another organization that operates in a different market grants access to their existing customer base. This results in a significant increase in potential customers. The merged entity can offer its products or services to a larger audience.

For example, suppose a company currently operates exclusively in India. It is now in the process of acquiring a company in Switzerland that offers the exact same product. By doing so, the company aims to tap into the Swiss market and expand its audience base.

- Product Enhancement: Each market has specific expectations for products. Engaging with a new audience might reveal areas where existing products fall short. This insight drives product improvement, ultimately benefiting the company.

- Access to Geography-Based Resources: Merging with a company in a different location provides access to resources that may not have been available in the company’s original location. For example, a company in North India, specializing in fresh fruits and vegetables, might now have access to coconuts from South India, reducing costs associated with sourcing.

- Reduced External Risks: Entering a new market comes with various challenges influenced by political, economic, social, technological, environmental, and legal factors. These factors can significantly impact a company’s success in a new market. In a Market Extension Merger, since one company is merging with an already established entity, it bypasses the need to navigate these challenges. Everything required for operation is readily available, reducing external risks.

Live industry example:

In 2002, Eagle Bancshares, based in Atlanta, Georgia, boasted a workforce of 283 dedicated professionals. This institution efficiently handles a noteworthy 90,000 accounts and manages a substantial portfolio of US assets, totaling an impressive $1.1 billion. What particularly attracted interest in Eagle Bancshares as a merger partner was its ownership of Tucker Federal Bank, a prominent player in Atlanta’s banking landscape and the favored choice for depositing market shares.

With the merger with RBC Centura, the latter gained a significant foothold in the North American market. This strategic move was bolstered by Atlanta’s robust financial sector, renowned as a leading force in the banking industry, offering RBC an exceptional opportunity for growth and expansion.

Disadvantages of Market Extension Merger

Here are some drawbacks associated with market extension mergers:

- Integration Difficulties: Merging companies from distinct geographic areas can be intricate and demanding. Differences in culture, regulatory demands, and operational practices can give rise to integration challenges that are hard to surmount.

- Regulatory Obstacles: Venturing into new markets often entails navigating unfamiliar regulatory landscapes. Companies may face legal and compliance issues that require substantial time and resources to resolve.

- Competitive Reaction: Established rivals in the new market may react assertively to the arrival of a new entrant, potentially sparking price conflicts or other competitive hurdles.

- Diversion of Focus: Managing operations in multiple markets can divert the management’s attention away from fundamental business activities. This can lead to a loss of emphasis on the company’s existing markets and core strengths.

- Branding and Reputation Vulnerabilities: Expanding into new markets may necessitate rebranding or adjusting marketing strategies to align with local preferences. Mishandling this process could harm a company’s brand and reputation.

- Disruptions in the Supply Chain: Coordinating and streamlining supply chains across different regions can be intricate and may result in disruptions in the production and distribution of goods and services.

- Cultural and Linguistic Barriers: Language and cultural disparities can present communication challenges and impede effective collaboration and decision-making within the merged entity.

Conglomerate Merger

Conglomerates refer to the merging of two or more entirely unrelated companies. In this type of merger, the involved companies engage in businesses that have no apparent connection. They may operate in different product categories, distinct industries, or be situated in geographically distant locations.

Live industry example:

In 1998, the renowned conglomerate Berkshire Hathaway took over Dairy Queen, a popular ice cream and fast-food chain that was under the leadership of Warren Buffett.

Advantages of Conglomerate Merger

Consider the positive aspects of Conglomerate Merger:

- Diversification of Business Interests: A conglomerate merger enables companies to operate in multiple industries simultaneously, broadening their market reach and reducing investment risk by spreading it across various sectors.

For example, If Company A is engaged in petrol production and Company B in steel manufacturing, their operations may seem unrelated, but they have decided to merge nonetheless. Even though there are no obvious commonalities, there may still be underlying synergies that justify the merger. This could be attributed to potential advantages such as tax benefits in financial reporting through the utilization of each other’s products, or the opportunity to jointly utilize unused land space.

- Financial Benefits and Synergies: Particularly in the pure form, conglomerate mergers bring substantial financial benefits. They allow for the capture of synergies between the merging entities, leading to increased operational efficiency and cost savings.

- Access to Talent and Networking Opportunities: Such mergers provide access to a fresh pool of talented personnel and expansive networking opportunities, which can significantly benefit the combined entity in terms of expertise and market connections.

