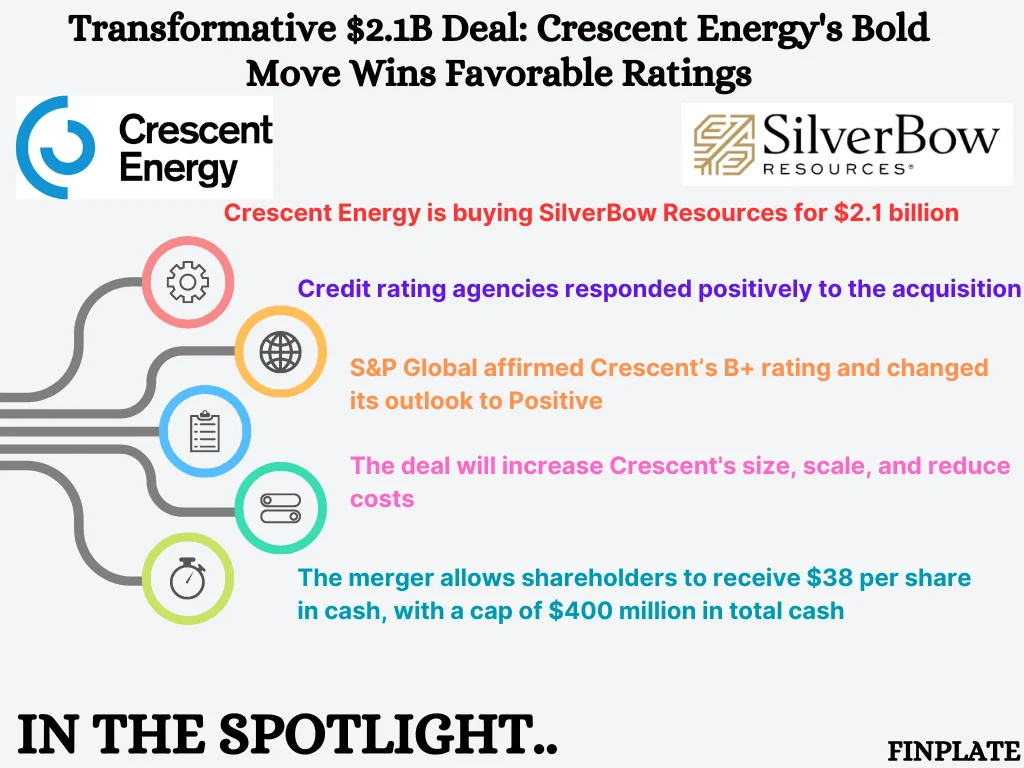

Crescent Energy (NYSE:CRGY) announced on Wednesday that it received positive feedback from all three credit rating agencies after agreeing to buy SilverBow Resources (SBOW) for $2.1 billion. Here’s what happened:

- Credit Ratings: S&P Global kept Crescent’s (CRGY) B+ rating and changed its outlook to Positive. This positive outlook is because the new, bigger company will have lower costs.

- Deal Structure: The acquisition is a cash-election merger. Shareholders can choose to get $38 per share in cash, but the total cash payout is capped at $400 million. The deal is expected to close by the end of the third quarter.

- Kimmeridge Energy Management: On the same day, Kimmeridge Energy Management withdrew its independent nominees for SilverBow Resources’ board. Kimmeridge had wanted to buy SilverBow and replace three directors with their own candidates at the upcoming annual shareholder meeting. However, they stepped back because SilverBow is being sold to Crescent Energy.

In summary, Crescent Energy’s acquisition of SilverBow Resources is moving forward with positive responses from credit agencies, and Kimmeridge Energy has ceased its efforts to take over SilverBow’s board due to the pending sale.

About Crescent Energy

Crescent Energy , a unique energy company based in the U.S., is dedicated to delivering value to its shareholders through a disciplined strategy of growth via acquisitions and consistent capital returns. The company boasts a portfolio of low-decline, cash-flow-centric assets, encompassing both mid-cycle unconventional and conventional assets with long reserve lives and a vast inventory of high-return development locations in the Eagle Ford and Uinta basins. Crescent’s leadership team, comprised of seasoned investment, financial, and industry professionals, brings proven expertise in both investment and operations. For over a decade, Crescent and its predecessors have consistently executed a strategy focused on cash flow, risk management, and returns.

About SilverBow Resources

SilverBow Resources, Inc. (NYSE: SBOW), headquartered in Houston, is an energy company focused on the exploration, development, and production of oil and gas in the Eagle Ford Shale and Austin Chalk regions of South Texas. With a history spanning over 30 years in South Texas, the company has developed a deep understanding of the local reservoirs. This expertise enables them to build a high-quality drilling inventory and consistently improve their operations to maximize the returns on their capital investments.

Summary