- Acquisition of Intellectual Property: Conglomerate mergers open doors to valuable intellectual property, which can strengthen the combined entity’s competitive edge in the market.

Live industry example:

In 1995, Disney bought ABC. This gave them access to ABC’s national TV channel and ESPN’s sports coverage. Disney already had some cable channels. ABC usually buys its TV shows from other people. But ABC also had a very creative culture that liked making new and unique shows. This will likely make ABC a stronger competitor against other TV networks and cable services.

Disadvantages of Conglomerate Merger

Along with the positive side, there is a dark side to Conglomerate Mergers:

- Cultural Disparities and Conflicts: Conglomerate mergers often lead to cultural disparities and conflicts due to the diverse backgrounds and industries involved, which can be challenging to manage and can lead to higher operational costs.

- Governance Issues: Managing such a vast entity can become cumbersome, potentially resulting in governance issues that may disrupt operations.

- Loss of Taxation Benefits: There may be a loss of taxation benefits that the merging companies previously enjoyed independently.

- Potential Decline in Market Efficiency: Critics argue that conglomerate mergers might lead to a decline in market efficiency overall, as the combined entity may not be as focused or agile in specific industries.

- Innovation Concerns: Some argue that conglomerate mergers can stifle innovation, as they often prioritize acquisition over organic growth, potentially hindering the development of new and innovative products or services.

For example, Company A specializes in textiles while Company B is a software development firm. Their respective industries have no apparent connection, yet they have chosen to merge.

Horizontal Merger

This type of merger is particularly intriguing as it involves competitors coming together. These companies, which offer similar products or services, merge to enhance their collective value beyond what they possess individually.

Live industry example:

In 2019, Disney+ is a streaming service possessed by Disney, while Hotstar is a streaming platform under the ownership of Star Network in India. Rather than directly entering the streaming market in India, Disney opted to merge with Hotstar and subsequently renamed it Disney+ Hotstar.

Reasons for Horizontal Mergers:

- Competition Reduction: Achieving a larger market share and greater pricing power by minimizing competitive forces.

- Rapid Growth Generation: Utilizing M&A as an effective growth strategy, swiftly gaining access to successful aspects of the target, including products and personnel.

- Economies of Scale Leveraging: Capitalizing on the ability to make bulk purchases and decrease supply chain expenses, resulting in improved financial performance for the newly merged company.

For example, Company A manufactures and sells shampoo, while Company B also engages in the production and sale of shampoo. When these two companies combine and merge, this way they’ll be able to achieve economies of scale in a short period of time.

- Acquisition of Valuable Assets: Obtaining products, inventive ideas, skilled professionals, and supplementary resources from the target, fosters innovation and potential expansion into new markets.

- Expanding Customer Base: Broadening the customer demographic through geographical reach or introduction of new products and services, fortifying the acquirer’s market position.

Advantages of Horizontal Merger

Taking into account the pros of Horizontal Mergers:

- Increased Purchasing Power: Combining companies can lead to substantial discounts from suppliers, thanks to the enhanced purchasing power of the merged entity. This results in lower manufacturing costs per unit, ultimately boosting profitability.

- Access to Skilled Personnel: Horizontal mergers provide access to a broader pool of skilled personnel. This enriches the talent pool and enhances the company’s overall capabilities.

- Improved Access to Financial Resources: Merging companies can benefit from improved access to financial resources. This can lead to a lower cost of capital and potentially open up new avenues for investment and growth.

- Expanded Customer Base: The merger can result in an expanded customer base. This can lead to increased market share and revenue potential, solidifying the company’s position in the industry.

Live industry example:

In 2012, Facebook and WhatsApp joined together and made the simple photo-sharing app better. They added new features, and now more than a billion people use it.

Disadvantages of Horizontal Merger

Cons of Horizontal Mergers can’t be neglected too:

- Antitrust Scrutiny: Horizontal mergers, which involve the combination of companies operating in the same industry or producing similar products, often catch the attention of antitrust authorities. These authorities are responsible for ensuring that mergers do not lead to monopolistic behavior or harm competition in the market. Such mergers frequently become subjects of investigation by US antitrust agencies, indicating that they are closely monitored for potential anticompetitive effects.

- Risks of Resource Consolidation: When companies merge horizontally, they consolidate their resources, aiming to create a stronger, more competitive entity. However, this approach can be risky if the merged company heavily invests in a particular business model or strategy that may become outdated or less effective over time.

- Complexities of Scale: Horizontal mergers often aim to achieve economies of scale, which means operating at a larger size to reduce costs and increase efficiency. However, this can introduce complexities such as the need for additional layers of middle management, which can lead to slower decision-making and decreased organizational control. The increased size can also make the company less agile and responsive to changes in the market.

- Overestimation of Deal Value: There is a common pitfall associated with horizontal mergers where companies tend to overestimate the value of the deals they are making. This overestimation is often driven by a defensive stance, fearing that a competitor might make a more favorable agreement if they delay or decline the merger. This defensive posture can lead to mergers that are grossly overvalued, potentially harming the financial health of the combined entity.

- Reputational Risks with Size Expansion: As a company grows in size, it becomes more visible and prominent in the market. This increased visibility can make the company a more conspicuous target for public scrutiny, potentially leading to reputational risks if it faces controversies or scandals.

Vertical Merger and its Types

A vertical merger occurs when two or more companies within the same industry, though producing distinct products or services at various stages of the value chain, combine their operations. This integration serves as a strategic mechanism for companies to expand their enterprises and gain more authority over the processes that underpin the supply chain.

The supply chain involves numerous participants, primarily encompassing suppliers who furnish the raw materials, manufacturers responsible for creating the product, distributors tasked with delivering it to retailers, and ultimately, retailers who sell the product and services to end consumers. So, what drives companies to engage in such mergers? The rationale behind it is this: Vertical mergers enable companies to harness synergies that ultimately enhance operational efficiency, reduce expenses, and facilitate business expansion. Additionally, they empower companies to extend their operations into different segments of the supply chain.

For example, Company A produces flour, and Company B produces bread. If these two companies were to merge, it would be classified as a vertical merger. In this scenario, Company B would no longer need to procure its raw materials externally, as they could now be sourced internally within the organization. The advantages of this arrangement are outlined below.

Advantages of Vertical Merger

Pointing out the upsides of Vertical Merger:

- Secure and maintain control over the supply of inputs (backward vertical integration): This involves gaining authority over the provision of essential materials or inputs, reducing dependence on external suppliers, and ensuring a consistent supply.

- Access new markets or have authority over product distribution (forward vertical integration): This entails entering new markets directly or having more control over how products reach customers, potentially resulting in a larger market share and more direct customer feedback.

- Augment revenue streams: Vertical integration often leads to a broader range of products or services, which can expand the customer base and, subsequently, increase revenue.

- Mitigate risks associated with external suppliers or distributors: By bringing supply chain functions in-house, a company can lessen exposure to risks like supply disruptions, quality control issues, or conflicts of interest.

- Leverage combined resources and core competencies: Through a merger, both companies can pool their resources, skills, and strengths, potentially leading to increased efficiency, innovation, and competitiveness.

- Enhanced coordination and communication: Vertical integration usually results in tighter coordination between different stages of production or distribution, leading to smoother operations and improved overall performance.

- Potential for cost efficiencies: In some cases, vertical integration can lead to cost savings through factors like economies of scale, reduced transaction costs, or improved operational efficiency.

- Increased market influence and negotiation power: A vertically integrated company often wields greater market influence and negotiation power, potentially leading to more favorable terms in dealings with suppliers or buyers.

- Strategic control over critical technologies or knowledge: Vertical integration can grant a company authority over proprietary technologies or specialized knowledge critical to its operations, representing a substantial competitive advantage.

Disadvantages of Vertical Merger

Also pointing out the downside of Vertical Merger:

- Loss of Flexibility: In some cases, separate companies may have more flexibility in adapting to changes in the market or making independent business decisions. A vertical merger can sometimes lead to a loss of this agility.

- Supplier or Customer Dependency: A vertical merger can create a situation where a company becomes overly dependent on its upstream or downstream partners. If there are disruptions in the supply chain, it could have a significant impact on the merged entity’s operations.

- Risk of Market Downturn: If the industry experiences a downturn, a vertically integrated company may be more vulnerable because it is exposed to multiple stages of the production process. This can amplify the impact of a downturn.

- Coordination Challenges: Achieving seamless coordination between different parts of the merged entity can be difficult. Conflicts of interest, disagreements over pricing, and other coordination challenges may arise.

- Potential for Monopoly Power Abuse: In some cases, a vertical merger could lead to a company gaining monopoly power in a particular market, which may result in higher prices, reduced choice for consumers, and other forms of market abuse.

Types of Vertical Integration

Forward Vertical Integration:

Forward Integration is a form of vertical integration in which a company moves downstream toward the supplier aspects of the value chain and merges with another company in order to take more control of the value chain. Business functions that are considered “Downstream” are Retailers, Distributors, Sales and marketing, Customer Support, and sales assistance. By eliminating the intermediaries, the company can get more hold on its product distribution and other operations related to it.

Live industry example:

In 2017, Amazon acquired Whole Foods Market for $13.7 billion. With this acquisition, Amazon could offer grocery products through physical stores where it was only dealing in online retail of goods.

When can an organization consider doing forward integration?

- Cost-Effectiveness and Distribution Demands: Sometimes, using regular distributors and retailers can be too expensive for a business. They might also struggle to meet the organization’s distribution needs. This is where forward integration comes into play. It’s like the organization saying, “We’ll handle distributing our products ourselves because it’s more cost-effective and better suits our needs.

- Competitive Edge due to Limited Reputable Distributors: In some cases, there aren’t many good distributors available in the market. When a business takes control of its own distribution (forward integration), it gains a competitive edge. This means the company can get its products out there better than its competitors, who might be relying on a limited number of good distributors.

- Enough People and Money for In-House Distribution: For forward integration to work, the organization needs to have enough people and financial resources. It’s like having a team of workers and enough money to set up your own delivery service. This ensures that the costs of managing the distribution channel are covered without straining the organization’s resources.

- Reduced Costs and Increased Sales: When an organization takes charge of its distribution, it can often do it more efficiently and at a lower cost compared to using external distributors. This means that the products can be sold at a lower price. When prices are lower, more people are likely to buy, which leads to an increase in sales for the organization.

For eg. Company A produces cars and Company B sells cars and both companies merge. This way Company A will be able to take hold of its operations related to distribution.

Advantages of Forward Vertical Integration

Looking at the Advantages of Forward Integration:

- Make Things Work Together and Earn More Money: Moving forward in business means making all the steps from making things to selling them work together better. This helps the company make more money and be more successful.

- Stop New Competitors from Joining: When a company moves forward, it can do both making and selling inside the company. This makes everything work smoothly. It also makes it harder for new companies to start and compete with the company.

- Get More People to Buy and Use Your Things: Moving forward helps the company reach new places and more people quickly. This makes more people buy and use their products. The company has become more popular and successful.

- Be Better Than Other Companies: Moving forward makes it cheaper to get things to the people who want them. This makes the company better than other companies. The company can offer lower prices and be the first choice for customers.

- Spend Less, Earn More: Making things work together better saves money. When the company has more control, they can find ways to spend less. This means they make more money and become more successful.

- Have More Power Over How Things Are Sent: Before moving forward, companies rely on others to send their products. This means they have less power and control. Moving forward gives the company more power and control over how things are sent, making the process more secure and efficient.

Live industry example:

In 2019, McDonald’s acquired Dynamic Yield with the aim of enhancing its customer-centric approach. This involved implementing the technology in various digital customer interaction points, including outdoor digital Drive-Thru menu displays, self-order kiosks, and the McDonald’s Global Mobile App.

Disadvantages of Forward Vertical Integration

Here are the disadvantages of forward integration:

- Potential Synergy Challenges: Forward integration necessitates a high degree of cooperation and synergy between merging companies. However, there may be instances where achieving these synergies proves challenging or unattainable. This could stem from difficulties in initial strategic planning or executing the integration, presenting a significant risk.

- Elevated Operating Expenses: Post-forward integration, the company must manage both the existing core business and the newly integrated distribution arm. If not handled efficiently, this dual operation can lead to increased costs. It is imperative for the company to thoroughly assess costs and benefits to ensure that the advantages of forward integration outweigh the additional expenses.

- Shifted Focus from Core Business: After forward integration, there’s a risk that management’s attention may gravitate more toward the new venture, potentially sidelining the original core business. This shift in focus could pose a risk, particularly if the profitability of the original business diminishes. If this occurs, the expected synergies between the integrated entities may weaken.

Backward Vertical Integration:

Backward Integration is a form of vertical integration in which a company moves upstream toward the product manufacturing aspects of the value chain. Business functions considered “Upstream” are Raw material suppliers, Research and Development, and production of the parts of the company’s finished goods.

Live industry example:

In 1995, Amazon started its business as an online bookseller selling the world’s largest collection of books. However, In 2009, it integrated backward and started publishing books in-house expanding its operations as both a book publisher and a book retailer.

When Can an Organization Consider Backward Integration?

- Cost Efficiency and Supply Chain Control: There are instances where relying on external suppliers or manufacturers proves to be costly for a business. Moreover, these external sources might not fully align with the organization’s production needs. This is where backward integration becomes a strategic move. It’s akin to the organization asserting, “We’ll handle the production of essential components ourselves because it’s more cost-effective and aligns better with our requirements.”

- Competitive Advantage due to Limited Quality Suppliers: In certain scenarios, finding reputable and high-quality suppliers can be a challenge. By taking control of the production process (backward integration), a business gains a competitive edge. This means the organization can maintain consistent quality and availability of essential components, potentially outperforming competitors who rely on a limited pool of suppliers.

- Sufficient Resources for In-House Production: For backward integration to be successful, the organization must have adequate manpower and financial resources. It’s akin to having a skilled team and enough capital to establish an in-house manufacturing unit. This ensures that the costs associated with producing critical components are managed without overstretching the organization’s resources.

- Cost Reduction and Enhanced Product Quality: When an organization controls its production process, it often leads to increased efficiency and cost savings compared to relying on external suppliers. This, in turn, can result in higher-quality components. With improved quality and potentially lower costs, the organization can enhance its overall product offering, potentially attracting a broader customer base.

Advantages of Backward Vertical Integration

Considering the Advantages of Backward Integration:

- Augmented Competitive Edge: When the company’s dependency on external sources gets reduced, it gains a competitive edge because now it can source the raw material in-house and it doesn’t have to depend on external sources for it. When operations happen within a company, many advantages come at the company’s side like the flow of raw materials as and when required and customization if needed at a valid cost which would have been much higher if it had been sourcing its raw materials from outside. This would make its position stronger in the industry too.

- Elevated Product Quality: Sometimes companies have to agree to disturbed quality in raw materials that they source externally and eventually the final product’s quality suffers. When things are being done out of the sight of the company, it cannot regulate the raw material in making and has to use as the supplier provides. In this situation, Backward integration proves to be very helpful. The company can make the product according to its needs keeping the quality at its best.

- Heightened Supply Network Control: If someone is dependent on anyone else for something, it has to adjust according to the other one as things are in the other person’s control rather than their own. So company gets more control by having the supplier a part of its own company.

For example, Company A manufactures cars while Company B supplies batteries to Company A. Subsequently, Company A adopts a backward integration approach and merges with Company B, thereby assuming control of in-house battery production.

- Optimized Operations for Increased Profits: When a company sources some raw material from another company, it pays for the other company’s profit because the other company is also there to earn from what it is selling. But when a company produces its raw material in-house, it would just manufacture it and directly put it to use. This way margins that a company has to bear while purchasing raw material from external sources get saved, with which eventually the company can keep the selling price low and attract customers with lower prices.

Live Industry example:

In 2015, Continental, a worldwide automotive supplier and tire producer, acquired Veyance Technologies, a company specializing in the production of rubber goods for industrial use. Through this acquisition, Continental aims to bolster its worldwide presence in rubber and plastics technologies and enhance its share of sales in both industrial and end-user markets.

Disadvantages of Backward Vertical Integration

Now look at the Disadvantages of Backward Integration:

- Focus shift: The company’s focus may shift after backward integration because earlier when it just had handled its own product’s production and was easily buying raw materials from outside of the organization, now it has to look at the raw materials production also. This way it is aid that its focus may shift over time, especially in the initial stages when it is not used for raw material production.

- Failure to Achieve Synergistic Realization: It is not easy for two companies to combine and start producing for another one just like that. Sometimes companies fail to synergize and they end up getting confused and malfunctioning in place of smoothly producing and supplying to another.

- Reduction in Corporate flexibility: When a company buys its raw material from a company, it has flexibility in choosing in supplier. For instance, due to some reason, if a supplier cannot provide a particular part but the company needs it urgently, it can approach other suppliers and source the part from them easily. But when it has integrated backward, the choice available to the company gets restricted.

- Change in technology: When a company integrates backward, it does it because it wants to use that raw material in its product. But after some years, some technological variation came into the market and the company wants to use that variant in its product in place of that old raw material for which it integrated backward. Since the raw material company is a part of its own now, it has to use the same old raw material and if it shifts to the news variant, the merger would not be of any use after that.

Controversy in Vertical Mergers

Vertical mergers seem very interesting and helpful when looking at advantages but they also carry a controversial part. Businesses may employ this tactic to restrict the availability of essential resources to other participants in the supply chain, thereby undermining equitable competition with tactics considered unfair in the industry.